第 54 卷 第 1 期

2019 年 2 月

JOURNAL OF SOUTHWEST JIAOTONG UNIVERSITY

Vol.54 No.1 Feb. 2019

Review article

T

HE

I

MPLEMENTATION

T

HEORY OF

C

ONSERVATIVE

A

CCRUAL

A

CCOUNTING TO THE

Q

UALITY OF

A

CCOUNTING

I

NFORMATION

S

YSTEMS

Iskandar Mudaa,*, Siti Nurannisa Landau b, Erlina c

a

Universitas Sumatera Utara, Faculty Economic and Business, TM Hanafiah Address 12, Medan, Indonesia,

a Corresponding Author : iskandar1@usu.ac.id

b Universitas Sumatera Utara, Faculty Economic and Business, TM Hanafiah Address 12, Medan, Indonesia,

annisalandau03@gmail.com

c Universitas Sumatera Utara, Faculty Economic and Business, TM Hanafiah Address 12, Medan, Indonesia,

erlina@usu.ac.id

Abstract

This research study aimed to know the Implementation Theory of Conservative Accrual Accounting to the Quality of Accounting Information Systems which is influenced by several variables including the effect of information technology use, user expertise and the intensity of usage on the quality of accounting information and work motivation as the intervening variable. The population for this study is the financial management staff at several Regional Work Units in Medan, Indonesia. The sampling method used is Random selection methods. Data analysis using in this study is an analysis of Structural Equation Modeling. The results of this study showed that information technology use variable has a positive effect on the quality of accounting information, user expertise variable doesn’t have a positive effect on the quality of accounting information and intensity of usage variable have a positive effect on the quality of accounting information at regional work unit. The results show that indicated the successful implementation of the Theory of Conservative Accrual Accounting with the support of information technology, user expertise, using intensity and work motivation.

Keywords: Theory of Conservative Accrual Accounting, the quality of accounting information, information

technology use, user expertise, Intensity of Use, Work motivation

摘要 :技术使用,会计信息技术,以及信息和工作动机的使用,作为信息技术会计的一种手段。 干预变量。这项研究的人口是印度尼西亚几个区域工作单位的财务管理人员。使用的采样方法是 随机选择方法。使用该研究的数据分析是结构方程模型的分析。研究结果表明,信息技术使用变 量具有正面的会计信息质量,用户专业知识对会计信息没有积极影响,使用变量强度对质量有积 极影响。印度尼西亚区域工作单位的会计信息。结果表明,保守准确性会计理论的实施与信息技 术,用户专业知识,使用强度和工作动机的支持。 关键词: 保守的权责发生制会计理论,会计信息质量,信息技术使用,用户专业知识,使用强度,工作动机

I. I

NTRODUCTIONThe local government is a public sector organization that manages government budgets with various policies and programs in the hope of generating as much benefits as possible for the

society in the region. In the right decision making, accounting information is a primary consideration tool within a government agency [1]. Good accounting information is information that indicates the actual circumstances interpreted in the form of financial statements by following

applicable accounting standards. Accrual-based accounting system is a modern accounting system that is widely applied in developed countries. In countries joined to Government 20 (G20) as found in the following Table 1 as a follows:

Table 1. G20 Member Country

No States Population in People (2018) GDP in Million (USD/2017) 1 South Africa 55.380.210 $767,2 Billion 2 United States of America 329.256.465 $19,49 Trillion 3 Saudi Arabia 33.091.113 $1,775 Trillion 4 Argentina 44.694.198 $922,1 Trillion 5 Australia 23.470.145 $1,248 Trillion 6 Brazil 208.846.892 $3,248 Trillion 7 United Kingdom 65.105.246 $2,925 Trillion 8 China 1.384.688.986 $23,21 Trillion 9 India 1.296.834.042 $9,474 Trillion 10 Indonesia 262.787.403 $3,25 Trillion 11 Italy 62.246.674 $2,317 Trillion 12 Japan 126.168.156 $5,443 Trillion 13 Germany 80.457.737 $4,199 Trillion 14 Canada 35.881.659 $1,774 Trillion 15 South Korea 51.418.097 $2,035 Trillion 16 Mexico 125.959.205 $2,463 Trillion 17 France 67.364.357 $2,856 Trillion 18 Russia 142.122.776 $4,016 Trillion 19 Turkey 81.257.239 $2,186 Trillion 20 European Union 516.195.432 $20,85 Trillion

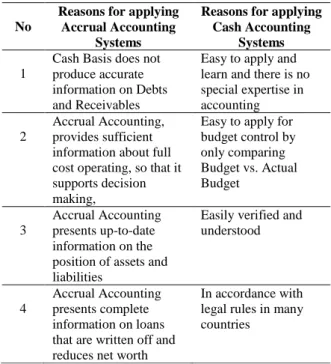

Based on Table 1 countries joined in the G20 [2] group at the 13th meeting on November 30, 2018 to December 1, 2018 in Buenos Aires, Argentina, evaluating the implementation of the Accrual Based Accounting System that has been implemented. Some of the reasons for the G20 countries to apply Accrual Based Accounting are to provide greater benefits for the government, the public as users of financial statements and for the development of the accounting profession compared to cash-based accounting. Benefits for the government include providing more transparent information about government costs and improving the quality of decision making within the government by using expanded information, not just cash-based information. The following in the Table 2 are some reasons for using Accrual Accounting versus Cash Base Accounting Systems [3] as a follows:

