78

The State of the Business Cycle, Financial

Fragility and the Multiplier

Willi Semmler

Alexander Haider

Andreas Lichtenberger

Abstract

The mult ipli er eff ect of fi scal spendi ng has long been an obj ect of st udy. T he gr eat r eces si on of 2007 -9 and the US f i s cal st i mul us pr ogram r evi ved empi ri cal studi es on t he mult i pl i er , s how i ng the wi de r ange it s val ue can t ake. T hi s paper expl or es t he ef f ect s of the fi s cal mul ti pli er i n t he cont ext of a K eynesi an busi nes s cycl e t heor y, emphas iz i ng t he r egi me dependence o f t he mult i pl i er. It i s, as K eynes , Mins ky and Ki ndl eberger sugges t, t he st at e of the busi ness cycl e, t he f l ow of cr edi ts , f i nanci al f ragi li t y and f i nanci al s t r es s that ar e of i mport ance f or t he si z e of t he f is cal mult ipl i er . But t he mul ti pli er ef f ect i s a ls o essent i al l y dependent on the monet ar y pol i cy s t ance, whi ch aff ect s t he f i nancial s tr es s , t he i nt er est rat e and r is k pr emi a. T hus, one can observe t hat t he si z e of mul t i pl i er is not onl y dependent on t he st at e of t he bus i nes s cycl e, f i nanci al fragi li t y and f i nanci al st ress, but al so subj ect t o t he ext ent of f iscal

79

act i on as w el l as t he accompanying t ype of monet ar y pol i cy. Last l y, human behavior dr i ven by uncert ainti es about t he fut ur e, as hol ds for t he r ecent Pande mi c Reces s ion, can al s o s i gnif i cant l y a ff ect t he fi s cal mul ti pli er .

Ke ywords : Ke ynes i a n Busi ness C ycl es ; Fi s cal M ul ti pli er ; Fi nanci al St ress ; NM PC

J EL C l as si fi cat i on Num ber: E12; C30 ; E44; E62

I. Introduction

Aft er t he Great R ecess i on of t he years 2007 -9, whereas t he US econom y was doi ng reas onabl y wel l in t erm s of out put and em pl o ym e nt devel opm ent, the Euro -Area econom y had l ong b een under threat of a debt defl ati on and s ecul ar s t agnat ion. Thes e peri ls were bro ught about b y erroneous ti mi ng of budget cons ol idat ions and unreasonabl e aus t erit y poli ci es i n a recess i on, creat ing a doubl e di p reces si on, fi rst i n 2007 -9 and then i n 2012 -13; t he s econd cam e to be call ed the S overei gn Debt cri s is . Overall , recover y

proved s l uggi s h and there was a s eri ous ris k of debt defl at ion.1 In cont ras t ,

US fi s cal cons ol i dat ion was more prudent and for t he US eco nom y t his has l ed to a persi st i ng ups wi ng si nce 2010.

Di fferent ex pl anat ions have been put forward to ex pl ai n t he prol onged cris i s and l ow growt h i n Europe. Som e aut hors have bl am ed the i nfl ex i bl e l abor m arket i n Europe, ot hers focused on m odels bui l di ng on s el f -ful fil l ing propheci es l eadi ng t he econom y t o a bad equi li bri um. De Grauwe (2012), for ex am pl e, s howed t hat change s i n expect ati ons ca n i nduce t hi s ki nd of s el f -defeati ng s cenari o. Furt hermore, he argued t hat count ri es

1

80

organiz ed i n a l oos e currenc y uni on, l ike t he Euro -Area, are es peci all y prone t o m ovi ng towards a bad equi li brium , whi l e c ount ri es wi th aut onom ous cent ral banks are m ore resil i ent to s uch pres sures .

Other st udi es have s t res s ed t he si gni fi cance of busi ness c ycl e st ages and posit i ve feedback effect s bet ween t he real econom y and t he financi al s ect or, wit h t he pot ent i al t o creat e havoc i n t he fi nanci al and real s phere. In a si tuat ion where em plo ym ent pos sibil it i es are m eager, i ncom e i s s ubdued, and agents’ creditworthiness is constrained, such feedback effects have the pot ent i al t o overpower autom ati c st abil iz ers. C ons ol i dat i on pol i ci es i n s uch a s et ti ng m a y t hen res ult i n st rong downward m ult ipli e r effects and int ens i f y t he econom i c downt urn.

