1. I nt r oduc t i on

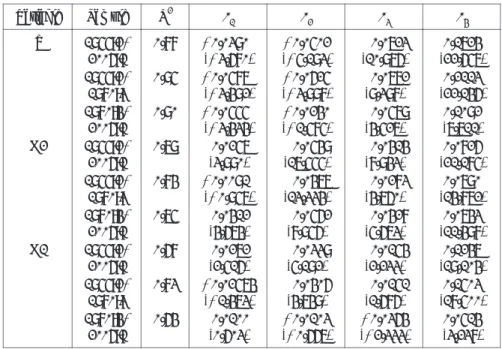

Mone t a r y e c onomi s t s l ong ha ve t hought t ha t gove r nme nt i nj e c t i ons of mone y i nt o a ma c - r oe c onomy ha ve a c e r t a i n ne ut r a l e f f e c t . The ma i n i de a i s t ha t c ha nge s i n t he mone y s t oc k e ve nt ua l l y c ha nge nomi na l pr i c e s a nd nomi na l wa ge s , ul t i ma t e l y l e a vi ng i mpor t a nt r e a l v a r i - a bl e s , l i ke r e a l out put , r e a l c ons umpt i on e xpe ndi t ur e s , r e a l wa ge s , a nd r e a l i nt e r e s t r a t e s , una f f e c t e d. Si nc e e c onomi c de c i s i on ma ki ng i s ba s e d on r e a l f a c t or s , t he l ong- r un e f f e c t of i nj e c t i ng mone y i nt o t he ma c r o e c onomy i s of t e n de s c r i be d a s ne ut r al — i n t he e nd, r e a l v a r i - a bl e s do not c ha nge a nd s o e c onomi c de c i s i on ma ki ng i s a l s o unc ha nge d. Ho w l ong s uc h a pr oc e s s t a ke s , a nd wha t mi ght ha ppe n i n t he me a nt i me , a r e hot l y de ba t e d que s t i ons . Al t hough t he r e a r e ma ny c l a s s i c a l hypot he s e s t o t he e f f i c a c y of mone t a r y pol i c y , one hypot he s i s t ha t i s wi de l y a c c e pt e d a mong t he e c onomi s t s a nd pol i c yma ke r s i s t he l ong- r un ne ut r a l i t y of mone y . A f or ma l de f i ni t i on of t he l ong- r un ne ut r a l i t y ( LRN) of mone y i s t ha t a pe r ma ne nt , une xpe c t e d ( e xoge nous ) c ha nge t o t he l e ve l of mone y s uppl y ha s no e f f e c t on t he l e ve l of r e a l out put i n t he l ong r un. Unde r LRN, c ha nge s i n t he mone y s uppl y ma y or ma y not ha ve s hor t - r un r e a l e f f e c t s . Re l a t e d t o t he LRN of mone y i s t he l ong- r un s upe r ne ut r a l i t y ( LRSN) of mone y ,

i n J a pa ne s e Ec onomy

Md. J a ha nur Ra hma n* a nd Tos hi hi s a Toyoda **

(Received on May 8,2007)

Abs t r ac t

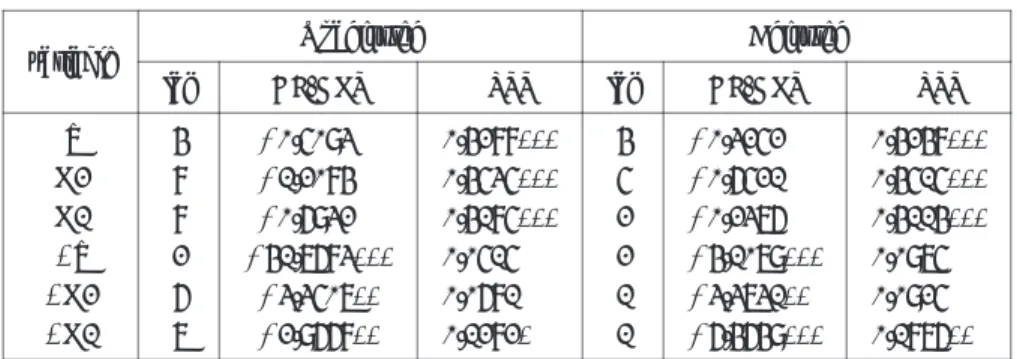

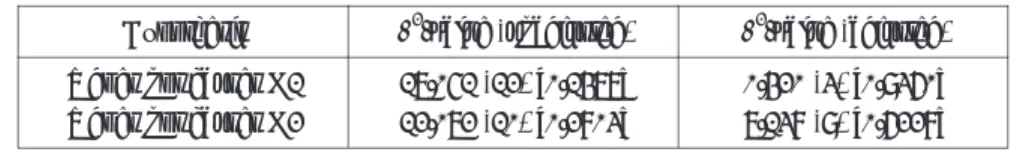

Pr e vi ous t e s t s of t he l ong- r un ne ut r a l i t y of mone y hypot he s i s ha v e ge ne r a l l y r e l i e d on s e a - s ona l l y a dj us t e d da t a a nd ove r l ooke d t he i mpor t a nt i s s ue s of s e a s ona l i t y . Thi s pa pe r a na l ys e s t he l ong- r un ne ut r a l i t y of mone y i n J a pa n us i ng qua r t e r l y s e a s ona l l y una dj us t e d da t a , whi c h pe r mi t s a n e xa mi na t i on of t he e f f e c t s of s e a s ona l i t y a nd t he r obus t ne s s of pr e vi ous e mpi r i c a l r e s ul t s . Fi s he r a nd Se a t e r ( 1993) me t hodol ogy i s us e d wi t h bot h s e a s ona l l y una dj us t e d a nd a dj us t e d J a pa ne s e r e a l GDP a nd nomi na l mone y s uppl y t o t e s t t he l ong- r un ne ut r a l i t y of mone y hypot he s i s . Us i ng t wo me a s ur e s of mone y s t oc k, na me l y M1 a nd M2, i t i s s hown t ha t t he hypot he s i s i s s uppor t e d us i ng M2 a s t he me a s ur e of mone y s uppl y, whi l e i t i s r e j e c t e d us i ng M1.