Table 2. Reasons for applying Accrual and Cash Accounting Systems

No

Reasons for applying Accrual Accounting

Systems

Reasons for applying Cash Accounting

Systems

1

Cash Basis does not produce accurate information on Debts and Receivables

Easy to apply and learn and there is no special expertise in accounting 2

Accrual Accounting, provides sufficient information about full cost operating, so that it supports decision making,

Easy to apply for budget control by only comparing Budget vs. Actual Budget 3 Accrual Accounting presents up-to-date information on the position of assets and liabilities

Easily verified and understood

4

Accrual Accounting presents complete information on loans that are written off and reduces net worth

In accordance with legal rules in many countries

Based on the Table 2 there are many benefits obtained from the application of Accrual Accounting. But based on certain cases such as in the Mongolian country that tried Accrual Base Accounting but it has not been successful. Benefits for the public using financial statements, among others, if financial statements presented on an accrual basis allow report users to assess the accountability of management of all resources by an entity, assess performance, financial position and cash flow of an entity and make decisions regarding the provision of resources, or do business with a government entity. The application of accrual-based accounting requires reliable resources in the field of accounting, therefore the development of aspects of human resources in the field of accounting is needed. Implementation of accrual basis accounting requires several requirements, among others, Accounting Systems, user expertise, user intensity can improve the quality of accounting information needed. All of these factors can improve the quality of the system if accompanied by strong motivation to implement the accrual basis accounting.

In public sector agencies or organizations, local government accounting information is reflected in the Local Government Financial Statements. In this case, the Government should be able to present quality accounting information in accordance with Government Regulation No. 71 of 2010 on Government Accounting Standards (SAP) Republic of Indonesia [4] which explains that quality accounting information that meets the

characteristics; Relevant, reliable, comparable, and understandable. However, the phenomenon that occurs in the field does not match the explanation. Based on the 2016 Audit Report by the Audit Board of Republic of Indonesia explains that Medan received a Qualified opinion on the 2016 financial statements.

This is due to the financial irregularities occurring in certain Regional Work Units Local Government Work there is a delay in submitting financial files from Medan City Government to Audit Board where the City Government has just provided 2016 financial report to Audit Board on May 10, 2017, while according to Ministry of Home Affairs the file should have been received at the latest by Audit Board by March 2017. The delay in submitting the financial statements is one indication that the quality of the information presented is not good, as it is not presented in time. According [5] Quality information is the level where a data that has been processed by the information system to have meaning for its users, which can be a fact and a useful value and in-time presentation. The development of information systems used will produce better information and will provide various facilities on the activities of government agencies in order to improve the quality of accounting information.

Information system that has been widely used by government agencies is the Computer Based Information System. A computer-based information system is a collection of various hardware and software that turns data into information that can provide benefits to its users [6]. The existence of information technology will further improve the services provided by government agencies. Information technology used must be up-to-date technology for the information produced more appropriate.

To produce quality accounting information with information technology, it takes human intervention to control the system. In this case it takes people who are experts in the field of information systems that understand and can operate properly a system so as to generate accounting information that can be used for decision making in order to improve government performance. In addition to technology users who are experts in the field, the intensity of usage can be one of the factors that influence to whether or not the quality of accounting information generated by an information system [7]. The more often users use information technology, the possibility of error can be minimized. Users can find out immediately if an error occurs and it also can be fixed immediately. Thus, the resulting

information will be better.

The principle of conservatism as the difference in verifiability requested for recognition of profit compared to loss. The accounting conservatism arises from incentives related to contract costs, litigation, taxes, and politics that are beneficial for companies to reduce agency costs and reduce excessive payments to parties such as managers, shareholders, courts and the government. In addition, conservatism also causes an understatement of earnings in the current period which can lead to overstatement of earnings in subsequent periods, as a result of inflation on costs in that period.

Accounting information is the output generated by an accounting information system. This accounting information will be used in decision making. The decision is an economic decision that is used to determine the choice in deciding what action will be taken later. Financial Report is one of accounting information generated by a system, in this case the financial statements presented by government agencies [8].Given the importance of the benefits of accounting information presented in the financial statements of Local Government Work Unit, the accounting information generated an information system must be quality.

Information technology other than as computer technology (hardware and software) to process and store information also serves as a communication technology for information dissemination [9]. Computers as one of components of information technology is a tool that can multiply the capabilities owned and the computer can also do something that humans may not be able to do.

Users are people who operate or use information technology to produce output in the form of information that will be useful for information users [10]. An information system is said to be successful and qualified when the system can provide information services and produce quality information as well. Quality information should meet the qualitative characteristics of accounting information [11] & [12]. Expertise is a combination of knowledge gained from the education, training and experience of a person in a particular field.