Our cont ributi on wi ll focus on nonli nearit i es i n m acroeconomi cs . Thus we wil l cons i der not onl y t he st at e dependence of pol i ci es , but al s o t he m agnit ude of poli c y s hocks . This vi ew i s rel at ed t o busi nes s c ycl e s t udi es in t he t radi ti on of Ke ynes , Kal ecki, Kal dor, and Goodwi n on the real s i de

and Ke ynes , Ki ndl e berger and M i ns k y on t he financi al s i de.2 B y s t res s ing

nonli nearit i es , t here fore, we acknowl edge that t he ti mi ng of pol i ci es m at t ers. W e s t ress t he poi nt t hat cons ol idati on poli ci es m a y ent ail s t rong cont ract ionar y effe ct s duri ng a reces s i on wit h t he pot enti al of deepeni ng an econom i c downt u rn.

Si nce mul ti pl i er st udi es have becom e cent ral i n ass es si ng t he dangers of prem at ure fis cal consoli dati on pol i ci es , we focus on the fi s cal m ult ipli er i n econom et ri c regi m e change m odels fi rst, but we al so ex pl ore fi s cal and monet ar y pol i c y under fi nanci a l fragi l i t y and fi nanci al s t ress , whi ch are si gni fi cant dri vers of t he s iz e of the f iscal mul ti pl i er. In part i cul ar, we ex pl ore downward pus hing forces in an econom y under financ i al s t ress t hat can prevent recovery and debt st abil iz at ion from t aki ng pl ace and result i n l arge-s cal e downward mul ti pl i er effect s. In t he pres ent paper we wi ll

2

81

ex empli f y our t heory, m odel and econom et ri cs b y referri ng t o the Great R ecession. W e wi ll not deal at l engt h wit h t he recent P andemi c R eces s ion

st arti ng i n 2020, where res e arch i s li kel y t o find t hat hum an behavi or,

dri ven b y uncert ai nt i es about t he future, is al s o s i gni fi cant l y affect i ng t he fis cal m ult i pl i er. S ecti on 2 asks whet her Ke yn es act ual l y h ad a m ul t ipli er theor y as oft en pres ent ed as st at i c m ult ipli er i n t he m acro economi c t ex t books, or whether Keynes’ focused, rather, on the dynamics of the business c ycl e, and i nt ended to propose a busi nes s c ycl e -re gi m e dependence of the mult i pl i er. This i ss ue wil l be di scussed i n t he cont ex t of a s urve y of recent mult i pl i er st udi es t hat have been publ is hed si nce the Gr eat R eces s ion. S ect ion 3 outl ines a m odel showi ng t hat t he s t at e of t he bus i ness c ycl e, financi al m arkets , and m onet ar y p ol i c y act i ons are i m port ant i n det erm ini ng t he s iz e of t he mult i pl i er. Aft er devel opi ng a t heor et i cal model , s ect i on 4 pres ent s t he empi ri cal resul t s regardi ng t he regi m e dependence of the m ul t ipli er. Bas ed on a mul ti -regi m e VAR (M R VAR ) for Germ an y, France, S pai n and It al y, we provi de evi dence of a regi m e dependent mult i pl i er. Fi nall y, s ecti on 5 con cludes t he paper; here we al so wil l di s cus s whet her som e l es s ons from the Great R ecess ion can be l earned for the P andemi c R ecess i on .

