2019 年 8 月

JOURNAL OF SOUTHWEST JIAOTONG UNIVERSITY

Vol. 54 No. 4 Aug. 2019 ISSN -0258-2724 DOI:10.35741/issn.0258-2724.54.4.39 Research article

T

HE

M

OTIVES FOR

A

PPLYING

C

REATIVE

A

CCOUNTING

M

ETHODS AND

T

HEIR

I

MPACT ON THE

C

REDIBILITY OF

F

INANCIAL

S

TATEMENTS IN

J

ORDANIAN

H

OTELS

采用创新性会计方法的动机及其对约旦酒店业财务报表可信度的影响

Mousa Mohammad Abdullah Saleh 1, Omar A. A. Jawabreh 2, Mohammad Nayef Alsarayreh 3, Enas Fakhry Mohammad Abu-Eker 4, Ashraf Jahmani 5

1

Department of Financial and Administrative Sciences, Al-Balqa Applied University, Salt, Jordan, dr.mousasaleh@bau.edu.jo

2 Department of Hotel Management, Faculty of Tourism and Hospitality, University of Jordan,

Amman, Jordan, o.jawabreh@ju.edu.jo

3

Al-Balqa Applied University, Salt, Jordan, Mohammad.sarayreh@bau.edu.jo

4 Al-Balqa Applied University,

Salt, Jordan, Qtaypah882003@yahoo.com

5

Al Falah University,

Dubai, United Arab Emirates, ashraf.jahmani@afu.ac.ae

Abstract

This study explored the motives for applying creative accounting methods and their impact on the credibility of financial statements in Jordanian hotels. This study is an attempt to shed light on the motives for creative accounting in hotel management and their impact on the credibility of financial statements in hotels. To promote scientific and intellectual awareness of the creative accounting practices of investors and business owners. This could be done through holding seminars in trade unions and accounting associations for the purpose of raising awareness of investors and hotel management about these practices and attention by the accounting professionals of the Association of Jordanian Accountants and Auditors, the indicators of the practice of creative accounting methods. Tightening procedures on auditing the financial statements that can contain those indicators.

Keywords: Creative Accounting, Credibility of Financial Statements, Income Statement, Budget, Cash Flow.

摘要 这项研究探讨了采用创新会计方法的动机及其对约旦酒店财务报表信誉的影响。本研究旨在阐明酒店管理中创新 会计的动机及其对酒店财务报表信誉的影响。促进科学和知识意识的投资者和企业主的创新会计做法。这可以通 过在工会和会计协会举办研讨会来实现,以提高投资者和酒店管理者对这些做法的认识,以及约旦会计师和审计 师协会的会计专业人员对创造性会计实践指标的关注。 方法。 审计可能包含这些指标的财务报表的收紧程序。 关键词: 创新会计,财务报表信誉,损益表,预算,现金流量。

I.

I

NTRODUCTIONThere is much talk lately about the subject of tax evasion in the Hashemite Kingdom of Jordan and many wonder about the size of tax evasion and its ways and causes. Some also question the possibility of losing a certain organization, which would affect the results of its business with the continuation of this loss for several years. They also wonder whether this loss is real or fabricated, since some enterprises are making very modest profits relative to their capital.

The tourism and hospitality sector is considered one of the most important sectors in Jordan. There are tourist areas that are attractive to tourists from all over the world. Despite these advantages enjoyed by Jordan, the hospitality sector is exposed to difficult economic conditions that have led to the decline of the sector in the recent period [1].

The tax laws and the possibility of obtaining the necessary funding are considered the common problems facing many enterprises, including the hotel sector [2]; the difference and rise in energy prices is also a key factor in raising the cost of hotels and reducing the proportion of desired profitability.

Because of many of the previous factors, some hospitality companies may find themselves vulnerable to financial failure. One may find that some financial managers may be forced to use accounting practices known as creative accounting to control the results of business and to beautify the financial position in a way that serve the desires of the company [3] based on the flexibility of the accounting principles.

