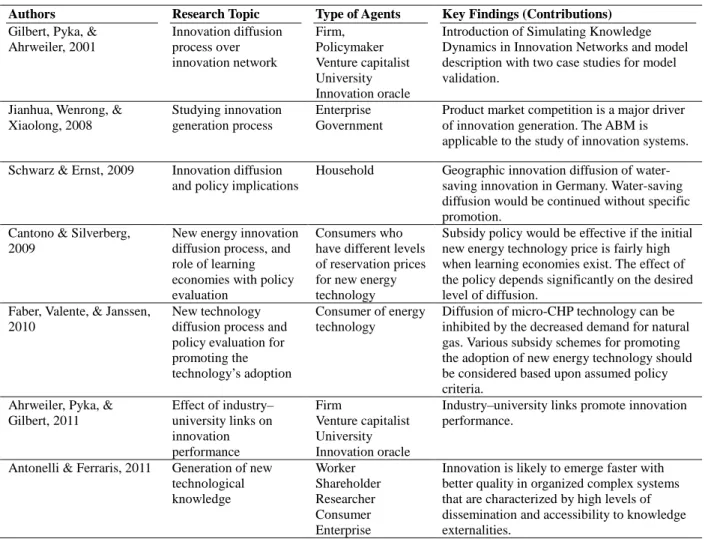

The national-level financial system can be divided into "internally dominated system (I-system)" and "externally dominated system (O-system)." USA At the same time, the new product includes a gradually improved technological component in the form of the "A" component. the index indicates the level of technological performance).

Process Overview and Scheduling

When the last, tenth, "consumer demand" is satisfied by some of the agents, the simulation is finished. Instead, the simulation model fixes the times of consumer demand change, and the simulation is finished when the last consumer's demand is satisfied by some of the agents.

Design Concept

Agents guess the technological specification of a consumer group's product by gathering their own information and learning about other agents' information. An agent requesting R&D cooperation shall pay half of the expected R&D costs to the partner agent.

Initialization

The age distribution of bankrupt agents is observed to find consistency with theoretical studies on firm exit and entry dynamics. The implemented spin-off mechanism is the same regardless of the simulation factor, such as the dependency of the relations between the agents.

Input

However, the variation in the simulation parameters can produce a different systemic environment that affects the spin-off agent's survival. In this system, the spin-off agents have a better chance of survival than in a system that has a high relationship dependency.

Sub-Model

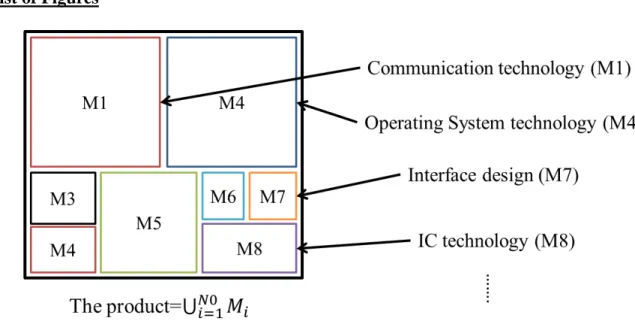

Thus the number of the product's technological components and the product's technological complexity (accumulation) increase. When the consumer group demands a new product, the new demand is transformed into innovation in the form of two technological components for the new product's technological specification.

External Validation

Experimental Setup For Simulation

Therefore, we believe that the distribution pattern emerges from the implemented dynamics and not from a particular set of simulation parameters. We use graphical presentation to analyze the system-level results of the stylized simulation factors and use statistical analysis for more detailed interpretation.

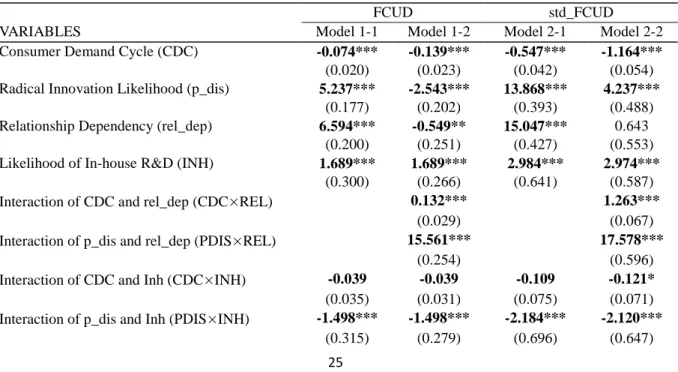

The coefficient shows that greater reliance on historical partners or internal R&D for technology purchasing causes a greater delay in the implementation of new products. Therefore, those actors that rely on historical partners or internal R&D rather than on new partners experience, on average, a greater delay in technology acquisition. The coefficient tells us that it is beneficial to rely less on historical partners or internal R&D for technology purchasing, when the consumer group often demands radically innovative technological features for a new product.

