Overview of Securities and

Corporate Bond Market

Development &

Review of the related Law and

Sub-decrees

Prof. Shigehito Inukai, Waseda University

with Matthias Schmidt

ADB Consultants

Thursday, 30th May 2013

1

Presentation for Securities and Exchange Commission

Cambodia

V.6Issues to be taken into account

Uncertain and cumbersome rules should

be eliminated as much as possible

Inconsistency between related laws and

regulations should be eliminated

The financial services (include securities)

markets and their infrastructures including

regulatory framework should reveal a high

integrity in themselves

1. What are Securities / Financial

Instruments for Investments?

3

Securities related Law

(Company Law / Law on I&T-NGS, etc.)

“Corporate Bond” has not yet been defined in the

company law (Law on Commercial Enterprises) and any

other laws

Law on Negotiable Instruments and Payment

Transactions exists, but does not include definition(s) of

“Securities”

“Non - government Securities” & “Debt Securities” are

defined in the Glossary of Law on Issuance & Trading of

Non-Government Securities (I&T-NGS)

First of all, the existence of a clear definition of

Securities as financial instruments for investments

is quite important

Example: Test regarding Investment Contract(*)

(Securities in wider meaning) to be regulated by

financial services market regulator

General Criteria of the Investment Contract

1 Existence of “Investment of money by investors” and

“Distribution to investors of business interests”

2 Existence of "Joint venture or operation based on the

investments from multiple investors"

3 Separation of operators and investors

5

A) In the investment contract, “ Transfer of Cash Flow from

the present time to the future ” should be existing.

B) As a result, Liquidity Concept is not important.

(*) includes Securities (Shares and Bonds), CIS (Collective Investment Scheme) and many kinds of derivatives, etc.

2. What is Financial Services

Market?

Financial Services Market

7

Banking

business Insurance

business

Financial Services Market should

be regulated with integrity

Securities Market

and

Securities Business

Source: ADB Consultants, for purpose of CA Knowledge Support

3. What Financial Services Market

Regulator should regulate

What should be governed/regulated?

9

Trading rule or

Rule for Transactions

(Rules relate to

requirements/conditions and the effect)

Operators rule, Traders rule

or Rule for Intermediaries

Rule for certain financial

Business Industries

(Code of Conduct / Fit and proper rule) (This rule should be cross-

organizational)

Financial Services (Securities) Market rule

(Primary market + Secondary market)

[Disclosure rules / Unfair trading prohibition / SRO rules]

(Regulator should oversee a fair price formation

in the market)

Transactions Market Participants

Market

Source: ADB Consultants, for purpose of CA Knowledge Support

4. Current Financial Services

Market related Regulations

Government Securities related Law

(Law and Sub-decree: Law on Government

Securities (GS) / Draft Prakas on Operation of GS)

Both “Law on GS” and “Draft Prakas on

Operation of GS” only stipulate supply side

(issuing) of the GS

11

Non-Government Securities (NGS) related Law

(Law and Sub-decree)

Law on the Issuance & Trading (I&T) of Non-Government

Securities (NGS) (2007)

Anukret on the implementation of the Law on I&T of NGS

(2009)

Second Draft Prakas on Issuance of Debt Securities (2013)

This law and sub-decrees govern/regulate the following:

securities exchange, clearing and settlement

facilities, securities depositories

other operators in the securities markets who trade

or provide financial services

public limited companies or registered legal entities

that issue securities

13

Other Financial Market related Law

Law on Banking and Financial Institutions

(1999)

Law on Insurance (2000)

Law on Financial Lease (2009)

5. Areas and Items to be

governed/regulated in Financial

Services Market

Area to be governed/regulated

Generally, Law and Sub-decrees should govern/regulate:

15

Financial Services and Financial instruments for investments, including securities

Transactions and trading of Government and Non-government Securities and other investment contracts

Financial Services businesses and those business providers (Operators, traders and intermediaries, including brokers, underwriters, etc.) with

their code of conduct and fit and proper rule perspective

Market place and market system(s) providers including the securities exchange(*), clearing and settlement system/facilities, securities

depositories

(*) Securities exchange may having two dimensions / functions (market place provider + listing authority(SRO) -- should avoid “conflict of interest”)

Market itself including Disclosure Rules, Unfair Trading Prohibition and Formation of fair market prices

Generally, Issuing of Securities of Business Corporations and Enterprises may be governed by Company Act and Securities regulation.

16 Market as the place or space for trade

Stock Exchange, off-exchange (OTC) market, and trade execution system, etc.