The intensity of use in computer technology can be defined as the size or extent of the use of computer technology to generate information. In this research the intensity of use is how often users in Local Government Work Unit using applications in computer technology to present

accounting information in the form of financial statements of Local Government Work Unit [13] & [14]. The ease with which technological developments have been described before, makes computer technology usable at any time by the user. This can increase the intensity of computer use.

The presentation of accounting information must be timely, complete, relevant, reliable and comparable. This is in accordance with the qualitative characteristics of accounting information in SAP. To meet these characteristics required adequate resources, one of which is information technology. Quality accounting information can meet its qualitative characteristics if the presentation process using information technology. As stated in [15], the result that the use of information technology has a significant positive influence on the quality of accounting information.

The use of information technology should be supported by users who are experts in the field of information technology, especially computer technology. With the existence of users who have understood about the ins and outs of the use of computer technology, the work will be easier to do. Thus the accounting information presented is also better because it is done by people who are experts in their field.

When a person is working with the demands of time, the intensity of work will be higher along with the closer the deadline for completion of work. For a computer technology user, this will result in the increasing of intensity of computer use in completing the financial statements. The influence between the quality of accounting information and the intensity of its use is shown in [16].

II. M

ATERIALS AND METHODS A. Type of ResearchThis type of research is quantitative research. Quantitative research emphasizes on the testing of theories through measurement of numerical research variables and performs analysis with statistical procedures.

B. Population and Sample

For descriptive quantitative research, an acceptable sample size is 10% of the population which is considered to be in a very minimal amount and a smaller population at least requires a sample of 20% of the population. Since the number of Local Government Work Unit in Indonesia is 33, the Local Government Work Unit used as sample in this research is 20% x 33

which is 8 Local Government Work Unit with simple random sampling process is done by draw. Next, the second step is to determine the number of research respondents through census all financial staff who use information technology on 8 Local Government Work Unit selected will be made to 80 respondents.

C. Types and Data Sources

The type of data in this research was subject data. Subject data is a type of research data in the form of opinion, attitude, experience or characteristics of a group or someone who becomes the subject of research. Data source in this research was primary data. Primary data is data directly obtained from the field through the dissemination of questionnaires to respondents. The data in this research were analyzed quantitatively through SEM.

D. Validity Test

Validity test is done with the purpose of knowing the accuracy of the questionnaire. The reliability of the questionnaire means that the questionnaire is able to measure what should be measured.

E. Paper format Reliability Test

Statistical Testing of Cronbach Alpha instruments are said to reliably measure variables when having an alpha value greater than 0.60. F. Normality test

The normality testing of the data in this study uses a Skewness value test. Univariate normality in multivariate is evaluated by looking at the critical ratio of Kurtosis and Skewnes in the intervals of -2.58 to 2.58 so it can be concluded that the data is normally distributed.

G. Outliers Test

A multivariate outlier evaluation is conducted to anticipate the possibility of an outlier after the data is combined. Multivariate outlier test was done with mahalanobis distance at p <0.005. H. Multicollinearity Test

To detect the presence or absence of multicollinearity in the regression model can be done by analyzing the correlation matrix of the independent variables. If the inter-independent variables have a fairly high correlation (generally above 0.90), then this is an indication of the existence of multicollinearity.

I. Hypothesis Testing

Hypothesis testing is conducted to determine the effect of whether or not the relationship between independent variables on the dependent variable. The hypothesis is accepted if the prob value (P) <0.05. Hypothesis testing is done to determine the influence of relationship between independent variables and the dependent variable. The hypothesis is accepted if the prob (P) value <0.05.

III. R

ESULTS ANDA

NALYSIS A. Descriptive Data and RespondentsFrom the collection of distributed questionnaires, there are 66 (82.5%) questionnaires received back by the researchers of the total sample of 80 respondents with the following description of total respondents. B. Validity test

The results of testing the validity of the data for all the questions on the variable quality of accounting information, use of information technology, user expertise, and intensity of usage have rcount > rtable, where rtable is 0.204. So it can be

concluded that each question in this research variable is declared valid.

The result of data validity test for all items of question on variable of quality of accounting information, use of information technology, user expertise, and intensity of use have rcount> rtable,

where rtable equals to 0.204. So it can be concluded that each question in this research variable declared valid.

C. Reliability Test

Based on the following Table 3 it can be seen that all variables in this research is reliable. This is evidenced by the value of Cronbach Alpha > 0.60.

Table 3. The Reliability Test

Variable Cronbach’s Alpha Decision Use of Information Technology (X1) 0,870 Reliable

User Expertise (X2) 0,926 Reliable

Intensity of Use (X3) 0,641 Reliable

Quality of Accounting Information (Y)

0,903 Reliable

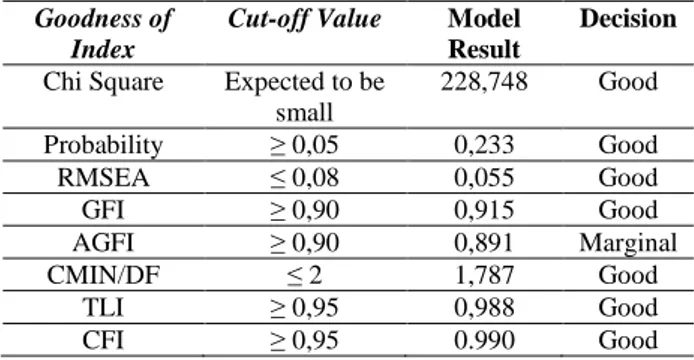

D. Full Model Test of Goodness of Fit of SEM Evaluation conducted in this research, among others, is to test the unidimensionality of each construct with confirmatory factor analysis to test its conformity with the goodness of fit index.