In this regard, the agent and historical partners are likely to be aware of incrementally innovative technology based on the existing technology stock they own. The negative coefficient of RELxINH implies that if an agent decides not to source technology from new partners, relying more on internal R&D capabilities rather than historical partners for technology sourcing helps to reduce any delays in product implementation. Therefore, it is likely that the agent and the historical partners would have similar technology and development capabilities.

In this case, relying on internal R&D rather than historical partners for technology procurement helps reduce any delays in technology procurement.

The Effect of Relationship Dependency on the Stability of Technology Sourcing

We use a sensitivity test to assess how the simulation results respond to change in non-simulation parameters. We measure how much of the total variation in simulation results is explained by variation in non-simulation parameters and simulation factors. We also assess to what extent each of the factors uniquely explains the total variation in outcomes.

The analysis shows the extent to which the simulation factors explain the total variation in the simulation results. We then estimate the ratio of the total variance of the dependent variables to the explained variance with respect to the non-simulation parameters. The result shows to what extent the non-simulation parameters explain the variation of the dependent variables.

Simulation Parameter Only” shows that 62.31% of the total variation in FCUD and 41.54% of the variation in std_FCUD is explained by the variation in the simulation parameters.

Findings from the Simulation

Juxtaposing with the Real World

Thus, when economic agents are in an institutional environment that encourages liberal technology transactions (eg, the US), less reliance on internal R&D capability to source technology and technology acquisition from other agents constitute an approach that is more efficient. When we consider that the JP system is a system driven by historical relationships, the way for Japanese players to deal with the shock of radical innovation is to engage in more dynamic partnerships with a greater variety of players rather than remaining with historical partnerships, while at the same time strengthening internal R&D capability (see AP 13). In a growing innovation-driven industry, reliance on internal R&D still benefits technology resource efficiency when the institutional environment is based on "long-term historical relationships." This explains why JP players have a strong tendency to rely on internal R&D, as a study on the technology acquisition strategy of Japanese firms shows (Kani & Motohashi, 2013).

Therefore, we suggest that it is necessary for Japanese firms to have a more dynamic relationship with a variety of economic agents while maintaining and strengthening internal R&D capability, and that the Japanese NIS promotes this approach. Second, Japanese firms need to maintain and strengthen their internal R&D capabilities while having a more dynamic partnership network with a variety of players. The business departments dealing with the IT industry need to strengthen their approach to purchasing radically innovative technologies from firms or universities that have the ideas they need, while at the same time strengthening their internal R&D capabilities by investing more in R&D invest and further well-qualified talent (eg through aggressive M&A).

Further, such divisions should maintain repeated R&D collaborations, long-term technology sharing contracts, and so on with former business partners, while maintaining a strong internal R&D capability. Exploring domestic micro-CHP generation in the Netherlands: An agent-based demand model for technology diffusion. Changing Varieties of Capitalism and Revealed Comparative Advantage from 1990 to 2005: A Test of the Hall and Soskice Claims.