Ĭ Financial products / instruments / services

Financial services provider Intermediary

and corresponding system

Safety net Regulatory agency Conflict resolution agency / mechanism (Financial ADR system) Financial service market laws, regulations and company laws and regulations and related soft law

Į Market system infrastructure (social capital)

Electronic platform, which integrates a series of operational process of securities investment into the “e-commerce”

Securities clearing/ settlement

system Disclosure Profiling /Registration system

Asset

Administration fiduciary service system

Various types of IT communications

system

Various types of IT communications

system

Cash management system

ĭ Public institutional infrastructure such as market related laws and regulations (social capital)

į Taxation system İ Financial expert and educational system

Fund-raiser, issuer company, industry group, organization Financial services

provider Intermediary and corresponding

system

Component of Financial Services Market

16Self-Regulatory Organizations (SROs)

Investors / Financial services

consumers

Investors / Financial services

consumers

6. Discussion Points

17

Discussion Points

•

Understanding of Cambodia Approach

•

Legislative Coverage of Securities Market (examples)

•

Review of Legislation

• Law

• Anukret

• (Draft) Prakas

•

Investor Types/Market Participants as evident in Legislation

•

Discussion on Professional Market Segment

Public Offer / Private or Personal Offer / Private Placement / Exempt Offer

•

Questions from studying Legislation

19

1

stStep: Law on the Trading and Issuance of non-

government Securities

• General Principles: public offer, securities firms

• Introduced the concept of an Exempt Offer (Article 16 + Glossary)

• Introduced the concept of Private or Personal Offer (Glossary)

2

ndStep: Anukret on the Implementation of the Law on the

Issuance and Trading of non-government Securities

• Basic rules and process, timelines

• Explained the concept of Exempt Offer (Article 6)

• Definition of Collective Investment Scheme (CIS)

3

rdStep: (Draft) Prakas on Corporate Bond Issuance

• Specific provisions for disclosure/documentation

• Private placement (Article 4), reference to intermediaries

• Offering to QII (Qualified Institutional Investors)

• Small number private offering (less than 30)

Understanding of Cambodia Approach

Central Bank Law

Market Participants

Government Bonds

Basic law

Corporate Bonds

Company law

Legislation Coverage of Securities Market

[for illustration purposes only]

Approach 1 Main, comprehensive

law describing securities market, its

institutions and participants Based on general law

provisions, e.g. company law

Examples:

e.g. Malaysia, Singapore

Approach 1 Selection of laws or regulations for

specific purposes, e.g. to

issue securities, licensing of participants, market activities Refers to general

law provisions. Example: Cambodia (?)

21

Review of Law on the Trading and Issuance

of non-government Securities

•

SECC Plenary approval vs. timeframe

•

Mention of secondary market (Art 29; no details)

•

‘Securities Dealer’ and ‘Securities Firm’; distinction?

•

Significant mention of Corporate Governance (Ch 6)

•

Terminology:

• Disclosure Document (issuance documentation)

• Proposal (issuance application)

• Registered (accepted issuance application?)

• Private or Personal Offer (Glossary)

• Exempt Offer (Art 16-2 + glossary)

• Exempt Dealer (not in glossary)

• Exempt Transaction

• Exempt Securities (and ‘operation of…’)

Review of Anukret on the Implementation of

the Law on the Issuance and Trading

of non-government Securities

•

Objective (foreign investment) vs. “…members of the public in

Cambodia…”

•

Listing, pricing approval before issuance application, 6 months

approval timeframe (Art 7)

•

Suggestion that other languages may be possible (Art 11)

•

Publishing of historical prices by market operator…

•

Terminology:

• Exempt Offer (Art 6)

• Exempt Dealer (not in glossary)

• Exempt Transaction (sovereign guarantee only?)

• Custody – ‘physical possession and control’ (Annex/Glossary)

23

Review of (Draft) Prakas on Corporate Bond

Issuance

•

Introduction and detailed definition of Private Placement (Art 4)

•

Provision for one or more bond trustees (Art 5/9)

•

Mentions some new terms only in passing (see Terminology)

•

Significant focus on disclosure/continuous disclosure

•

Terminology:

• Private Placement

• Exempt offer

• Bondholders meeting

• Paying agent

• Securities registrar

• Securities transfer agent

• Institutional Investor (Art 4, no definition)

