1

Growth Theory:The Economy

in the Very Long Run

•Solow growth model

•Growth accounting

CHAPTER 7~8 Summary

CHAPTER 7~8 Summary

G.Mankiw / macroeconomics 5

thedition

ンキュ クロ経済学Ⅱ 応用編

―第 章 経済成長

2

Solow growth model

Solow growth model

• Why our national income growth?

• Why some economic grow faster than others?

To explain these questions,

we must broaden our analysis

so that it describes change in the economy over time.

Solow growth model

• Saving

• Population growth

• Technological progress

How affect the level of an

economy’s output and its growth

over time.

3

The Accumulation of Capital

The Accumulation of Capital

1

ststep: The Supply for goods

The Supply of Goods The Supply of Goods

and the Production Function and the Production Function

Y = F(K,L) zY = F(zK,zL)

Set z = 1/L Y/L = F(K/L,1)

Set y = Y/L ← output per worker k = K/L ← capital per worker

y = f(k)

Where we define f(k) = F(K,1) MPK = f(k+1)-f(k)

*The

Production function has constant

returns to scale.

*Y/L is a function of the

amount of capital per worker K/L .

Diminishing marginal product of

capital

Output, f(k)

1

MPK

*MPK: Marginal product of capital

The slope of production function is MPK. y

4

The Accumulation of Capital

The Accumulation of Capital

2

ndstep: The Demand for goods

The Demand for Goods The Demand for Goods and the Consumption Function and the Consumption Function

y = c+i

Set s is saving rate c = (1-s)y

To see what this consumption function implies for investment, substitute (1-s)y for c in the national income

Accounts identity. y = (1-s)y+i

i = sy

Investment = Saving

*The demand for goods in the solow model comes from consumption and investment.

5

The Accumulation of Capital

The Accumulation of Capital

3

rdstep: Growth in the Capital Stock and the Steady State

The Capital Stock is key determination of the economy output.

•Investment: expenditure on plant and equipment.

c=f(k)-sf(k)

i y

Output, f(k)

Investment, sf(k) Output

per worker, y

Capital per worker, k

figure2: Output, Consumption and Investment

c=f(k)-sf(k)

i y

Output, f(k)

Investment, sf(k) Output

per worker, y

Capital per worker, k

figure2: Output, Consumption and Investment

Investment = Saving i = sy

By substituting

the production function for y, we can express investment per worker as a function of the capital stock per worker.

i = sf(k)

This equation relates the existing stock of capital k to the accumulation

of new capital i.

6

The Accumulation of Capital

The Accumulation of Capital

4

thstep: Growth in the Capital Stock and the Steady State

The Capital Stock is key determination of the economy output.

•Depreciation: wearing out of old capital; causes capital stock to fall.

figure3: Depreciation

Depreciation, δk

Capital

per worker, k Depreciation

per worker,δ

figure3: Depreciation

Depreciation, δk

Capital

per worker, k Depreciation

per worker,δ

Depreciation

We assume that a

certain fraction

δ of the capital stock wears

the depreciation rate.

7

The Accumulation of Capital

The Accumulation of Capital

5

thstep: Growth in the Capital Stock and the Steady State

The Capital Stock is key determination of the economy output.

•Investment: expenditure on plant and equipment.

•Depreciation: wearing out of old capital

;causes capital stock to fall.

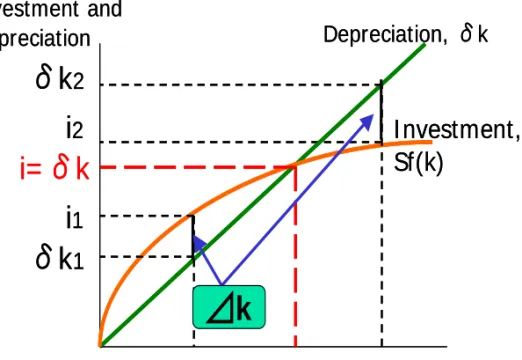

Relationship between Investment & Depreciation

Investment = Saving

i = sf(k)

Change in capital stock = Investment-Depreciation

⊿k = i-δk

⊿k = sf(k)-δk

Where ⊿k is change in the capital stock between one year and the next.

The higher the capital stock The higher the capital stock The Greater amount of the The Greater amount of the

output & investment. output & investment.

Yet greater the amount of depreciation. Yet greater the amount of depreciation.