Figure 1. Result of Full Model Test of Structural Equation

Modeling (SEM)

From the Figure 1 above the value of Goodness of Fit from full model of SEM can be seen in Table 3 result of measurement below: Table 3. Full Model Test of Goodness of Fit of SEM

Goodness of Index

Cut-off Value Model Result

Decision

Chi Square Expected to be small 228,748 Good Probability ≥ 0,05 0,233 Good RMSEA ≤ 0,08 0,055 Good GFI ≥ 0,90 0,915 Good AGFI ≥ 0,90 0,891 Marginal CMIN/DF ≤ 2 1,787 Good TLI ≥ 0,95 0,988 Good CFI ≥ 0,95 0.990 Good

According to the above Table 3, the Conformity test of the model can be well received and it can be concluded that the structure of modeling analysis can be done. The data used in this research were normally distributed so that the data in this research can be analyzed using SEM. The results of correlation calculations showed that there is no Multicollinearity between independent variables in the regression model. E. Hypothesis testing

H1 : The use of Information Technology

influences the Quality of Accounting Information

Based on the data from the results of processing can be concluded that H1 in this

research is acceptable.

H2 : User Expertise influences Accounting

Information Quality

Based on the data from the results of data processing it is known that the value of p (probability) is 0.514. These results do not meet the requirements of less than 0.05 so it can be concluded that H2 in this research can be rejected.

H3 : Intensity of Use influences the Quality of

Accounting Information

Based on the data from the results of data processing it is known that the value of p (probability) is 0.001. The results are eligible at less than 0.05 so H3 in this research is acceptable

IV. D

ISCUSSIONA. Influence of Information Technology Use on Accounting Information Quality

The results of this research indicate that there is a positive influence between the use of information technology and the quality of accounting information. In accordance with the results of collecting the questionnaire it indicates that the entire financial sub-section has enough computers to perform the task. There are several other things that indicate the use of technology that has been optimal, which is the process of accounting from the beginning of the transaction until the making of financial statements that are entirely done by computerization. This research is in line with the results of research [17], [18], [19] & [20] which shows there is an influence between the use of information technology and the quality of accounting information.

B. The Influence of User Expertise on Accounting Information Quality

The results of this research indicate there is no influence between the expertise of information technology users on the quality of accounting information. In fact, based on the results of questionnaires, program operators in Local Government Work Unit sampled in this research are not entirely educational backgrounds in information technology and have not followed much in information technology training. This happens because Local Government application program training has not been done. The results of this research are in line with [21], [22], [23], [24], [25], [26], [27] & [28] study showing that the user expertise is not a factor which influences accounting information.

C. The Influence of Intensity of Use on Accounting Information Quality

The results of this study indicate that there is an influence between the intensity of usage on the quality of accounting information. This happens because when making financial statements, respondents almost completely use the application program. The research data reflects that the intensity of usage affects the quality of accounting information produced considering the respondent's answer that the

accounting information produced has met its qualitative characteristics. This study supports the results of [29], [30], [31] & [32] study which shows a relationship between the quality of accounting information and the intensity of its use.

The research data reflect that the intensity of use influences the quality of accounting information generated based on respondents' answers that accounting information generated already meets the qualitative characteristics. This research supports the results of [33], [34], [35], [36], [37], [38], [39], [40], [41] & [42] research which shows the relationship between the quality of accounting information and the intensity of its use.

V. C

ONCLUSION1. The use of information technology positively influences the quality of accounting information.

2. Expertise of information technology users do not influence on the quality of accounting information.

3. Intensity of the use of information technology positively influences the quality of accounting information.

4. The successful implementation of the Theory of Conservative Accrual Accounting with the support of information technology, user expertise, using intensity and work motivation.

R

EFERENCES[1]. AGASISTI, T., CATALANO, G., &

ERBACCI,

A.

(2018).

How

Resistance to Change Affects the

Implementation

of

Accrual

Accounting

in

Italian

Public

Universities: A Comparative Case

Study. International

Journal

of

Public

Administration, 41(12),

pp.946-956.

[2]. GENERAL KNOWLEDGE. (2018).

Group of Twenty (G20) Member

Countries.

Retrieved

from

https://ilmupengetahuanumum.com/

negara-anggota-g20-group-twenty-kelompok-20/

[3]. WORLD

BANK

(2018).

Budget

Execution

and

Financial

Accountability Course (Bases of

government accounting). Retrieved

from

e/befa05/Executionaccrual.doc

[Acceses on December 08, 2018].

[4]. REPUBLIC of INDONESIA (2010).

Government Regulation of the

Republic of Indonesia Number 71 of

2010

concerning

Government

Accounting Standards. Jakarta.