* Ph. D. St ude nt , Fa c ul t y of Ec onomi c Sc i e nc e s , Hi r os hi ma Shudo Uni v e r s i t y , J a pa n.

** Pr of e s s or , Fa c ul t y of Ec onomi c Sc i e nc e s , Hi r os hi ma Shudo Uni v e r s i t y , J a pa n.

whi c h oc c ur s whe n pe r ma ne nt , e xoge nous c ha nge s i n t he gr owt h r a t e of mone y s uppl y l e a ve t he l e v e l of r e a l out put una f f e c t e d.

The s e l ong- r un ne ut r a l i t y pr e pos i t i ons ha ve be e n s t udi e d e xt e ns i ve l y , bot h t he or e t i c a l l y a nd e mpi r i c a l l y a nd v a r i ous e c onome t r i c pr oc e dur e s a r e a v a i l a bl e f or t e s t i ng t he s e hypot he s e s . Mode r n t he or e t i c a l f ounda t i on wa s pr o vi de d by Fr i e dma n ( 1969a , 1969b) . Muc h of t he e xi s t - i ng e mpi r i c a l l i t e r a t ur e ha s be e n mot i v a t e d by t he wor k of Mc Ca l l um ( 1984) who, dr a wi ng on t he r e ma r ks ma de by Sa r ge nt ( 1971) a nd Luc a s ( 1972, 1976) , s ho ws t ha t t he ne ut r a l i t y r e s ul t s obt a i ne d f r om f r e que nc y- doma i n me t hods a r e uni nf or ma t i ve be c a us e of t he pr obl e m of obs e r va - t i ona l e qui v a l e nc e . Mc Ca l l um ( 1984) c l a i ms t ha t wi t hout kno wi ng t he t i me s e r i e s pr ope r t i e s of t he mone y s uppl y, bot h f r e que nc y- doma i n a nd r e duc e d- f or m e s t i ma t e s a r e una bl e t o di s c r i mi - na t e e mpi r i c a l l y be t we e n l ong- r un non- ne ut r a l i t i e s a nd t he e f f e c t s a r i s i ng f r om a ut or e gr e s s i ve mone y s uppl y s pe c i f i c a t i ons of t he t ype de ve l ope d by Luc a s ( 1972) . He l uc i dl y poi nt s out t ha t a v a l i d t e s t of t he ne ut r a l i t y hypot he s i s c a n onl y be c onduc t e d us i ng c r os s - e qua t i on r e s t r i c t i ons i n a bi v a r i a t e v e c t or a ut or e gr e s s i on ( VAR) .

I n r e s pons e t o t hi s , Fi s he r ( 1988) , Fi s he r a nd Se a t e r ( 1993) , a nd a l s o i n a s e r i e s of pa pe r s by Ki ng a nd Wa t s on ( 1992, 1994, 1997) ha ve a dva nc e d t he domi na nt a ppr oa c he s i n t hi s l i ne of r e s e a r c h. The ne ut r a l i t y of mone y hypot he s i s ha s be e n t e s t e d f or nume r ous c ount r i e s us i ng t he i r me t hodol ogi e s . For e xa mpl e , Bos c he n a nd Ot r ok ( 1994) , Bos c he n a nd Ot r ok ( 1994) , Ol e ka l ns ( 1996) , Se r l e t i s a nd Kr a us e ( 1996) , Ha ug a nd Luc a s ( 1997) , Coe a nd Na s on ( 2003) , She l l e y a nd Wa l l a c e ( 2006) us e d Fi s he r a nd Se a t e r me t hod, whi l e We be r ( 1994) , J e f f e r s on ( 1997) , Se r l e t i s a nd Kous t a s ( 1998, 2001) e mpl oye d Ki ng a nd Wa t s on me t hods f or t e s t i ng t he LRN a nd LRSN of mone y .

I n s pi t e of t he pr ogr e s s i n r e s e a r c h on l ong- r un ne ut r a l i t y of mone y , onl y a ve r y l i mi t e d numbe r of c ompr e he ns i v e s t udi e s a r e a v a i l a bl e i n J a pa n. Ya ma da ( 1997) s ho ws t ha t mone t a r y ne ut r a l i t y hol ds i n t e r ms of r e a l out put , by a ppl yi ng Fi s he r a nd Se a t e r ’ s ( 1993) pr oc e dur e t o t he J a pa ne s e s e a s ona l l y a dj us t e d qua r t e r l y da t a f r om 1957q1 t o 1995q1. Us i ng t wo t ype s of da t a s e t s f or c e nt ur y- l ong a nnua l da t a c ove r i ng 119 ye a r s f r om 1885 t hr ough 2003 a s we l l a s pos t - wa r s e a s ona l l y a dj us t e d qua r t e r l y da t a ove r t he pe r i od 1955q2 – 2003q4, Oi e t al . ( 2004) ha ve f ound e vi de nc e s uppor t i ng l ong- r un ne ut r a l i t y , e s pe c i a l l y f or t he c a s e of M2 a s a me a s ur e of mone y s t oc k. The y us e d Ki ng a nd Wa t s on’ s ( 1997) pr oc e dur e .

But , a n ove r l ooke d i mpor t a nt i s s ue i n a l l pr e vi ous pa pe r s i n J a pa n i s t ha t of s e a s ona l i t y .

Eve n mos t of t he pr e vi ous r e s e a r c he s us e d s e a s ona l l y a dj us t e d da t a i n t e s t i ng l ong- r un ne ut r a l i t y

hypot he s e s . But i n qua r t e r l y obs e r ve da t a , s e a s ona l i t y ha s be e n a n i s s ue t ha t ha s a t t r a c t e d c on-

s i de r a bl e r e s e a r c h i nt e r e s t i n t he mode l i ng of e c onomi c t i me s e r i e s . Re c e nt l y , s ome publ i s he d pa pe r s ha ve a r gue d t ha t mode l i ng, i ns t e a d of r e movi ng, s e a s ona l i t y ma y be be ne f i c i a l f or e c o- nomi c a na l ys i s , f or e xa mpl e , Hyl l e be r g ( 1992) , Le ong e t al . ( 2000) .