Accounting is defined as the science and art of evaluating transactions that have financial impact by monetary units [4], i.e. they are based on accounting principles and standards. The technical and creative expertise of accounting can also be used to beautify the figures in the financial statements in what is known as creative accounting. According to [5], creative accounting is the use of the best principles, rules and policies of accounting to achieve total reliability of financial information in a creative way. From the above definition, the most important objective of creative accounting is to optimize the appropriate standards and principles in order to access reliable and high quality financial information. However, the reality is very different since some people use their expertise and practical ability to exploit gaps and alternatives in accounting measurement and resort to creative accounting for manipulation and fraud.

It can be dangerous to practice creative accounting because some executive departments seek to portray their desired profits instead of their actual profits in pursuit of some ulterior motive (financial rewards, etc.). The use of these methods can give a different perception of what the statement reflects, which may affect how people decide to use these financial statements.

It can be argued that creative accounting and its negative image may not be limited to the subject of tax evasion or the presentation of unreliable data, but may go beyond the issue to affect the integrity of the economic system as a whole and the efficiency of its institutions [6]. The use of creative accounting and its negative image is also often motivated by, for example, a desire to falsely improve the reputation of management before the board of directors or shareholders in order to maintain the management's gains. One of the negative effects of using these methods is that they blur the correct image of the investor, especially if the income is manipulated in the short term. This manipulation may cause the investor to make the wrong decision and thus could affect the economy of the Kingdom in general.

The idea of the current study emerged from a collection of research compiled on the subject of creative accounting. The researchers conducted a previous study on the possibility of accounting fraud in the financial statements of hotels and tourism companies. Surprisingly, the most prominent result of that study was the absence of such fraud [7], [8]. The researchers conducted another study forecasting the failure of hospitality companies using the Altman model. They then tried to complete what they started in the previous studies, keeping in mind the importance of this sector and the fiscal information it could provide for Jordan.

The importance of this study emerged from the increasingly significant tourism and hospitality sector in Jordan, as well as from the spread of creative accounting. This study is an attempt to cover and to identify the methods of creative accounting and to link the impact of each method to the quality and the reliability of financial statements.

This study aims to achieve a number of objectives, including: identifying methods of creative accounting that can be conducted in hotels, demonstrating the purpose of each possible creative accounting method in hotels and finally studying the

impact of each method of creative accounting on the quality of financial statements.

In this study, the researchers sought to shed light on the hotels sector that is one of the main sectors in the Jordanian economy.

II.

M

ETHODOLOGYThis study is an attempt to shed light on the motives of creative accounting in hotel management and its impact on the credibility of financial statements in hotels. The sample of the study consisted of (99) chartered accountants (auditors) randomly selected from the study population, which consists of 345 chartered accountants.

A. Hypotheses of the Study

The first main hypothesis: The management of Jordanian hotels have major motives that cause the use of creative accounting methods.

The following sub- hypotheses are derived from this hypothesis:

H1:1 factors related to the hotel (size of hotel capital, hotel classification, profit size) have a statistically significant impact on the use of creative accounting methods

H1:2. There is a statistically significant relationship between the attempt to reduce the tax burden of the hotel and the use of creative accounting methods.

H1:3. There is a statistically significant relationship between trying to improve the outcome of the hotel activity and improving the financial position in order to obtain the required funding and the use of creative accounting methods.

The second main hypothesis: Applying creative accounting methods in financial statements affects the reliability of these financial statements.

The following sub- hypotheses are derived from the second main hypothesis:

1. There is a statistically significant relationship between the methods of manipulation in the income statement and the reliability of the financial statements.

2. There is a statistically significant relationship between the methods of manipulation in the financial position statement and the reliability of the financial statements.

3. There is a statistically significant relationship between the methods of manipulation in the cash flow statement and the reliability of the financial statements.

III.

P

REVIOUSS

TUDIESThe results of many studies related to the subject of the current study confirm that many establishments practice creative accounting methods in their financial statements. Most of these studies were conducted in developed countries with precise systems and standards [9], [10], [11]. Therefore, developing countries whose systems are less efficient and accurate than those of developed countries could be motivated and could practice creative accounting methods.

Most of the studies, especially the Arabic ones, have concentrated on the subject of creative accounting partially by taking a simple picture of creative accounting. Most of the previous studies, especially the Arabic ones, focused on the subject of creative accounting methods without dealing with matters that may precede applying its methods such [12] study that focused on the methods of creative accounting in companies where the methods were investigated through a questionnaire distributed to the legal accountants (auditors) [13].