[5]. COHEN, S., & KARATZIMAS, S.

(2017).

Accounting

information

quality and decision-usefulness of

governmental

financial

reporting:

Moving from cash to modified cash.

Meditari

Accountancy

Research,

25(1), pp.95-113.

[6]. COHEN,

S.,MANES

ROSSI,F.,

CAPERCHIONE, E., & BRUSCA, I.

(2018).

Local

government

administration systems and local

government accounting information

needs:

is

there

a

mismatch?. International Review of

Administrative

Sciences,

0020852317748732. 18(4). 79-92.

[7]. Ali, O., & Soar, J. (2018). Technology

Innovation

Adoption

Theories.

In Technology Adoption and Social

Issues:

Concepts,

Methodologies,

Tools, and Applications (pp.

821-860). IGI Global.

[8]. BASNAN, N., SALLEH, M. F. M.,

AHMAD, A., HARUN, A. M., &

UPAWI, I. (2017). Challenges in

accounting for heritage assets and

the

way

forward:

Towards

implementing accrual accounting in

Malaysia.

Geografia-Malaysian

Journal of Society and Space,

11(11). pp. 45-57.

[9]. BRUNO, A., & LAPSLEY, I. (2018).

The emergence of an accounting

practice:

The

fabrication

of

a

government

accrual

accounting

system. Accounting, Auditing &

Accountability

Journal,

31(4),

pp.1045-1066.

[10]. BRUSCA, I., CAPERCHIONE, E.,

COHEN, S., & MANES-ROSSI, F.

(2018). IPSAS, EPSAS and other

challenges in European public sector

accounting and auditing. In The

Palgrave

Handbook

of

Public

Administration and Management in

Europe (pp. 165-185). Palgrave

Macmillan, London.

[11]. MUDA, I; AFRINA. A;E. (2019).

Influence of human resources to the

effect

of

system

quality

and

information quality on the user

satisfaction

of

accrual-based

accounting system (Implementing of

adaptive behavior assessment system

theory,

case

in

Indonesia).

Contaduría y Administración, 64(2),

pp.1-25.

[12]. MULYANI, S., PUSPITASARI, E., &

YUNITA, D. H. (2018). Analysis of

the Critical Factors in Supporting the

Implementation of the Accrual-based

Accounting in the Local Government.

Review of Integrative Business and

Economics Research, 7, pp.183-199.

[13]. PANDEY, V., & GUPTA, S. (2018). A

comprehensive four-stage framework

for

evaluation

of

Information

Communication

Technologies

for

Development

interventions.

Information

Technology

for

Development, 24(3), pp.511-531.

[14]. CARINI,C., GIACOMINI, D., &

TEODORI, C. (2018). Accounting

Reform in Italy and Perceptions on

the Local Government Consolidated

Report.

International Journal

of

Public Administration, pp.1-10.

[15]. ARGENTO,D., PEDA, P., & GROSSI,

G. (2018). The enabling role of

institutional entrepreneurs in the

adoption

of

IPSAS

within

a

transitional economy: The case of

Estonia. Public Administration and

Development, 38(1), pp.39-49.

[16]. BEŞTELIU,N.E. (2018). Ways Of

Taking Over And Operationalizing

The International Public Sector

Accounting

Standards

(IPSAS)-Essential

Milestones

In

This

Process. In International Scientific

Conference" Strategies XXI. 1.

pp.52-65. Carol I" National Defence

University.

[17]. CHOW,D.S.,

POLLANEN,

R.,

BASKERVILLE, R.,

AGGESTAM-PONTOPPIDAN, C., & DAY, R.

(2018). Usefulness of consolidated

government accounts: a comparative

study. Public

Money

&

Management, pp.1-12.

[18]. CRAWFORD, L., MORGAN, G.G., &

CORDERY,

C.J.

(2018).

Accountability and not‐for‐profit

organizations:

Implications

for

developing international financial

reporting

standards. Financial

Accountability

&

Management, 34(2), pp.181-205.

[19]. DA COSTA MARQUES, M.D.C.

(2018). Public Accounting and

IPSAS in Portugal: The Accounting

Standardization System for Public

Administrations. Journal of Modern

Accounting

and

Auditing, 14(4),

pp.153-164.

[20]. DAS, S.K. (2018). Accrual Budgeting.

In Public Budgeting in India (pp.

143-162). Springer, New Delhi.

[21]. DASÍ GONZÍLEZ, R.O.S.A., GPMNO

RUÍZ, A.M.P.A.R.O., BARGUES,

V., & MANUEL, J. (2018). The

Recent Reform of Spanish Local

Governmental

Accounting:

A

Critical Perspective from Local

Governmental

Accountants

as

Internal Users of Budgeting and

Financial

Accounting

Information. Lex Localis-Journal of

Local Self-Government, 16(3). pp.

66-78.

[22]. EULNER, V., & WALDBAUER, G.

(2018). New development: Cash

versus accrual accounting for the

public

sector

(EPSAS). Public

Money & Management, pp.1-4.

[23]. FERRY,

L.,

ZAKARIA,

Z.,

ZAKARIA, Z., & SLACK, R.