Tr a di t i ona l l y , s e a s ona l i t y ha s be e n e xpl i c i t l y r e move d us i ng s e a s ona l a dj us t me nt pr oc e - dur e s , s uc h a s us i ng dummy va r i a bl e s or pr e f i l t e r i ng t he s e r i e s us i ng pe r i od- t o- pe r i od di f f e r - e nc e s or t he ARI MA X- 11 me t hodol ogy . The s e me t hodol ogi e s ha ve i mpor t a nt dr a wba c ks : Ghys e l s a nd Pe r r on ( 1993) , a nd Fr a ns e s ( 1996) s ho ws t ha t s e a s ona l a dj us t me nt pr oc e dur e s c a n r e move c yc l i c a l f l uc t ua t i ons i n t he da t a , a s s e a s ona l i t y a nd bus i ne s s c yc l e s a r e t ypi c a l l y c or r e l a t - e d, a nd c a n t he r e by di s t or t t he da t a . Mor e ove r , s e a s ona l a dj us t me nt s c a n a f f e c t t he po we r of uni t r oot a nd c oi nt e gr a t i on t e s t s . I f s e a s ona l i t y i s de t e r mi ni s t i c , r e movi ng i t wi t h t he a i d of dummy v a r i a bl e s ha s no e f f e c t wha t s oe ve r on uni t r oot t e s t s ( Di c ke y e t al . , 1984) . Ho we ve r , whe n s e a s ona l e f f e c t s a r e s t oc ha s t i c , s t a nda r d f i l t e r s c a n gr e a t l y a f f e c t t he po we r of uni t r oot t e s t s . Ghys e l s ( 1990) s ho ws t ha t r e movi ng s e a s ona l i t y us i ng t he X- 11 me t hod or t he “ v a r i a - t i on i n s pe r i ods ” i nduc e s e xc e s s pe r s i s t e nc e i n t he s e r i e s a nd c ons e que nt l y r e duc e s t he powe r of uni t r oot t e s t s t o r e j e c t nons t a t i ona r i t y . Ol e ka l ns ( 1994) e xt e nds t hi s r e s ul t t o t he c a s e s i n whi c h dummi e s or band- pas s f i l t e r s a r e us e d t o r e move s e a s ona l i t y. Abe ys i nghe ( 1994) s hows t ha t r e movi ng s t oc ha s t i c s e a s ona l i t y wi t h dummy va r i a bl e s l e a ds t o t he s pur i ous r e gr e s s i on pr obl e m.

The i s s ue s of l ong- r un ne ut r a l i t y ha ve be e n t he he a r t of de ba t e s ove r t he r e a l e f f e c t s of macr oeconomi c pol i ci es and ar e s t i l l ver y cont r over s i al t opi cs among macr oeconomi c r e s e a r c he r s . The e mpi r i c a l t e s t a bi l i t y of t he s e hypot he s e s i s i mpor t a nt f or pol i c y f or mul a t i on a nd de s i gn, s uc h a s t he e f f e c t i ve ne s s i n mone t a r y pol i c y , whi l e s t he de t e r mi na t i on of t he or de r of i nt e gr a t i on, s e a s ona l or nons e a s ona l , i s c r uc i a l f or t he s e e xi s t i ng me t hods . So t hi s pa pe r pr e - s e nt s t he e c onome t r i c t r e a t me nt of s e a s ona l i t y f or t he pur pos e of t e s t i ng f or t he l ong- r un ne ut r a l - i t y of mone y . Fi s he r a nd Se a t e r ( 1993) a ppr oa c h i s us e d t o i n v e s t i ga t e t he l ong- r un ne ut r a l i t y of mone y i n J a pa n ove r t he e xt e nde d pe r i od t o 2006.

1)Cons e que nt l y, bot h qua r t e r l y s e a s ona l l y una dj us t e d a nd a dj us t e d t i me s e r i e s da t a on r e a l GDP , nomi na l mone t a r y v a r i a bl e s M1 a nd M2 a r e us e d i n t hi s pa pe r t o e xa mi ne t he e f f e c t s of s e a s ona l i t y a nd t he r obus t ne s s of pr e vi ous e mpi r i c a l r e s ul t s i n J a pa n.

1) We a l s o us e d Ki ng a nd Wa t s on ( 1997) me t hod. The r e s ul t s ( not s hown) a r e qua l i t a t i ve l y s a me a s

t hos e obt a i ne d f r om Fi s he r a nd Se a t e r ( 1993) me t hod.

2. Ove r vi e w of Long- Run Ne ut r al i t y Te s t s

The r e ha s l ong be e n i nt e r e s t i n t e s t i ng l ong- r un pr opos i t i ons a bout t he l i nk be t we e n mone y a nd r e a l or nomi na l va r i a bl e s , whi c h a r e a t t he he a r t of c l a s s i c a l ma c r oe c onomi c s . I n t hi s s e c - t i on, t he hi s t or y of s uc h t e s t s i s r e vi e we d a nd t he a ppr oa c h t a ke n i n t hi s pa pe r i s hi ghl i ght e d.

One not a bl e e a r l y s t r a nd of r e s e a r c h on t he s e i s s ue s wa s a t t he Fe de r a l Re s e r ve Ba nk of St . Loui s dur i ng t he 1960s . The St . Loui s r e s e a r c he r s be ga n t he e mpi r i c a l s t udy of t he r e l a t i on- s hi p be t we e n nomi na l i nc ome a nd t he mone y s t oc k i n a dyna mi c r e gr e s s i on f r a me wor k,

( 1) whe r e Y

ti s l og of nomi na l i nc ome , m

ti s l og of mone y s t oc k, x

ta r e ot he r v a r i a bl e s t ha t a f f e c t nomi na l i nc ome , e

ti s a n e r r or t e r m, a nd i n t he l a g ope r a t or L a nd D = 1 - L i ndi c a t e s a f i r s t di f f e r e nc e .