The motives of the application of creative accounting have been addressed only through the theoretical framework and have not been identified through practical application. This study attempted to identify and to measure the motives of applying creative accounting applied by hotel management. Al-Qari [14] measured the motives of applying creative accounting in Saudi corporations. Al-Qari study [14] is the only Arabic study that tackles in detail the motives of applying creative accounting according to the knowledge of the researchers; it concluded that there are ten motives for Saudi companies to practice creative accounting methods. The most prominent of these motives are tax evasion, the desire to obtain administrative compensation, the desire to influence the investment decisions of shareholders and the desire to achieve specific goals for profit [15], [16], [17], [18], [19]. The current study not only measure the motives of Jordanian hotels management for applying creative accounting but also connect each motive with each method of creative accounting to investigate whether there is a relationship between each motive and each method.

Al-Batniji [20], Al-Qatish and Sufi [21] studied applying the methods of creative accounting in both the income statement and the financial position where each item of the financial statements was studied and the possibility of applying creative accounting in those items and the counter-action for the application of creative accounting in each item. While in the current study, the researchers connect

each motive with a method for example in order to find the relationship between motives and methods. For example, if the hotel management motive is tax evasion, the emphasis will be on creative accounting procedures in the income statement. The focus will be on the hotel's financial position statement if the motive is to improve the hotel’s activity and its financial position.

It is well known that the accounting science is one of the advanced and rapidly developed sciences and the accounting standards and the experience of accountants and their abilities are developing. This rapid development cause in some cases the accountants to try to find legal gaps in those accounting standards and to use them to show a picture that does not reflect the reality of the company. Some studies have pointed to the causes of the collapse of some large companies referred to their use of creative accounting methods to improve their financial appearance. Hamada study [22] mentioned that the misleading and circumvention in the use of accounting principles and standards led to the collapse of these companies, and most those companies belong to the banking sector.

The current study is a result of the spread of creative accounting methods in various sectors and the lack of discovery of these practices in most cases and their impact on the presentation of misleading data in some cases. Henceforth the problem of study, which is to identify the motives of the management of hotels in Jordan to use creative accounting methods in hotels as well as to treat this usage to prevent the hotel sector from experiencing the same problems as the banking sector. In addition, the study investigates whether these creative methods and practices affect the quality of the financial statements in those hotels.

Several studies have attempted to identify the methods of applying creative accounting and the quality of accounting information [6], [23], [24], [25], [26]. Most of the previous studies have focused on the relationship between the methods of applying creative accounting and the quality of the financial statements in terms of relevance, reliability, stability and comparability.

A. Methodology

1) Hypotheses Testing

In order to ascertain the validity of the hypotheses and to accept or reject them, the researchers used regression weight method, whose outputs include the regression estimate that

indicated how much the independent variable interprets the dependent variable.

Figure 1. Results related to study hypotheses.

IV.

T

HES

AMPLE OF THES

TUDYThe sample of the study consisted of (99) chartered accountants (auditors) randomly selected from the study population, which consists of 345 chartered accountants. Table 1 shows the distribution of sample’s individuals according to the demographic variables.

V.

R

ESULTS Table 1.The demographic variables of the sample of the study

Category Frequency Percentage

Age 26-35 years 64 21.3 36-45 years 91 30.3 46-55 years 24 8.0 More than 55 years 121 40.3 Scientific qualification Diploma 12 4.0 Bachelor 167 55.7 Higher Diploma 34 11.3 Master 51 17.0 PhD 36 12.0 Specialty Accounting 218 72.7 Business Administration 21 7.0 Finance and Banking 61 20.3 Years of experience Less than 5 years 27 9.0 6-10 years 34 11.3 11-15 years 61 20.3 16-21 years 18 6.0 21-25 years 57 19.0 103 34.3 Total 300 100.0

Table 1 shows the following:

1. The highest percentage of the distribution of the sample was according to the age variable (40.3%) for the age group (more than 55 years), followed by the percentage (30.3) for the age group (36-45 years), while the lowest percentage (8.0%) for the age group (46-55 years).