(2018,

June).

Framing

public

governance in Malaysia: Rhetorical

appeals through accrual accounting.

In Accounting

Forum.42(2),

pp.

170-183). Elsevier.

[24]. FUENTES, S.F., & BORREGUERO,

J.H. (2018). Institutional capacity in

the accounting reform process in

Spanish local governments. Revista

de Contabilidad, 21(2), pp.188-195.

[25]. GONZÁLEZ, R.M.D., JULVE, V. M.,

& BARGUES, J.M.V. (2018).

Towards

convergence

of

government financial statistics and

accounting in Europe at central and

local

levels. Revista

de

Contabilidad, 21(2), pp.140-149.

[26]. HYNDMAN,

N.,

LIGUORI,

M.,

MEYER, R. E., POLZER, T.,

ROTA, S., SEIWALD, J., &

STECCOLINI,

I.

(2018).

Legitimating change in the public

sector:

the

introduction

of

(rational?) accounting practices in

the United Kingdom, Italy and

Austria. Public

Management

Review, 20(9), pp.1374-1399.

[27]. IM,T., LEE, H., & LIM,D. (2018).

Questionable Reform: The Adoption

of the Double-Entry Bookkeeping

and Accrual Basis Accounting

System in Korea. Korean Journal of

Policy Studies. 33(4). pp.57-80.

[28]. ISMAIL, S., SIRAJ, S. A., &

BAHARIM,

S.

(2018).

Implementation

of

accrual

accounting by Malaysian federal

government: are the accountants

ready?. Journal of Accounting &

Organizational

Change, 14(2),

pp.234-247.

[29]. KACHKOVA,

O.E.,

VAKHRUSHINA,

M.

A.,

DEMINA, I. D., KRISHTALEVA,

T.

I.,

SIDOROVA,

M.

I.,

DOMBROVSKAYA,

E.N.,

&

KLEPIKOVA,

L.V.

(2018).

Developing the Accounting Concept

in the Public Sector. European

Research Studies Journal, 21(1),

pp.636-649.

[30]. LECLERCQ-VANDELANNOITTE,

A., & EMMANUEL, B. (2018).

From sovereign IT governance to

liberal

IT

governmentality?

A

Foucauldian

analogy. European

Journal

of

Information

Systems, 27(3), pp.326-346.

[31]. MENSAH,I.K.

(2018).

Citizens’

Readiness to Adopt and Use

E-government Services in the City of

Harbin,

China. International

Journal

of

Public

Administration, 41(4), pp.297-307.

[32]. MUSSARI, R., & SORRENTINO, D.

(2017).

Italian

Public

Sector

Accounting

Reform:

A

Step

Towards European Public Sector

Accounting

Harmonisation. Accounting,

Economics,

and

Law:

A

Convivium, 7(2), pp.137-153.

[33]. NAKMAHACHALASINT,

O.,

&

NARKTABTEE,

K.

(2018).

Implementation

of

accrual

accounting in Thailand’s central

government. Public

Money

&

Management, pp.1-10.

[34]. OMBATI, R., & SHUKLA, A. (2018).

Analyzing the problems with the

current adoption of IFRS in the

companies among India, China,

Germany,

Russia

and

Kenya. Accounting, 4(1), pp.29-40.

[35]. REICHARD, C., & VAN HELDEN, J.

(2018). Cash or accruals for

budgeting? Why some governments

in Europe changed their budgeting

mode and others not. OECD Journal

on Budgeting, 18(1), pp.1-25.

[36]. RODRÍGUEZ BOLÍVAR, M. P.,

NAVARRO GALERA, A., LÓPEZ

SUBIRÉS, M. D., & ALCAIDE

MUÑOZ, L. (2018). Analysing the

accounting

measurement

of

financial sustainability in local

governments

through

political

factors. Accounting,

Auditing

&

Accountability

Journal, 31(8),

pp.2135-2164.

[37]. SALITERER, I., SICILIA, M., &

STECCOLINI, I. (2018). Public

Budgets and Budgeting in Europe:

State of the Art and Future

Challenges.

In The

Palgrave

Handbook of Public Administration

and Management in Europe (pp.

141-163).

Palgrave

Macmillan,

London.

[38]. SIMON, J., FEJSZÁK,T., SCHATZ,

B., DONCHEV,T., & IVANOV, M.

(2018). Experiences

Concerning

Transition to Accrual Accounting in

the

Public

Sector

from

the

Perspective

of

Supreme

Audit

Institutions. Public

Finance

Quarterly, 63(2), pp.139-154.

[39]. SORRENTINO, M. (2017). Towards a

Full Accrual Accounting in the

Public Sector: A Critical Analysis of

IPSAS 12. International Business

Management, 11(12), pp.2196-2202.

[40]. SPANOS,P., & LIAPIS,K. (2018).

International Accounting Standards,

Budgeting

and

Controlling

in

Private and Public Sector. KnE

Social Sciences, 3(10), pp.107-130.

[41]. VARDIASHVILI,

M.

(2018).