The St . Loui s r es ear cher s wer e mot i vat ed t o s t udy s uch di s t r i but ed l ag model s by Fr i e dma n’ s ( 1969) a r gume nt t ha t t he r e wa s a l a g i n t he e f f e c t of mone t a r y a c t i ons on t he ma c r o e c onomy . I n t he we l l - kno wn wor k of Ande r s on a nd J or da n ( 1968) , t he y s ought t o de t e r mi ne t he na t ur e of t he l a gs i n t he e f f e c t s of mone t a r y pol i c y i n e s t i ma t i ng t he B c oe f f i c i e nt s i n Equa - t i on ( 1) . The y f ound t ha t t he r e wa s a l e s s t ha n one - f or - one s hor t - r un e f f e c t of mone y on nomi - na l i nc ome , i . e . , B

0< 1. To c a l c ul a t e t he e f f e c t of a s us t a i ne d ( l ong- r un) c ha nge i n t he l e ve l of mone y on t he pa t h of nomi na l i nc ome , t he y c a l c ul a t e d dyna mi c mul t i pl i e r s a s f ol l o ws :

La t e r St . Loui s a na l ys i s , Ande r s e n a nd Ka r nos ky ( 1972) , us e d t hi s r e gr e s s i on f r a me wor k t o t e s t LRN a s f ol l o ws . The y i ma gi ne d a pe r ma ne nt c ha nge i n t he l e v e l of mone y ha v e no l ong- r un e f f e c t i n t he l e v e l of nomi na l i nc ome i f

The y a l s o i mpl e me nt e d t he c ompa r a bl e t e s t f or LRN us i ng l og of r e a l i nc ome ( y

t) a s

The St . Loui s a ppr oa c h wa s c ont r ove r s i a l . Not a bl y , Ando a nd Modi gl i a ni ( 1990) c r i t i - c i z e d t he St . Loui s r e gr e s s i on f or not r e c ogni z i ng t ha t nomi na l i nc ome a nd t he mone y s t oc k we r e s i mul t a ne ous l y de t e r mi ne d. Ho we v e r , Si ms ( 1972) pr o vi de d s ome s uppor t i n a bi v a r i a t e

Δ Y

t= B L ( ) Δ m

t+ C L x ( )

t+ ε

tB L B L

i ii

( ) = ∑m=0 C L ( ) = ∑if=0C L

i i

C L

i i∂

∂

+=

∑

=Y

m

t sB

t

i i

s 0

lim ( )

s t s

t

i i

Y

sm B B

→∞

+

=

∂

∂ = ∑ = 1 = 1

0

lim ( )

s t s

t i i

y

sm B B

→∞

+

=

∂

∂ = ∑ = 1 = 0

0

c ont e xt f or t he St . Loui s r e gr e s s i on, bui l di ng on Gr a nge r ’ s ( 1969) e a r l i e r wor k on t e s t i ng f or c a us a l i t y . The or e t i c a l l y , Si ms e s t a bl i s he d t ha t i t wa s onl y l e gi t i ma t e t o r un t he r e gr e s s i on

f or t he pur pos e s of t he St . Loui s r e s e a r c he r s i f t he r e v e r s e r e gr e s s i on

di s pl a ye d D c oe f f i c i e nt s t ha t we r e z e r o. Looki ng a t nomi na l i nc ome a nd mone y e mpi r i c a l l y , he f ound e vi de nc e t ha t t he D c oe f f i c i e nt s we r e s t a t i s t i c a l l y i ns i gni f i c a nt .

The i nt e r pr e t a t i on of t he St . Loui s r e gr e s s i ons wa s a l s o c a l l e d i nt o que s t i on by t he a na l ys e s of Sa r ge nt ( 1971) a nd Luc a s ( 1972) . St udyi ng a n e c onomy i n whi c h onl y una nt i c i pa t e d mone - t a r y c ha nge s ha d r e a l e f f e c t s a nd whi c h ot he r wi s e di s pl a ye d t he LRN pr ope r t i e s , Luc a s ( 1972) s ho we d t ha t r e s t r i c t i ons on s ums of c oe f f i c i e nt s di d not pr ovi de a wa y of t e s t i ng t he c l a s s i c a l pr opos i t i ons . To i l l us t r a t e Luc a s ’ s poi nt , c ons i de r a n e c onomy i n whi c h t he be ha vi or of r e a l a nd nomi na l i nc ome i s gi v e n by

whe r e f i s a pos i t i ve pa r a me t e r a nd 0 < q < 1. Tha t i s : una nt i c i pa t e d mone t a r y e xpa ns i ons r a i s e r e a l i nc ome a nd r a i s e nomi na l i nc ome l e s s t ha n one - f or - one . I f t he mone y s uppl y i s gi v e n by t he f i r s t - or de r a ut or e gr e s s i on

i t t he n f ol l o ws t ha t t he r a t i ona l e xpe c t a t i ons s ol ut i ons f or r e a l a nd nomi na l out put a r e

( 2a ) ( 2b) Unde r Luc a s ’ s a s s umpt i on t ha t t he mone y s uppl y pr oc e s s i s s t a t i ona r y ( | r | < 1) , t he s um of c oe f - f i c i e nt s i n t he r e a l out put e qua t i on i s i nc ons i s t e nt wi t h ne ut r a l i t y ( f ( 1 - r ) > 0) . The s e i mpl i - c a t i ons oc c ur de s pi t e t he f a c t t ha t t he mode l i s one wi t h a s t r ong f or m of ne ut r a l i t y . On t he ba s i s of t hi s f i ndi ng, Luc a s a nd Sa r ge nt a r gue d t ha t i f l ong- r un v a r i a t i on i n mone y i s not a pa r t of t he e n vi r onme nt t ha t s ha pe s t he be ha vi or a l r e s pons e s of e c onomi c a ge nt s , t he n a r e duc e d f or m a na l ys i s — s uc h a s dyna mi c r e gr e s s i ons or ve c t or a ut or e gr e s s i ons — c a n ne ve r pr ovi de a ns we r s a bout t he e f f e c t of l ong- r un v a r i a t i ons i n mone y .