2. The highest percentage of the sample was divided according to the percentage of the scientific qualification (55.7%) for bachelor’s holders, followed by (17.0%) for Master’s holders while the lowest percentage (4.0%) for diploma’s holders.

3. The highest percentage of the sample was distributed according to the specialty variable (72.7%) for (accounting), while the lowest percentage (7.0%) for (business administration).

4. The highest percentage of the distribution of the sample according to the variable years of experience (34.3%) was for the years of experience (26 years and above), followed by the percentage (20.3%) for (11-15 years) -20 years). While the lowest percentage (6.0%) for (16-20 years).

The results of the study that aims to identify the motives of Jordanian hotels management to use creative accounting methods and their impact on the reliability of financial statements.

Table 2.

Statistical description of the variables of the study in descending order according to the arithmetic average

Variables Arithmetic average* S.D. Rank Convenience Tax 3.98 0.30 1 High Technical factors 3.94 0.48 2 High budget 3.88 0.64 3 High Profits 3.87 0.39 4 High Income statement 3.76 0.73 5 High

Cash Flows 3.65 0.59 6 Medium

Reliability 3.64 0.37 7 Medium

*The maximum degree is 5

Table 2 shows that the arithmetic averages of the study variables ranged from 3.64 to 3.98 and with high and moderate convenience degrees. The tax variable has got the highest rank with an arithmetic average of 3.98 and a standard deviation of 0.30, followed by technical variable with 3.94 arithmetic averages and a standard deviation, while the lowest was the variable (reliability) and the standard deviation (0.37).

Table 3.

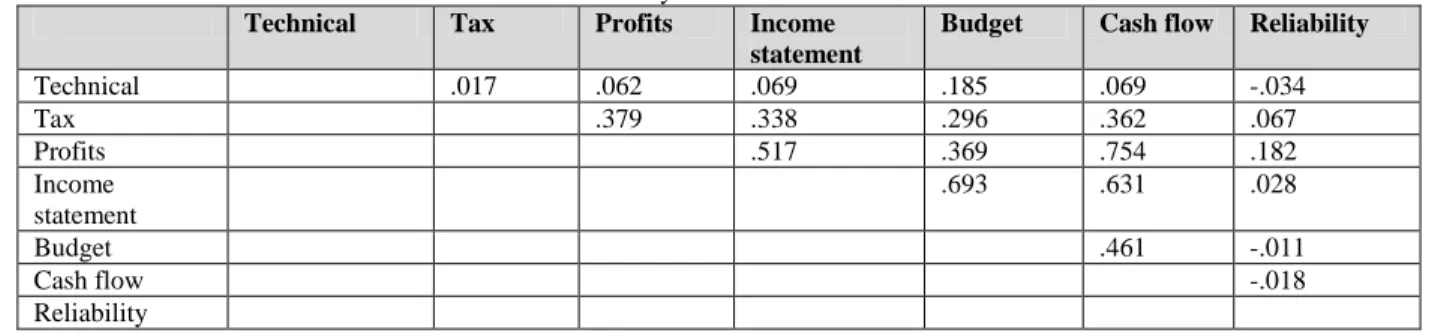

Pearson correlation coefficient test for the variables of the study

Technical Tax Profits Income statement

Budget Cash flow Reliability

Technical .017 .062 .069 .185 .069 -.034 Tax .379 .338 .296 .362 .067 Profits .517 .369 .754 .182 Income statement .693 .631 .028 Budget .461 -.011 Cash flow -.018 Reliability

It is evident from Table 3 that the values of the correlation coefficients between the independent variables (technical factors, tax evasion and income increase) and the dependent variables (income statement, budget, cash flow and reliability) ranged from (-0.034 to 0.754) which indicates that the

relationships varied to be either low, moderate or high. It is clear from the table that there are no correlation coefficient equals 0.80 or above. This means that there is no overlap between the variables as it is required to delete variables that have a Pearson correlation of 0.80 or above.

Table 4.

Results of the regression weights test on study variables

Item Constant

coefficient

R Square B coefficient t-value Sig.