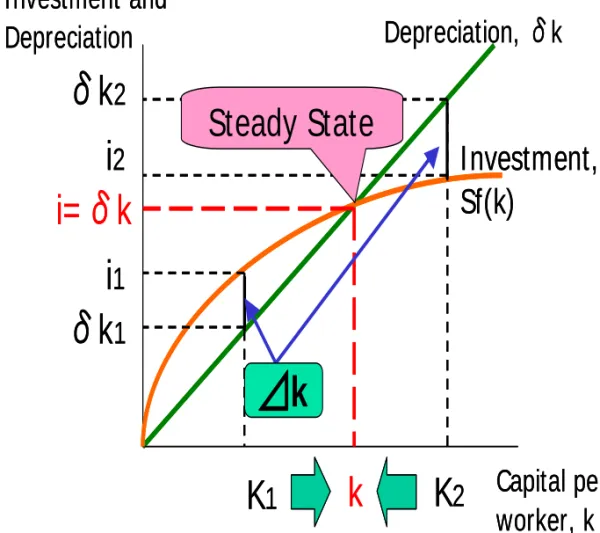

figure 4: investment, Depreciation,and the Steady State

Capital per worker, k I nvestment and

Depreciation

K1 k K2

δk2

δk1 i2

i=δk i1

Depreciation, δk

I nvestment, Sf(k)

figure 4: investment, Depreciation,and the Steady State

Capital per worker, k I nvestment and

Depreciation

K1 k K2

δk2

δk1 i2

i=δk i1

Depreciation, δk

I nvestment, Sf(k)

⊿k

8

figure 4: investment, Depreciation,and the Steady State

Capital per worker, k Investment and

Depreciation

K1 k K2

δk2

δk1 i2 i=δk

i1

Depreciation, δk

Investment, Sf(k)

figure 4: investment, Depreciation,and the Steady State

Capital per worker, k Investment and

Depreciation

K1 k K2

δk2

δk1 i2 i=δk

i1

Depreciation, δk

Investment, Sf(k)

⊿k

Steady State

The Accumulation of Capital

The Accumulation of Capital

(At k) Investment = Depreciation sf(k) =δk

⊿k = sf(k)-δk = 0

We therefore call k

the steadysteady--state level of capital.state

(At k1) Investment > Depreciation sf(k) >δk

⊿k = sf(k)-δk > 0

(At k2) Investment < Depreciation sf(k) <δk

⊿k = sf(k)-δk < 0.

6

thstep:Steady State

9

The Accumulation of Capital

The Accumulation of Capital

7

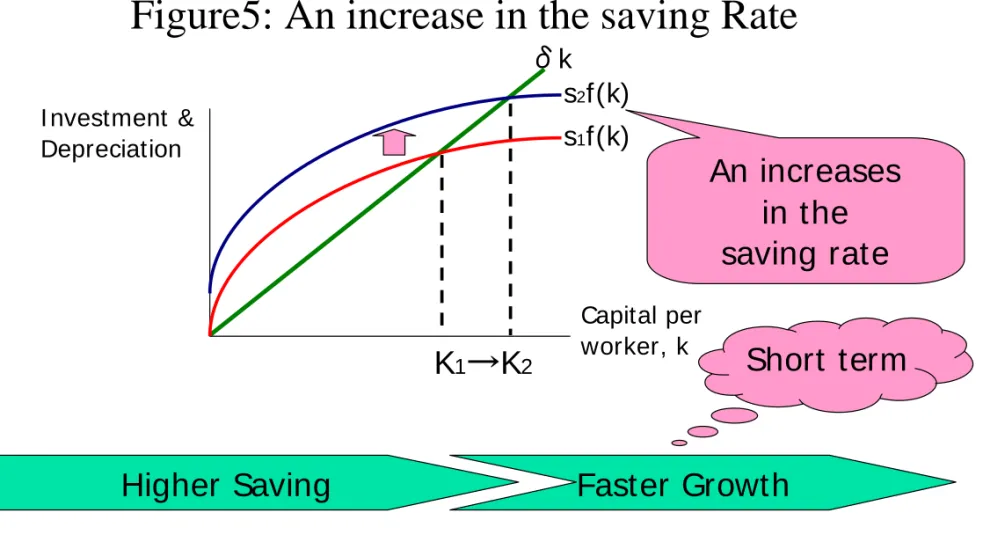

thstep: How Saving Affects Growth

Example:Japanese & German growth after World War Ⅱ

Figure 4-5: An I ncrease in the Saving Rate

I nvestment & Depreciation

Capital per worker, k

s1f(k)

K1 K2

s2f(k) δk

An increases in the

saving rate

Higher Saving Faster Growth

Short term

Figure5: An increase in the saving Rate

10

Population Growth

Population Growth

1

ststep: Population Growth

Figure 6: Population Growth in the Solow Model

Investment, break-even investment

K*

Break-even

investment, (δ+ n)k

Investment, Sf(k)

The Steady State

Capital per worker,k

Figure 6: Population Growth in the Solow Model

Investment, break-even investment

K*

Break-even

investment, (δ+ n)k

Investment, Sf(k)

The Steady State

Capital per worker,k Investment,

break-even investment

K*

Break-even

investment, (δ+ n)k

Investment, Sf(k)

The Steady State

Capital per worker,k

Thus,

k = K/L is capital per worker, and y = Y/L is output per worker.