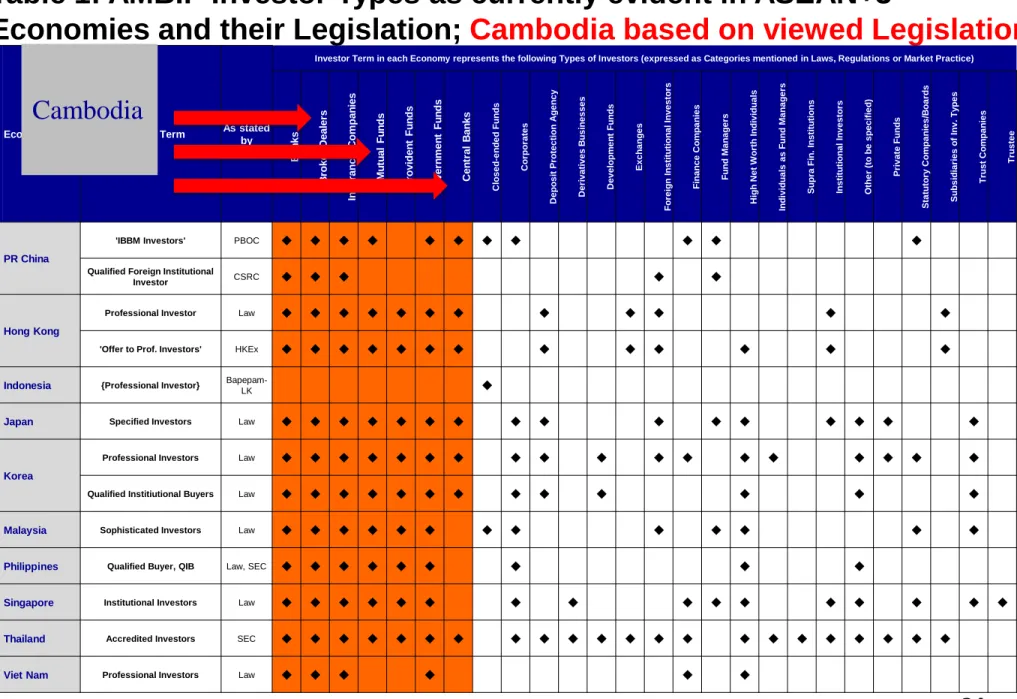

Table 1: AMBIF Investor Types as currently evident in ASEAN+3

Economies and their Legislation; Cambodia based on viewed Legislation

Economy Investor Term As stated by

Investor Term in each Economy represents the following Types of Investors (expressed as Categories mentioned in Laws, Regulations or Market Practice)

Banks Broker/Dealers Insurance Companies Mutual Funds Provident Funds Government Funds Central Banks Closed-ended Funds Corporates Deposit Protection Agency Derivatives Businesses Development Funds Exchanges Foreign Institutional Investors Finance Companies Fund Managers High Net Worth Individuals Individuals as Fund Managers Supra Fin. Institutions Institutional Investors Other (to be specified) Private Funds Statutory Companies/Boards Subsidiaries of Inv. Types Trust Companies Trustee