Income <--- Technical 3.347 0.005 0.103 0.675 0.500 Balance <--- Technical 2.907 0.034 0.244 1.857 0.066 Cash <--- Technical 3.313 0.005 0.084 0.681 0.497 Income <--- Tax 0.458 0.114 0.827 3.535 **0.001 Balance <--- Tax 1.346 0.088 0.634 3.055 *0.002 Cash <--- Tax 0.7840 0.130 0.718 3.828 **0.000

Income <--- Profit 0.009 0.267 0.968 5.949 **0.000 Balance <--- Profit 1.526 0.137 0.606 3.930 **0.000 Cash <--- Profit 0.778 - 0.567 1.143 11.292 **0.000 Credibility <--- Income 3.582 0.001 0.014 0.284 0.776 Credibility <--- Balance 3.666 0.000 0.007 - 0.122 0.902 Credibility <--- Cash 3.686 0.000 0.013 - 0.205 - 0.837

*is statically significant at α ≤ 0.05, ** is statically significant at α ≤ 0.01

VI.

D

ISSECTIONWhen examining the relationship between the technical factors related to the hotel and their impact on the income statement, the result of the analysis showed that there is no statistically significant relationship between them, where the value of Sig. of technical factors is 0.500. This relationship is absent because the technical factors are not very important to the hotel management and have not been considered when preparing the income statement, financial position and cash flow. The absence of the relationship with the income statement is also applied for the financial position and cash flow statement as the Sig. for the impact of technical factors on the financial position is 0.066, while it was 0.497 for the relationship between technical factors and cash flows. Consequently, the technical factors are not significant and could be considered to be the main motives for the organization’s management to practice creative accounting methods. This result is coincident with the results of Al-Qari [14] and Al-Momani [27]. Henceforth, technical factors are not considered to be the main motives for Jordanian hotel management teams that practice creative accounting methods.

When examining the relationship between tax evasion related to the hotel and its impact on the income statement, the result of the analysis showed that there is a statistically significant relationship between them, where the value of Sig. of technical factors is 0.001. The value of R2 was 0.114, which means that tax evasion has been interpreted to count for 11.4% of the variance in the income statement, which is less than the value of R2 (0.267) for the other independent variable (profit increase), which has an impact on the income statement. Therefore, profit increase plays the biggest part in interpreting the variance in the income statement as hotels aims to increase the profits and improve the financial position at first followed by reduction of the tax burden. This result is coincident with the studies of Al-Baaj [6], Al-Qari [14] and Al-Khersan and Saud

[28]. These studies agree with the current study that the motives of the management teams of Jordanian hotels for practicing creative accounting methods is to try to alleviate the tax burden as much as possible, and to increase profits and the financial position. However, the current study contradicted some studies [3], [14], [29], [30], [31], [32] in the ranking of management’s motives for practicing creative accounting, where priority was given in previous studies to tax evasion, whereas, in the current study, priority was to increase profits and improve the financial position. This can be justified by the fact that Jordanian hotels bear higher costs than other establishments in Jordan, especially in terms of their fixed costs.

This is most evident by looking at the financial statements of the Jordanian hotels. This is supported by the study of Al-Dahlama [33], which showed that Jordanian hotels use high quality information systems to minimize their costs, especially the fixed ones. Jordanian hotels are also striving to improve their image to investors [3]. This is done only by improving their financial position. The relationship between tax evasion and income statement also applies to the relationship between tax evasion and both the statement of financial position and cash flow statement. The Sig. value for the impact of tax evasion on the statement of financial position was 0.002; with regard to the value of R2, it was 0.088. This means that tax evasion could interpret 8.8% of the changes that occurred in the financial position. Comparing it to the other independent variable (increase in profits) that had an impact on the statement of financial position, R2 was 0.137; therefore, the profit increase variable had the largest share of change in the statement of financial position. Therefore, it seems that the motive for profit increase has had the highest impact on the change in the financial position, and the value of Sig. for tax evasion impact on the cash flow statement was 0.000. The value of R2 was 0.130, meaning that tax evasion interpreted 13% of changes in the cash flow statement. When the value of R2 for tax evasion impact is compared with R2

for the profit increase variable (0.567), it appears that the profit increase variable interpreted the variance in the cash flow statement by the greatest extent.