Theoretical and Practical Aspects of

Impairment

of

Non-Cash-Generating Assets in the Public

Sector Entities, according to the

International

Public

Sector

Accounting

Standard

(IPSAS)

21. Ecoforum Journal, 7(3).

pp.45-59.

[42]. WAKIL, A.A. (2018). Feasibility of

Transformation To Accrual Basis of

Accounting In The Public Sector:

Kingdom

of

Bahrain

Context. Academy of Accounting

and

Financial

Studies

Journal, 22(6). pp. 112-125.

参考文:

[1] AGASISTI,T.,CATALANO,G。,& ERBACCI,A。(2018)。阻力变革如何影 响意大利公立大学应计会计的实施:比较案 例研究。国际公共行政杂志,41(12),946-956。 [2] 基本知识。 (2018)。二十国集团(G20 ) 成 员 国 。 从 https://ilmupengetahuanumum.com/negara-anggota-g20-group-twenty-kelompok-20/检索 [3] 世界银行(2018 年)。预算执行和财务问 责 制 课 程 ( 政 府 会 计 基 础 ) 。 从 www1.worldbank.org/publicsector/pe/befa05/Executionaccrual.doc 检索[上访问非常 2018 年 12 月 8 日。

[4] 印度尼西亚共和国(2010 年)。印度尼西 亚共和国关于政府会计准则的 2010 年第 71 号 政府条例。雅加达。

[5] COHEN, S., & KARATZIMAS, , S 。 ( 2017 年)。政府财务报告的会计信息质量和 决策有用性:从现金转为改良现金。 Meditari 会计研究,25(1),95-113。

[6] COHEN , S. , MANES ROSSI , F 。 , CAPERCHIONE , E. , & 布 鲁 斯 卡 , I 。 ( 2018)。地方政府管理系统和地方政府会计 信息需求:是否存在不匹配?国际行政科学 评论,0020852317748732。18(4)。 79-92 。 [7] Ali,O。,&Soar,J。(2018)。技术创 新采纳理论。技术采用和社会问题:概念, 方法,工具和应用(第 821-860 页)。 IGI Global。 [8] BASNAN,N.,沙烈,M. F. M.,AHMAD ,A.,HARUN,A. M.,和 UPAWI,I。( 2017)。遗产资产会计方面的挑战和前进方 向:在马来西亚实施权责发生制会计。地理-马来西亚社会与空间期刊,11(11), 45-57。 [9] BRUNO,A。,&LAPSLEY,I。(2018 )。会计实践的出现:制定政府权责发生制 会计制度。会计,审计与问责期刊,31(4) ,1045-1066。 [10] 布 鲁 斯 卡 , I. , CAPERCHIONE , E. , COHEN,S.,& MANES-ROSSI,F。(2018 )。 IPSAS,EPSAS 和欧洲公共部门会计和 审计方面的其他挑战。在欧洲公共行政和管 理帕尔格雷夫手册(第 165-185 页)。帕尔格 雷夫麦克米伦,伦敦。 [11] MUDA,我; AFRINA。一,E。 (2019 )。人力资源系统质量和信息质量对权责发 生制会计系统的用户满意度的影响的影响( 实现自适应行为评价系统理论,案例印度尼 西亚)。会计与行政,64(2),1-25。 [12] MULYANI,S.,PUSPITASARI,E。, &YUNITA,D。H.(2018)。支持地方政府 实行权责发生制会计的关键因素分析。综述 商业和经济研究综述,7, 183-199。 [13] PANDEY,V。,& GUPTA,S。(2018 )。用于评估信息通信技术促进发展干预措 施的综合性四阶段框架。信息技术促进发展 ,24(3),511-531。 [14] CARINI , C. , GIACOMINI , D 。 , & TEODORI,C。(2018)。意大利会计改革 与地方政府综合报告的认知。国际公共行政 杂志, 1-10。 [15] ARGENTO , D 。 , PEDA , P 。 , & GROSSI,G。(2018)。机构企业家在过渡 经济中采用国际公共部门会计准则的促进作 用:爱沙尼亚的情况。公共行政与发展,38 (1),39-49。 [16] BEŞTELIU,N.E。 (2018)。接管和实 施国际公共部门会计准则(IPSAS)的方法 - 这一过程中的必要里程碑。在国际科学大会“ Strategies XXI.1。52-65。 [17] CHOW , D.S. , POLLANEN , R. , BASKERVILLE , R. , AGGESTAM-PONTOPPIDAN,C.,& DAY,R。(2018) 。合并政府账户的有用性:比较研究。公共 资金与管理, 1-12。 [18] CRAWFORD,L.,MORGAN,G. G., & CORDERY,C.J. (2018)。问责制和不以 营利为目的的组织:发展国际财务报告准则 的启示。财务责任与管理,34(2),181-205 。 [19] DA COSTA MARQUES,M.D.C. (2018 )。公共会计和 IPSAS 葡萄牙:会计标准体 系的公共管理。现代会计和审计的,14(4) ,153-164。