⊿k = Investment

-(Depreciation+population growth)

= i-(δ+n)k

n is the rate of population growth (δ+n)k is breakbreak--even investment.even investment

11

2

ndstep: The Effects of Population Growth

Population Growth

Population Growth

Figure 7: The Impact of Population Growth

(δ+ n2)k

k2*

I nvestment, break-even investment

k1*

Investment, Sf(k)

Capital per worker,k

(δ+ n1)k

Down

Figure 7: The Impact of Population Growth

(δ+ n2)k

k2*

I nvestment, break-even investment

k1*

Investment, Sf(k)

Capital per worker,k

(δ+ n1)k

Down

An increase in the rate of population growth

reduces the steady state capital stock.

Population growth

Lower level of capital per worker Lower income

12

The Higher Saving Rate

The Higher Saving Rate

& Population Growth

& Population Growth

The higher rate of saving The higher stock of capital

+

The higher level of output The higher income

Population growth

Lower level of capital per worker Lower income

When the economy reaches its steady state, output per worker stops growing.

We cannot explain long economic growth.

We cannot explain long economic growth.

13

1

ststep: The Efficiency of Labor

Technological Progress

Technological Progress

in the Solow Model

in the Solow Model

Y = F(K,L)

The model is modified to include exogenous technological progress.

E: efficiency of labor

Y = F(K,L × E)

L×E is

effective workers. effective workers.

The simple assumption The simple assumption about technological progress about technological progress

E glows at some constant rate g.

g: the rate of labor-augmenting technological progress

14

Technological Progress

Technological Progress

in the Solow Model

in the Solow Model

2

ndstep: The Effects of Technological Progress

Figure8: Technological progress in the Solow Growth Model

I

I

δ

Steady State

k

Capital per effective worker Capital per effective worker

k = K/(L × E)

Output per effective worker Output per effective worker

y = Y/(L × E)

change in the capital stock between one year and the next

⊿ k = sf(k)-( δ +n+g)k

15

Technological Progress

Technological Progress

in the Solow Model

in the Solow Model

y y

= y = Y L =

Y = y×L

y

y y

= ×

y = Y ×L =

Y = y× g

Y = y× ×L

y

y y

= y = Y L =

Y = y×L

y

y y

= ×

y = Y ×L =

Y = y× g

Y = y× ×L

y

3rd step: The Effects of Technological Progress

We can explain long economic growth.

We can explain long economic growth.

Technological progress

Technological progress

16

The Golden Rule Steady State

The Golden Rule Steady State

Golden rule level of capital

Steady-state output, depreciation and

investment per effective worker

Steady-state capital per effective worker,k*

(δ+ n+ g)k*

K*gold c*gold

i*gold

f(k* )

S gold f(k* ) Steady-state

output, depreciation and

investment per effective worker

Steady-state capital per effective worker,k*

(δ+ n+ g)k*

K*gold c*gold

i*gold

f(k* )

S gold f(k* )

Figure 9: steady state consumption Consumption = output – Investment

c = f(k) – sf(k)

Maximizes Consumption

c* = f(k*)-( δ +n+g)k*

At this point

MPK = δ +n+g

MPK- δ = n+g

17

Policies to Promote Growth

Policies to Promote Growth

• Change in the Rate of Saving

– Budget Deficit – Budget Surplus – Pension

• Allocating the Economy’s Investment

– Are there some types of investment that policy should especially encourage?

– Learning by doing

• Technological externally

• Knowledge spillover

• Social profit > Personal profit

– Infrastructure

18

The Worldwide Slowdown in

The Worldwide Slowdown in

Economic Growth

Economic Growth

• Measurement Problem

• Oil Price

• Worker Quality

• The Depletion of Idea

19

Beyond the Solow Model:

Beyond the Solow Model:

Endogenous Growth Theory

Endogenous Growth Theory

• ソロ モ ル 超え 技術進歩 説明 モ ル

– Y =

– Y 産出 資本 ック 資本 単 当た 生産

• ソロ モ ル 違 い 資 本 単 追 加 A 単 産出 た 資本 対 収益逓減 い

– ⊿ = Y δ 資本蓄積 変化 表わ – ⊿Y Y = ⊿ = δ

• 経済 所得 永続的 成長 説明

20

A Two

A Two - - Sector Model Sector Model

• 以上 生産部門 持 モ ル 展開

• 部門 経済 仮定 製 企業 研究大学

– u: 大学出身 労働力 占 割合

– 1-u: 製 業 労働力 割合

– E: 知識 ック 割合 労働 効率性 決定

• 場合 生産関数

– Y = F [K, (1-u)EL] 製 企業 生産関数

– ⊿E = g(u)E 研究大学 生産関数

– ⊿K = sY – δK 資本蓄積

• 持続的 成長 内生的 観測 大学 知識

創 決 減 い

21

The Micro Economics of

The Micro Economics of

Research and Development

Research and Development

• 部門 内生的成長モ ル 技術進歩 完全 理解 い い

– 研究開発 過程 実

• 知識 ほ 公共 あ そ 多く 利潤動機 駆 企

業 い

• 研究 利潤 発生 特許制度 企業

一時的 そ 分 い 独占 あ

• ひ 企業 行 た革新 次 企業 更 革新 た

• 内生的成長モ ル 長所

– 技術革新 仮定 完全 描写 い

• 研究 行 う 行 わ い ?

– 正 外部性 先人 優 た知識 利用

– 外部性 他人 領域侵害

– 正 外部性 大 い場合補助金 政政策 妥当 あ

22

Accounting for the Sources of

Accounting for the Sources of

Economic Growth

Economic Growth

Real GDP in the United

States has grown an average of 3%

per year over the past 40

years.

What explains this growth?

Reference: “74th Annual Report 1 April 2003 – 31 March 2004” Bank for International Settlements, 2004

23

Growth Accounting

Growth Accounting

• 生産要素 増加

– Y = F(K,L)

– 資本 増加

• MPK = F(K+1,L)-F(K,L)

• 資本 ⊿K単 増加 た 産出 近似的 MPK×⊿K 増加

– 労働 増加

• MPL = F(K,L+1)-F(K,L)

• 労働 ⊿L単 増加 た 産出 近似的 MPL×⊿L 増加

– 資本 労働 増加

• ⊿Y = (MPK×⊿K)+(MPL×⊿L)

•

• ( )

L L K

K Y

Y

L L Y

L MPL K

K Y

K MPK Y

Y

− Δ Δ +

Δ =

⎟ Δ

⎠

⎜ ⎞

⎝

⎛ ×

Δ +

⎟⎠

⎜ ⎞

⎝

⎛ ×

Δ =

α α 1

24

• 技術進歩

– Y = AF(K,L)

• A: TFP(Total Factor Productivity)

•

•

• ⊿A/A ソロ 残差(Solow residual) 呼 あ

• TFP 測定 た投入 産出 間 関係 変え あ そ う

含ま

Growth Accounting

Growth Accounting

( )

( )

LLK K Y

Y A

A

A A L

L K

K Y

Y

− Δ Δ −

Δ − Δ =

+ Δ

− Δ Δ +

Δ =

α α

α α

1 1

25

Case Study:

Case Study: “ “ The Myth of the Asia The Myth of the Asia ’ ’ s s

Miracle

Miracle ” ”

• Paul Krugman (Stanford University)

• 1950 年代 ソビエ 経済

著 く成長 遂 た

タ 信頼性 疑問 あ

• 成長 大 資本 労働力 投入

た 必然的 起 た あ

た

• ソロ モ ル 簡単

説明

26

• 近年 東ア ア 成長 当時

ロ ア 同 言え ???

Case Study:

Case Study: “ “ The Myth of the Asia The Myth of the Asia ’ ’ s s

Miracle

Miracle ” ”

27

中国 へ向 う ?

中国 へ向 う ?

• 中国経済 特徴

– 安い労働賃金 い生産コ 国際

競争力 維持 中国 一人あた GDP 日

本 1/30

– 急 資本蓄積

• 投資率 固定資本形成 対GDP比

– 中国 % 年

– 日本 % 年代初頭

» 中国 家計 日本以上 貯蓄率 高い

» % 年 中国 家計貯蓄率

» 対内直接投資 急増 高度成長期 日本 外資 完全 閉 出 いた

28

中国 日本

生産 生産要素 年 年

実質GDP

労働者数

実質資本 ック

労働生産性

資本労働比率

総要素生産性

出展:経済セ ナ 月号 P

非 次産業 成長率 分解:中国 日本

29

タ い 私 見解

• 実際 TFP い ?

– 計測 問題

• 中国 国土 広いた 測定 困難

• ソロ モ ル 残差 日本 先進国

技術 流出 い

– 中国国内 開発 た技術 い???

• 政治的 問題

– 意図的 タ 改 い ?

• 共産主義国 ソビエ 意図的 タ 水増 いた

• 共産党一等支配 正当化 た