When examining the relationship between increasing profits and improving the financial position and its impact on the income statement, the result of the analysis showed that there is a statistically significant relationship between them, as Sig. equals 0.000. From the previous result, it can be seen that the most prominent motivation when practicing creative accounting for hotel management is to try to increase profits and improve the financial position as much as possible.

This relationship between increasing profits and improving financial position and income statement also applies to that between increased profits and improved financial position and both the statement of financial position and the cash flow statement, as Sig. equals (0.000) for the impact of profit increase and improving financial position in the financial position statement. The Sig. value also equals (0.000) for the impact of profit increase and improving financial position in the cash flow statement. Several studies have supported previous findings, such as [3], [34], [35], [36], [37]. These studies agree with the current study that the most important goal in the management of Jordanian hotels is to try to increase profits and improve financial position as much as possible. This motivation affects all financial statements, as the impact of manipulation and creative accounting is reflected in them. This was demonstrated by an analysis of the relationship between the drive to increase profits and improve financial position.

An analysis of the effect of creative accounting on the reliability of financial statements, represented by honest representation, impartiality, objectivity, and verifiability, showed no statistically significant relationship between them, since Sig. equals 0.776. A similar examination of the effect of creative accounting practiced through the statement of financial position on the reliability of the financial statements showed no significant relationship, since Sig. equals 0.902. In addition, when examining the relationship between the methods of creative accounting practiced through the statement of cash flows and the reliability of the financial statements, the result of the analysis showed that there is no significant relationship between them, since Sig. equals (0837). This explains why there is no relationship between the practice of creative accounting through the cash flow statement and the

reliability of the financial statements. In fact, this is contrary to many studies, such as [3], [20], [38], which concluded that there is a relationship between the practice of creative accounting methods and the reliability of financial statements.

This conclusion can be explained by several things. Those who practice creative accounting practices in Jordanian hotels are highly experienced and highly qualified accountants. The gaps in the accounting principles and standards are exploited in an innovative manner. These practices do not affect the reliability of financial statements and statements in the income statement. This was supported by Ismail [34], who showed that those who practice creative accounting methods are professional accountants with a high degree of skill and knowledge of accounting principles and rules; therefore, the process of discovering these methods is difficult.

Jordanian hotels practice positive creative accounting, i.e., the financial statements issued by those hotels are certified by auditors because the manipulation of data and financial statements is within the principles and standards of accounting. This is in line with [39], [40], [41], [42], [43].

There is a close correlation between the financial statements of Jordanian hotels and the absence of a relationship between the methods of creative accounting in the income statement and the reliability of those statements. As long as those who practice creative accounting in Jordanian hotels are accountants with extensive experience and enjoy a high degree of efficiency, the practice of creative accounting does not affect the rest of the financial statements [34].

Creative accounting includes methods and practices carried out by hotel management accountants using their knowledge and experience based on accounting principles and standards, and the manipulation of the recorded numbers, to achieve specific targets for the management of those hotels [44], [45]. Accountants who manipulate accounting numbers are efficient, experienced and cautious. They are looking for innovative accounting practices and methods to manipulate financial statements and discover potentially misleading financial information.

Hotel management has several motives for practicing creative accounting methods, the most important of which is to increase profits, improve financial position, and try to reduce their tax burden. Creative accounting practices and their various methods do not affect the reliability of the financial

statements. Hotel management exercises the legal and the managerial right to creative accounting, i.e., the financial statements of hotels are validated by auditors, which verifies the reliability of these financial statements.

In the light of the findings of the study, the following recommendations can be made:

-Addressing the motivations of creative accounting practices, by offering tax and customs exemptions for Jordanian hotels, especially those that adhere to high standards of quality and service.

-Promoting scientific and intellectual awareness of the creative accounting practices of investors and business owners. This could be done by holding seminars in trade unions and accounting associations for the purpose of raising the awareness of investors and hotel management about these practices, and bringing the attention of the accounting professionals of the Association of Jordanian Accountants and Auditors to the indicators of these creative accounting methods.

-Tightening procedures in auditing financial statements that contain indicators of creative accounting.