Conc e r n a bout c a us a l i t y a nd t he Luc a s c r i t i que c a s t a s ha dow ove r a ppl i e d r e s e a r c h on l ong- r un ( LR) t e s t s f or ne a r l y t wo de c a de s . Howe ve r , Fi s he r a nd Se a t e r ( 1993) poi nt e d out

A L Y ( )

t= B L m ( )

t+ e

Y t,C L m ( )

t= D L Y ( )

t+ e

m t,y

t= φ( m

t− E m

t−1 t) + e

y t,Y

t= m

t− φθ ( m

t− E m

t−1 t) + e

Y t,m

t= ρ m

t−1+ e

m t,,

y

t= φ m

t− φρ m

t−1+ e

y t,Y

t= − ( 1 φθ ) m

t+ ρφθ m

t−1+ e

Y t,t ha t t he pe s s i mi s m wa s not ne c e s s a r i l y j us t i f i e d i f e c onomi s t s a r e c onc e r ne d a bout whe t he r LR hypot he s e s he l d i n a pa r t i c ul a r hi s t or y a nd t he hi s t or i c a l da t a c ont a i ne d l ong- r un v a r i a t i on i n mone y . Fi s he r a nd Se a t e r ( 1993) e mpl oy a bi v a r i a t e s t r uc t ur a l ve c t or a ut or e gr e s s i on ( SVAR) mode l t o t e s t l ong- r un ne ut r a l i t y a nd s uppe r ne ut r a l i t y unde r t he i de nt i f i c a t i on a s s umpt i on t ha t nomi na l v a r i a bl e i s e xoge nous i n t he l ong- r un. The y de mons t r a t e t he r e s t r i c t i ons i mpl i e d by t he s e pr e pos i t i ons a r e c ondi t i ona l on t he or de r of i nt e gr a t i on of t he v a r i a bl e s c ompr i s e d i n t he a na l ys i s . Spe c i f i c a l l y, ne ut r a l i t y t e s t s a r e pos s i bl e onl y i f nomi na l a s we l l a s r e a l va r i a bl e s a r e a t l e a s t i nt e gr a t e d of s a me or de r . Mor e ove r , s uppe r ne ut r a l i t y t e s t s a r e pos s i bl e onl y i f t he or de r of i nt e gr a t i on of t he nomi na l v a r i a bl e i s e qua l t o one pl us t he or de r of i nt e gr a t i on of t he r e a l va r i a bl e . Ba s e d on t he s e t wo i de a s , i nt e gr a t i on a nd i de nt i f i c a t i on, Ki ng a nd Wa t s on ( 1992, 1997) pr o vi de a wa y of t e s t i ng l ong- r un ne ut r a l i t y by me a ns of a s s umi ng di s t i nc t s t r uc - t ur a l a s s umpt i ons a bout t he e c onomy, whi l e pa yi ng s pe c i a l a t t e nt i on t o t he i nt e gr a t i on a nd c oi n- t e gr a t i on pr ope r t i e s of t he da t a . The i r me t hodol ogy doe s not a s s ume mone y e r oge ne i t y , a nd pr opos e s t ha t t he i mpa c t of mone y on out put , or out put on mone y be t e s t e d unde r a l t e r na t i ve i de nt i f yi ng r e s t r i c t i ons i n t wo va r i a bl e SVAR mode l s . Al t hough a l l t he s e t e s t pr oc e dur e s di f f e r i n t he de t a i l s , e a c h wa s ba s e d on t he c or e i de a t ha t l ong- r un pr opos i t i ons a r e t e s t a bl e i f t he r e i s s ui t a bl e l ong- r un va r i a t i on i n mone y. As a n e xa mpl e , s uppos e t ha t t he mone y s t oc k i s a s s ume d t o be a r a ndom wa l k ( r = 1) i n t he Luc a s mode l j us t c ons i de r e d. Thi s a s s umpt i on me a ns t ha t a l l c ha nge s i n mone y a r e una nt i c i pa t e d a nd pe r ma ne nt . Eva l ua t i ng t he e xpr e s s i ons a bo v e a t r = 1, i t t he n f ol l o ws t ha t t he s um of c oe f f i c i e nt s on t he mone t a r y v a r i a bl e s i n ( 2a ) i s z e r o a nd t he s um i n ( 2b) i s one a s s ugge s t e d by pr i or ne ut r a l i t y t e s t s .

Ne ut r a l i t y t e s t s ba s e d on SVAR a r e mor e c ompl i c a t e d t ha n t he s i mpl e Luc a s e xa mpl e on t hr e e di me ns i ons . Fi r s t , t he y a l l o w r e a l out put t o be pot e nt i a l l y a f f e c t e d by r e a l s hoc ks i n t he l ong- r un. Se c ond, t he y a l l o w f or mone y gr o wt h t o r e s pond t o i t s o wn l a gs a nd t o l a gs of out - put gr owt h. Thi r d, t he y a l l ow f or s hor t - r un i nt e r a c t i ons of r e a l a nd nomi na l va r i a bl e s . Al l of t he s e c ons i de r a t i ons a r e r e f l e c t e d i n t he f ol l o wi ng s t r uc t ur a l v e c t or a ut or e gr e s s i on,

( 3)

I n t hi s s t r uct ur al VAR, t her e ar e t wo s t r uct ur al s hocks e

y,tand e

m,twi t h mean 0 and whe r e . The f or me r r e f e r s t o r e a l pr oduc t i vi t y s hoc ks whi l e t he l a t t e r r e f e r s t o mone t a r y s hoc ks . I n a ddi t i on, bot h v a r i a bl e s a r e t r e a t e d e ndoge nous l y , whi c h

π

yy tπ

ym tα

yy i t iα ε

i p

ym i t i y t

i p

y m y m

Δ = Δ + Δ

−+ Δ +

= −

∑

,∑

= , ,1 1

π

mm tπ

my tα

my i t iα ε

i p

mm i t i m t

i p

m y y m

Δ = Δ + Δ

−+ Δ +

= −

∑

,∑

= , ,1 1

cov( , ) ε ε ′ = Σ

ε, ε = ( ε ε

y t,,

m t,) ′

mi t i ga t e s t he c a us a l i t y pr obl e ms pr e vi ous l y di s c us s e d i n t he c ont e xt of t he St . Loui s r e gr e s s i on.