[20] DAS,S. K. (2018)。权责发生制预算 。在(143-162 页)在印度的公共预算。施普 林格,新德里。

[21] DASÍ GONZÍLEZ, R.O.S.A., GPMNO RUÍZ, A.M.P.A.R.O., BARGUES , V. , & MANUEL,J。(2018)。当地政府会计的西 班牙人最近的改革:从地方政府会计师批判 的视角作为预算和财务会计信息的内部用户 。莱克斯 Localis 期刊地方自治政府,16(3) , 66-78。 [22] EULNER,V.,&WALDBAUER,G。( 2018)。新发展:现金与应计占公共部门( EPSAS)。公款和管理, 1-4。

[23] FERRY, L., ZAKARIA, Z., ZAKARIA, Z., & SLACK,R。(2018 年,6 月)。通过权责 发生制会计修辞呼吁:帧在马来西亚的公共 治理。在会计 Forum.42(2),第 170-183) 。爱思唯尔。 [24] FUENTES,S. F.,& BORREGUERO, J.H。 (2018)。在会计改革进程的机构能力 在西班牙地方政府。会计评论,21(2), 188-195。

[25] GONZÁLEZ, R.M.D., JULVE, V. M., &

BARGUES, J.M.V. (2018)。向政府财政统

计的融合,占在欧洲中央和地方两级。会计 评论,21(2),140-149。

[26] HYNDMAN, N., LIGUORI, M., MEYER, R. E., POLZER, T., ROTA, S., SEIWALD, J., &

STECCOLINI, I。(2018)。在公共部门合法 化变化:引进英国,意大利和奥地利会计实 务(理性?)。公共管理评论,20(9), 1374-1399。 [27] IM,T.,LEE,H.,&LIM,D. (2018) 。可疑的改革:复式记账和会计制度的基础 计提韩国的吸纳。韩国杂志政策研究。 33(4 )。57-80。

[28] ISMAIL, S., SIRAJ, S. A., & BAHARIM, S 。(2018)。权责发生制会计的联邦马来西 亚政府实施:会计师都准备好了吗?中国会 计和组织变化的,14(2),234-247。 [29] KACHKOVA,O.E.,VAKHRUSHINA, M.A.,Demina, I. D.,KRISHTALEVA,T. I. , Sidorova , M. I. , DOMBROVSKAYA , E.N.,&KLEPIKOVA,L.V. (2018)。发展 观会计公共部门。欧洲研究研究杂志,21(1 ),636-649。 [30] LECLERCQ-VANDELANNOITTE,A., &EMMANUEL,B.(2018)。主权 IT 治理 ,IT 自由主义的治理?一个福柯的比喻。欧 洲杂志信息系统,27(3),326-346。 [31] 门萨,I.K. (2018)。公民准备采纳和使 用电子政务在哈尔滨市,中国的服务。国际 期刊公共管理,41(4),297-307。

[32] MUSSARI, R., & SORRENTINO, D。( 2017)。意大利公共部门会计改革:步骤迈 向欧洲公共部门会计协调。会计,经济,和 法律:Convivium 的,7(2),137-153。 [33] NAKMAHACHALASINT , O. , & NARKTABTEE,K。(2018)。权责发生制 会计在泰国中央政府实施。公款和管理, 1-10。

[34] OMBATI, R., & SHUKLA, A。(2018) 。分析与公司之间印度,中国,德国,俄罗 斯和肯尼亚目前采用 IFRS 的问题。会计,4 (1),29-40。

[35] REICHARD, C., & VAN HELDEN,J。( 2018)。现金或应计的预算?为什么在欧洲 一些国家的政府改变了他们的模式和其他人 没有预算。 OECD 杂志上预算,18(1),1-25。

[36] 。 BOLIVAR RODRIGUEZ , M. P. , GALERA NAVARRO,A.,LOPEZ Subires, M.D。,&ALCAIDE MUNOZ,L。(2018) 。通过政治因素分析地方政府财政可持续性

的会计计量。会计,审计与职责杂志,31(8 ),2135-2164。

[37] 。 SALITERER, I., SICILIA, M., & STECCOLINI,I。(2018)。公共预算和预 算在欧洲:艺术与未来挑战的国家。在公共 行政与管理在欧洲的帕尔格雷夫手册(第 141-163)。帕尔格雷夫麦克米伦,伦敦。 [38]。 SIMON,J.,FEJSZÁK,T.,SCHATZ ,B.,DONCHEV,T.,& IVANOV,M。( 2018)。关于经验的最高审计机关的视野中 的公共部门过渡到权责发生制。公共财政季 刊,63(2),139-154。 [39]。SORRENTINO, M。(2017)。向完全 的权责发生制在公共部门:公共部门会计准 则 12.国际商务管理的批判性分析,11(12) ,2196-2202。 [40]。 SPANOS,P.,& LIAPIS,K. (2018 )。国际会计准则,预算编制以及在私营和 公共部门控制。 KNE 社会科学,3(10), 107-130。 [41]。 VARDIASHVILI,M。(2018)。非现 金产出资产的公共部门实体减值的理论和实 践方面,根据国际公共部门会计准则(IPSAS )21. 生态论坛杂志,7(3), 45-59。 [42]。 WAKIL,A.A。 (2018)。转型的可 行性权责发生制的基础公共部门:巴林语境 的王国。会计与金融研究学院学报,22(6), 112-125。