PR China

'IBBM Investors' PBOC u u u u u u u u u u u

Qualified Foreign Institutional

Investor CSRC u u u u u

Hong Kong

Professional Investor Law u u u u u u u u u u u u

'Offer to Prof. Investors' HKEx u u u u u u u u u u u u u

Indonesia {Professional Investor} Bapepam-

LK u

Japan Specified Investors Law u u u u u u u u u u u u u u u u

Korea

Professional Investors Law u u u u u u u u u u u u u u u u u u

Qualified Institiutional Buyers Law u u u u u u u u u u u u u

Malaysia Sophisticated Investors Law u u u u u u u u u u u u u

Philippines Qualified Buyer, QIB Law, SEC u u u u u u u u u

Singapore Institutional Investors Law u u u u u u u u u u u u u u u u

Thailand Accredited Investors SEC u u u u u u u u u u u u u u u u u u u u u u

Viet Nam Professional Investors Law u u u u u u

Cambodia

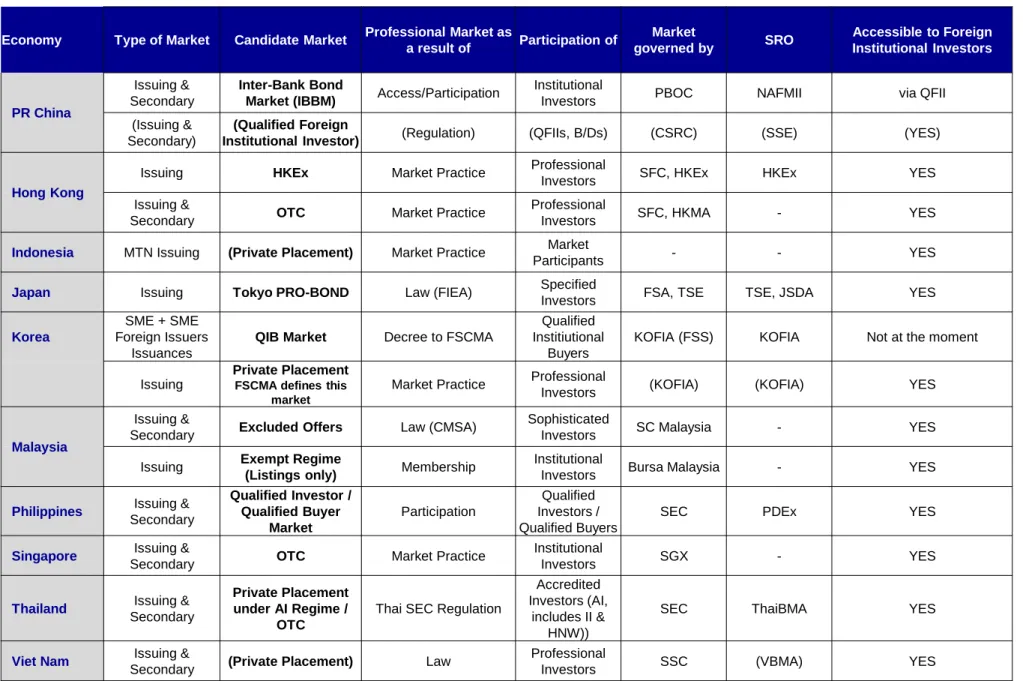

Table 2: Proposed AMBIF Market(s) or Segment(s) For Illustration only

25

Economy Type of Market Candidate Market Professional Market as

a result of Participation of Market

governed by SRO

Accessible to Foreign Institutional Investors

PR China

Issuing & Secondary

Inter-Bank Bond

Market (IBBM) Access/Participation Institutional

Investors PBOC NAFMII via QFII

(Issuing & Secondary)

(Qualified Foreign

Institutional Investor) (Regulation) (QFIIs, B/Ds) (CSRC) (SSE) (YES)

Hong Kong

Issuing HKEx Market Practice Professional

Investors SFC, HKEx HKEx YES

Issuing &

Secondary OTC Market Practice Professional

Investors SFC, HKMA - YES

Indonesia MTN Issuing (Private Placement) Market Practice Market

Participants - - YES

Japan Issuing Tokyo PRO-BOND Law (FIEA) Specified

Investors FSA, TSE TSE, JSDA YES

Korea

SME + SME Foreign Issuers

Issuances

QIB Market Decree to FSCMA

Qualified Institiutional

Buyers

KOFIA (FSS) KOFIA Not at the moment

Issuing

Private Placement FSCMA defines this

market

Market Practice Professional

Investors (KOFIA) (KOFIA) YES

Malaysia

Issuing &

Secondary Excluded Offers Law (CMSA) Sophisticated

Investors SC Malaysia - YES

Issuing Exempt Regime

(Listings only) Membership

Institutional

Investors Bursa Malaysia - YES

Philippines Issuing & Secondary

Qualified Investor / Qualified Buyer

Market

Participation

Qualified Investors / Qualified Buyers

SEC PDEx YES

Singapore Issuing &

Secondary OTC Market Practice Institutional

Investors SGX - YES

Thailand Issuing & Secondary

Private Placement under AI Regime /

OTC

Thai SEC Regulation

Accredited Investors (AI,

includes II & HNW))

SEC ThaiBMA YES

Viet Nam Issuing &

Secondary (Private Placement) Law Professional

Investors SSC (VBMA) YES

Example of a Possible AMBIF Approach

AMBIF Concept LCY Issuance Instruments Investor Issuer

Documentation

= AMBIF Market

Available in Market LCY Issuances

Straight Bonds etc. Licensed Investors, FII Acceptable Issuers Market Practice

Prerequisites in place?

Possible Approach Regulatory Guideline

~ AMBIF Market?!

✔

✔

✔

✔

✔

•

To what extent can banks participate in securities market

(primary / secondary)?

•

Is that governed in separate regulations?

•

Are Foreign Institutional Investors able to participate?

27

Questions from studying Legislation

Prof. Shigehito Inukai

Faculty of Law - Waseda University 1-6-1 Nishiwaseda, Shinjuku-ku Tokyo 169-8050

Office +81 3 3202 2472 Mobile +81 80 3360 7551 shige.inukai@me.com

Matthias Schmidt ADB Consultant

Office +61 3 95571314 Mobile +61 423 708910 macschmidt@me.com