Shor t - r un i nt e r a c t i ons of y

ta nd m

ta r e gove r ne d by t he p c oe f f i c i e nt s , whi l e t he dyna mi c i nt e r a c - t i ons a r e go v e r ne d by t he a c oe f f i c i e nt s . The a bo v e s ys t e m c a n be wr i t t e n a s

whe r e L i s l a g ope r a t or , t ha t i s , . As s umi ng bot h y a nd m a r e I ( 1) a nd not c oi nt e gr a t - e d, t he l ong- r un r e s pons e s of y

ta nd m

tt o t he s hoc ks e

y,ta nd e

m,t, a r e t he s ol ut i ons t o t he a bove s ys t e m, t ha t c a n be a ppr oxi ma t e d a s

whe r e . The l ong-

r un e f f e c t of mone t a r y s hoc k e

mi s

a nd t he l ong- r un e f f e c t of r e a l s hoc k e

yi s

Ba s e d on t he a bo v e s pe c i f i c a t i ons , t he l ong- r un ne ut r a l i t y of mone y wi t h r e s pe c t t o r e a l out put c a n be t e s t e d us i ng t he f ol l o wi ng l ong- r un mul t i pl i e r :

( 4) The e xpr e s s i on i n e qua t i on ( 4) i s a t t he he a r t of Fi s he r a nd Se a t e r ( 1993) a nd Ki ng a nd Wa t s on ( 1997) t e s t s . Fi s he r a nd Se a t e r ( 1993) t e r m t he r a t i o a s l ong- r un de r i v a t i ve ( LRD) of y wi t h r e s pe c t t o m , a nd Ki ng a nd Wa t s on ( 1997) c a l l e d t he l ong- r un e l a s t i c i t y of out put ( y ) wi t h r e s pe c t t o pe r ma ne nt e xoge nous c ha nge i n mone y ( m ) .

I f bot h mone y a nd r e a l GDP a r e i nt e gr a t e d of or de r one , I ( 1) , ( or s a me or de r ) t he n t he i mpl i c a t i on of l ong- r un ne ut r a l i t y of mone y i s t ha t

π α π α

π α π

yy yy i

i i p

yy ym i

i i p

my my i

i i

p

mm

L L

L

− − +

− + −

= =

=

∑ ∑

∑

, ,

,

( )

( )

1 1

1

α α

ε

mm i

ε

i i

p

t t

y t

L

m ty m

,

,

= ,

∑

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

⎡

⎣ ⎢ ⎤

⎦ ⎥ = ⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

1

⎥

Δ Δ L x

i t= x

t i−lim

, ,, ,

k

t k y t t k m t

t k y t t k m t

y y

mm m

→∞

+ +

+ +

∂ ∂ ∂ ∂

∂ ∂ ∂ ∂

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ =

ε ε

ε ε ϕ π

mm ip mm i ym ip ym imy i my i

p

yy i yy i

p

− +

+ −

⎡

⎣

⎢

= == =

∑ ∑

∑ ∑

α π α

π α π α

, ,

, ,

1 1

1 1

⎢⎢

⎤

⎦

⎥ ⎥

ϕ = π α π α π α π α

− ∑= − ∑= − + ∑= +

− + ∑= +

1

1 1 1

(

yy yy i,)(

,) (

,)(

i p

mm i mm i

p

my i my i

p

ym i yym i

p ,

)

∑

=1lim

,,

, , k

t k m t

t k m t

ym i ym i

p

yy yy

y

→∞

m

+ +

∂ ∂

=∂ ∂

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ = +

−

∑

ε

ε ϕ π α

π α

1 i ii p

∑

=⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

1

lim

,,

, , k

t k y t

t k y t

mm i mm i

p

my my

y m

m

→∞

+ +

∂ ∂

=∂ ∂

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ = +

−

∑

ε

ε ϕ α

π α

1 i ii p

∑

=⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

1

.

γ ε

ε

π α

π α

ym k

t k m t

t k m t

ym i ym i

p

yy i yy i

p

y

= ∂ m ∂

∂ ∂ = +

→∞

−

+ +

=

=

lim

,∑

,

, , 1

∑

1∑

( 5) Long- r un s uppe r ne ut r a l i t y ( LRSN) c a n be t e s t e d whe n mone y i s I ( 2) a nd r e a l out put i s I ( 1) . Us i ng t he gr owt h of mone y ( D m

t) i n s t e a d of mone y ( m

t) i n SVAR mode l i n Equa t i on ( 3) , t he LRD c a n be obt a i ne d a s

( 6) Not e t ha t t he LRD i s not de f i ne d f or t he c a s e i n whi c h . The r e f or e , a ne c e s s a r y c ondi t i on f or t e s t i ng LRN i s t ha t t he r e ha ve be e n pe r ma ne nt s hoc ks t o mone y s uppl y . Mone y t he r e f or e mus t be a t l e a s t f i r s t or de r i nt e gr a t e d, or I ( 1) , t o a ppl y t he t e s t . Equa t i ons ( 4) a nd ( 6) a l s o s how t ha t i f t he r e ha ve no pe r ma ne nt s hoc ks t o r e a l out put , t he n a nd e qua l t o z e r o r e s pe c t i ve l y , t ha t i s , t he LRD i s e qua l t o z e r o. The r e f or e , i f t he out put i s I ( 0) , LRN a nd LRSN c a nnot be r e j e c t e d.