Technology portfolio matrix

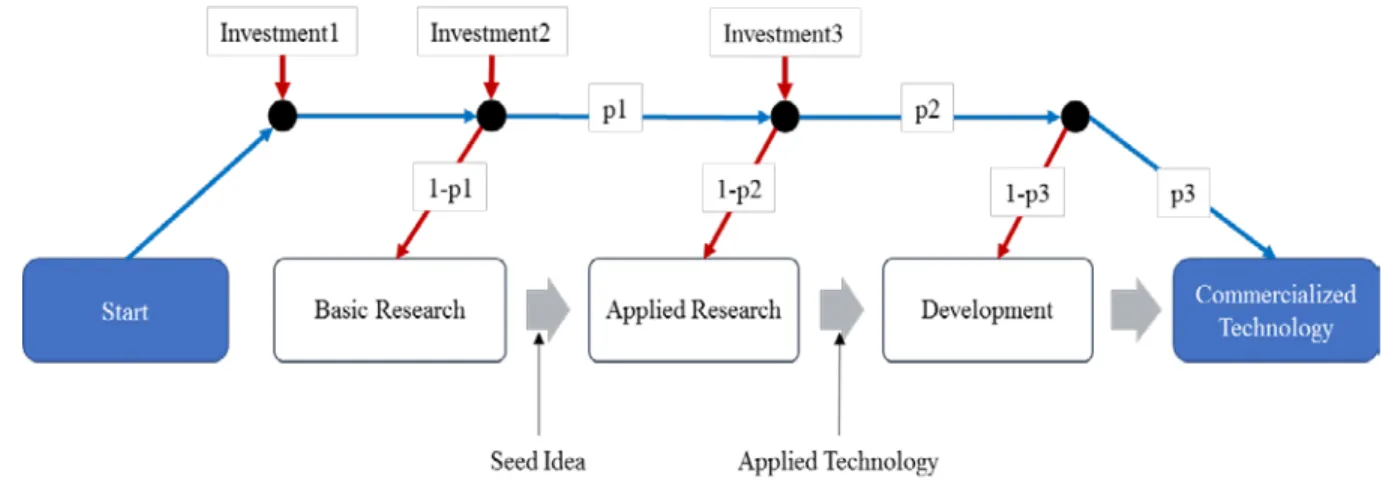

Internal R&D process

If the process moves to the applied research phase, the agent becomes the owner of the basic idea of the target technology. Likewise, p2 corresponds to the probability of moving from the applied research stage to the development stage, which enables the agent to have applied technology. The probability of moving to the next R&D stage consists of the following three factors: agent type, the agent's relevant knowledge of the target technology, and the technological performance of the target technology.

However, fixed agent has a lower p1 but a higher p2 than UNIV with involvement in the transition to the development stage. It calculates the relative value of the total commerciality of owning technology related to the target technology. If the agent has technology that is close to the target technology (eg (B, 3) technology is closer to (B, 4) than (B, 1) or (C, 4)), it is relatively easy to develop a new idea for the target technology.

If N is less than or equal to the performance of technology (𝑇𝐿𝑚𝑚𝑚,𝑖 ) required to make the product that is most in demand, it produces "1", which means that there are no specific problems to adopt the technology through technological development. performance promotion.

Technology source selection algorithm

Technology sourcing from partners

If any of the historical partners do not have the target technology, the agent checks each partner's R&D experience with the technology component. In this collaboration, the agent pays half of the expected total R&D expenditure to the partner. In the negotiation process, the partner first calculates the expected market share that he can additionally obtain if he develops the technology exclusively.

Check all technology portfolios of the partners to search (TC',TL') with a commerciality greater than 0.5 if there are such partners. The number of agents the agent searches for is set to the same number as the agent's historical partners. Then the agent randomly selects one of the agents from the group of non-historical partners.

The agent does not interact with agents who only have the technology in the basic research phase.

Update rule of the partnership network

An agent willing to acquire technology from new partners follows the same algorithm as the algorithm of technology acquisition from partners. In the algorithm, an agent chooses the entire number of agents with which it will interact, except historical partners.

Information learning over the partnership network

Market power and market share

Model of license contract and royalty payment

R&D collaboration model

Spin-off process

Since the current model is based on the structure of the closed economy, the total amount of capital assets must be kept at the same level. If the spin-off process operates unchecked at the system level, it can cause the total amount of capital assets to continue to increase because the new firm is created with its own capital assets. This is a component that controls the total amount of capital assets in the system.

Second, the total number of technologies for each of the technological components in the system is counted. Third, the technological component is selected that contains the minimum number of technologies in the system and that the parent agent has knowledge of. Fourth, the parent company's entire technologies related to the selected technological component are copied to the new company.

Identification of the technology area known to the parent agent (A), TF_A Selected technology group TC = TF_A, where TF_A = Min(PRO_T).

Codifying the product innovation pattern

56. where the parent organization trains human resources to know the business/technology area in which the parent company operates and also helps the employees to think about the startup. In order not to violate the rule on the preservation of the source of capital, the breakdown process is controlled by a "capital reservoir". The smartphone is therefore a new product that contains radical innovations in terms of the concept of the current model.

0 means that the corresponding technological component does not need to be improved or introduced for the implementation of new products. 1 means that the corresponding technological component needs to be improved or reintroduced for the implementation of new products.

Marginal effect of p_dis