3. I de nt i f yi ng Re s t r i c t i ons

By i t s na t ur e , t he l ong- r un mul t i pl i e r g

ymi s a s t r uc t ur a l pa r a me t e r , whi c h r e qui r e s i de nt i f y- i ng a s s umpt i ons t o e s t i ma t e i t . The s e i de nt i f yi ng a s s umpt i ons a r e mos t e a s i l y di s c us s e d i f we f ol l o w t he a c t ua l pr a c t i c e us e d i n s ome of t he pr i or l i t e r a t ur e . To be gi n, s uppos e t ha t we e s t i - ma t e a r e duc e d f or m VAR a s

I n t hi s r e duc e d f or m VAR, u

y,ta nd u

m,ta r e e r r or t e r ms wi t h me a n 0 a nd , whe r e . Compa r i ng t hi s e xpr e s s i on wi t h ( 3) , we not e a s t r uc t ur a l r e l a t i ons hi p be t we e n r e duc e d f or m s hoc ks u

ta nd s t r uc t ur a l s hoc ks e

tt ha t t a ke s t he f or m

wi t h c o v a r i a nc e ma t r i x

LRD = = ∂ ∂

∂ ∂ = +

→∞

−

+ +

∑

=γ ε

ε

π α

π α

ym k

t k m t

t k m t

ym i ym i

p

yy yy i

y

lim m

,,

, , 1 ii p

∑

=1= 0

γ ε

ε

π α

π α

y m k

t k m t

t k m t

ym i y m i

p

yy yy

y

Δ

m

ΔΔ

Δ

= ∂ Δ ∂

∂ ∂ = +

−

→∞

+ +

∑

=lim

,,

, , 1 i ii p

∑

=1lim(

,)

k

m

t k m t→∞

∂

+∂ ε = 0

lim(

,)

k

y

t k m t→∞

∂

+∂ ε lim( /

,)

k

y

t k m t→∞

∂

+∂ ε

ΔΔ y

tb

yy iΔ y

t ib Δ m u

i p

ym i t i y t

i p

=

−+ +

= −

∑

,∑

= , ,1 1

Δ m

tb

my iΔ y

t ib Δ m u

i p

mm i t i m t

i p

=

−+ +

= −

∑

,∑

= , ,1 1

cov( , ) u u ′ = Σ

uu = ( u

y t,, u

m t,) ′

u u

y t m t

yy ym

my mm

y t m t ,

,

, ,

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ = −

−

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ π π

−π π

ε ε

1

a nd t he c or r e s pondi ng pa r a me t e r s a r e

The bi v a r i a t e s t r uc t ur a l VAR of or de r p , a s i n e qua t i on ( 3) , ha s 2

2´ ( p + 1) unkno wns i n t he c oe f f i c i e nt s a nd 3 ( = 2 ´ ( 2 + 1) / 2) unkno wns i n t he c ov a r i a nc e ma t r i x of t he r e s i dua l . Me a n- whi l e , t he bi va r i a t e r e duc e d- f or m VAR of or de r p pr ovi de s e s t i ma t e s of 2

2´ p pa r a me t e r va l ue s f or t he c oe f f i c i e nt s a nd t hr e e va l ue s f or t he c ova r i a nc e ma t r i x of t he r e duc e d f or m e r r or s . Ac c or di ngl y , 2

2= 4 i de nt i f yi ng r e s t r i c t i ons mus t be pl a c e d t o i de nt i f y t he s t r uc t ur a l s hoc ks e

y,ta nd e

m,t. St a nda r di z i ng p

yya nd p

mmt o uni t y a nd us i ng t he a s s umpt i on t ha t t he s t r uc t ur a l s hoc ks a r e mut ua l l y unc or r e l a t e d, i . e . , , one a ddi t i ona l i de nt i f yi ng r e s t r i c t i on i s r e qui r e d. For t hi s r e a s on, t o c omput e t he g

ym, t he di f f e r e nt r e s e a r c he r s i mpos e d di f f e r e nt i de n- t i f yi ng a s s umpt i ons .

Fi s her and Seat er ( 1993) as s umed t hat mone y i s l ong- r un e xogenous by i mpos i ng . Tha t i s , t he r e a l s hoc k e

y,ti s a s s ume d not t o a f f e c t t he va r i a t i on i n mone y i n t he l ong- r un. For ma l l y, gi ve n t hi s a s s umpt i on, t he s e c ond e qua t i on of ( 3) gove r ni ng t he l ong- r un r e s pons e of mone y i mpl i e s t ha t : t he l ong- r un r e s pons e of mone y doe s not de pe nd on t he l ong- r un r e s pons e of out put . Us i ng t hi s a s s umpt i on, Fi s he r a nd Se a t e r de mons t r a t e t ha t g

ymc a n be c ons i s t e nt l y e s t i ma t e d a s t he s l ope c oe f f i c i e nt i n t he f ol l o wi ng OLS r e gr e s s i on:

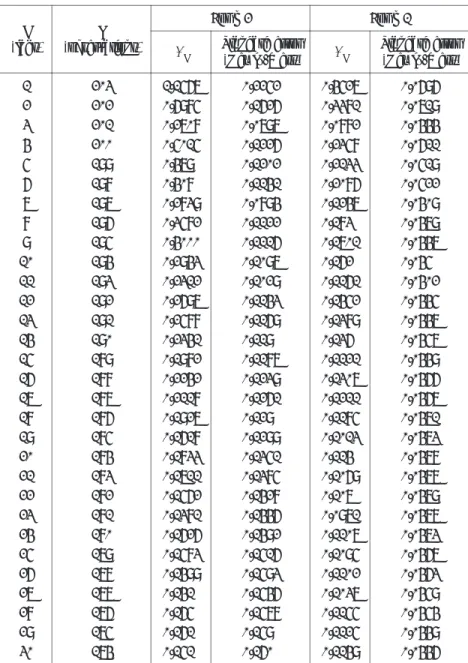

( 7) Tha t i s , LRD c a n be a ppr oxi ma t e d by . St a nda r d pr a c t i c e i s t o e s t i ma t e b

kus i ng OLS f or e a c h va l ue of k t a ki ng va l ue s of one t hr ough a pr e de t e r mi ne d uppe r l i mi t . Wi t h T obs e r va - t i ons , t he 95- pe r c e nt c onf i de nc e i nt e r v a l s t he n a r e c ons t r uc t e d f or t he b

k’ s f r om a t - di s t r i b ut i on wi t h T / k de gr e e s of f r e e dom us i ng s t a nda r d e r r or s c or r e c t e d f or s e r i a l c or r e l a t i on by t he Ne we y- We s t pr oc e dur e . Long- r un ne ut r a l i t y of mone y i s r e j e c t e d i f z e r o l i e s out s i de t he c onf i de nc e i nt e r v a l a s k be c ome l a r ge .

For t he LRSN of mone y, whi c h i s t e s t a bl e i f m i s I ( 2) a nd y i s I ( 1) , t he e s t i ma t or of g

ymi s t he s l ope c oe f f i c i e nt i n

( 8)

var( ) cov( , )

cov( , ) var( )

, , ,

, , ,

u u u

u u u

y t y t m t

y t m t m t

yy

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥

= π −−

−

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ π

−π π

ε ε ε

ε ε

ym

my mm

y t y t m t

y t m t

1

var( ) cov( , )

cov( ,

, , ,

, ,

)) var( ε

,)

π π

π π

m t

yy ym

my mm

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥

−

−

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥

′

−1b b

b b

yy i ym i

my i mm i

yy ym

my mm

yy i

, ,

, ,

⎡

,⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ = −

−

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ π π

−π π

α

1

α α

α α

ym i

my i mm i

i p

,

, ,

; , , ,

⎡

⎣ ⎢

⎢

⎤

⎦ ⎥

⎥ = 1 2 …

cov( ε

y t,, ε

m t,) = 0

( π

my+ ∑ip=1α

my i,) = 0

( y

t− y

t k− −1) = α

k+ β

k( m

t− m

t k− −1) + ε

ktlim

k k

→∞

β

( y

t− y

t k− −1) = α

k+ β

k( Δ m

t− Δ m

t k− −1) + ε

ktKi ng a nd Wa t s on ( 1997) e mpha s i z e t he r e l a t i ons hi p be t we e n t e s t r e s ul t s a nd i de nt i f yi ng i s s ue s . The y a na l yz e l ong- r un ne ut r a l i t y pr opos i t i ons a c r os s a r a nge of pos s i bl e i de nt i f i c a t i ons of t he i r bi va r i a t e s t r uc t ur a l VAR s ys t e m, i n a n e f f or t t o unde r s t a nd t he r obus t ne s s of va r i ous c onc l us i ons t o di f f e r i ng a s s umpt i ons . The y us e d one of t he f ol l o wi ng i de nt i f yi ng r e s t r i c t i ons i n t he i r LR t e s t s .

( i ) t he i mpa c t e l a s t i c i t y of y wi t h r e s pe c t t o m i s kno wn ( i . e . , p

ymi s kno wn) , ( i i ) t he i mpa c t e l a s t i c i t y of m wi t h r e s pe c t t o y i s kno wn ( i . e . , p

myi s kno wn) , ( i i i ) t he l ong- r un e l a s t i c i t y of y wi t h r e s pe c t t o m i s kno wn ( i . e . , g

ymi s kno wn) , ( i v) t he l ong- r un e l a s t i c i t y of m wi t h r e s pe c t t o y i s kno wn ( i . e . , g

myi s kno wn) .

2)Fi r s t , t he s hor t - t e r m r e s t r i c t i on s pe c i f i e s a c ont e mpor a ne ous r e l a t i ons hi p be t we e n e ndoge nous va r i a bl e s a nd s hoc ks by i mpos i ng r e s t r i c t i ons on t he s hor t - t e r m e l a s t i c i t y, s uc h a s s uppos e p

ym= 0 or p

my= 0. The f or me r r e s t r i c t i on i ndi c a t e s s hor t - r un ne ut r a l i t y whe r e by out put doe s not r e a c t c ont e mpor a ne ous l y t o t he s hoc k t o t he mone y s t oc k. I n c ont r a s t , t he l a t t e r r e s t r i c t i on i ndi - c a t e s t he s i t ua t i on whe r e by t he mone y s t oc k doe s not c ont e mpor a ne ous l y a c c ommoda t e c ha nge s i n out put , a nd out put be c ome s t he pr e de t e r mi ne d v a r i a bl e . Se c ond, t he l ong- t e r m r e s t r i c t i on s pe c i f i e s a l ong- t e r m r e l a t i ons hi p be t we e n e ndoge nous va r i a bl e s a nd s hoc ks by i mpos i ng r e s t r i c - t i ons on t he l ong- t e r m e l a s t i c i t y , f or e xa mpl e , c ons i de r g

my= 1. Thi s a s s umpt i on i s c ons i s t e nt wi t h l ong- r un pr i c e s t a bi l i t y unde r t he a s s umpt i on of s t a bl e v ol a t i l i t y . Addi t i ona l l y , l ong- r un ne ut r a l i t y ( g

ym= 0) i s a ppl i c a bl e a s a n i de nt i f yi ng r e s t r i c t i on. Va r yi ng t he v a l ue s of p

ym, p

mya nd g

my, t he y f ound t he e vi de nc e of s uppor t i ng l ong- r un ne ut r a l i t y of mone y f or r e a l out put i n t he pos t wa r U. S. da t a .

4. Te s t s f or Se as onal i t y

Se a s ona l i t y c a n be de t e r mi ni s t i c a nd/ or s t oc ha s t i c . For qua r t e r l y da t a , de t e r mi ni s t i c s e a - s ona l i t y a s s ume s t ha t t he da t a ge ne r a t i ng pr oc e s s f or t he v a r i a bl e y

ti s

whe r e s

st( = 1 i n s e a s on s , 0 e l s e whe r e , f or s = 1, 2, 3, 4) i s a s e a s ona l dummy va r i a bl e . I nc l ud- i ng s e a s ona l dummy va r i a bl e s i n a r e gr e s s i on mode l i s a ppr opr i a t e f or va r i a bl e s wi t h de t e r mi ni s - t i c s e a s ona l i t y . The a bs e nc e of t he s e dummy v a r i a bl e s wi l l l e a d t o t he s t a nda r d pr obl e m of

y

t= γ

1 1s

t+ γ

2 2s

t+ γ

3 3s

t+ γ

4 4s

t+ ε

t2) de not e s t he l ong- r un e l a s t i c i t y of mone y ( m ) wi t h r e s pe c t t o pe r ma ne nt e xoge - nous c ha nge i n out put ( y ) .

γ π α

π α

my

my i

p my i

mm i

p mm i

= + ∑

− ∑

=

= 1 1

, ,