II. Survey of Multiplier Studies

1. Keyn es an d th e mu l tipl i er s tud i es

Alt hough Ke ynes us ed the m ult ipl i er as an i ll ust rat i ve exam pl e of t he effect s of fi s cal s pendi ng, it is worth not i ng t hat in his General T heor y

(1936) Ke yn es actuall y dedi cat ed no speci fi c chapt er to t he m ul ti pli er.3

82

Ins t ead he cons t ruct ed m acroeconomi c d ynam i cs bas ed on t hree fragi l e forces: t he m argi na l propens it y t o consum e, t he m argi nal effi ci enc y of capit al , and t he st at e of l iquidi t y prefer ence. Al l t hree of t hes e forces are int erli nked i n a m agni f yi n g process creati ng booms and reces si ons . As Ke ynes st at es:

B y a c yc l i c al mo ve m ent , w e me a n t h at as t he s yst e m pr o gre sse s – i n, f o r e xa mp l e, t h e up w ar d di re ct i on , t he f or ce s p ro pel l i n g i t up w ard s at fi s t gat he r f or c e an d ha ve a c u mul at i ve e ffe ct o n o ne an ot h er , b ut gr a d ual l y l o se t he i r s t r e n gt h unt i l at a c ert ai n p oi nt t he y t e nd t o be r ep l ac ed b y fo rc es o pe rat i n g i n t h e op p osi t e di r ect i o n. T h es e i n t u rn gat her f or ce f or a t i me a nd acc en t u at e on e an ot h er , unt i l t he y t oo , h a vi n g r ea ch ed t h ei r maxi mu m de ve l o p me nt , wa ne a nd gi ve pl ac e t o t hei r o pp o si t e . We do n ot , h o we ve r, me r e l y me a n b y a c ycl i ca l mo ve me nt t h at up w ar d a n d d o wn w ar d t en de nci e s, on ce st art ed , d o no t per si s t f or e ve r i n t h e s a me d i re ct i on but are ul t i ma t e l y re ver se d . We me a n al so t hat t h er e i s so me r ec o gni za bl e de gre e of r e gul ari t y i n t he t i me s eq ue n ce an d d ur at i on of t he up w ard an d d o wn w a rd mo ve me n t s . T her e i s, ho w e ver , an ot her cha ra ct e r i st i c of w hat we ca l l t he t r a de c ycl e whi ch o ur e x pl a na t i on mu st co ve r i f i t i s t o be ad eq ua t e; na me l y, t he p he no me n on o f t h e cri s i s – t he f act t hat t he s ub st i t ut i o n of a d o wn w ar d f or a n u p wa rd t en de nc y o ft e n t a ke s p l ac e su d de nl y an d vi ol ent l y, w h ere as t her e i s , as a r ul e , no s uc h s har p t ur ni n g -p oi nt w h en a n up w ar d i s su bst i t ut e d f or a do w n wa rd t en de nc y. ( K e yn es , 19 3 6, p p .3 13 -3 1 4)

As Chi arell a et al . (2009) s how, the three forces m ent ioned above work toget her t o crea t e t he booms and bust s charact eri zi ng t he bus ines s c ycl e.

Thes e im port ant d ynam i c m acroeconom i c forces al so creat e a

m acroeconomi c envi ronm ent, whi ch m akes it di ffi cult t o predi ct ex actl y what t he effect of the fi s cal m ult ipl i er woul d be. In part i cul ar, t h e downward movement “often takes place suddenly and violently”. This has been st res s ed i n t he Ke ynes i an t radi ti on whi ch emphas iz es sudden ass et

83

pri ce fal ls , credi t cont ract ions, credit defaul t s, and s udden fi nanci al m arket cris es , as propos ed i n t he work o f Ki ndl eberger (1989) and M ins k y (1992).

And yet i n t he post -war peri od m an y t ex tbooks cont ai ned chapt ers on the fis cal mul ti pl i er where the m ult ipli er appeared as cons t ant and ti m e -invari ant . In em pi ri cal work of t he pos t -war period m ul ti pli ers were est im at ed t o l i e bet ween 1.5 and 3, al t hough thi s was presum abl y done most l y for pedagogi cal reas ons . However, i ns t ead of provi di ng a com pl et e hi st or y of em pi ri cal st udi es on t he m ul ti pl i er, we focus on recent di s cuss ions that were prom pt ed b y t he m el tdown and the f is cal react i on

aft er t he Great R ece ss i on of the years 2007 -9.4 S om e of t hes e st udi es m i ght

also be of rel evance to eval uat e t he fi scal expans ions aft er the P andem i c R ecession 2020.

Indeed, t he empi ri c al result s of recent fis cal mul ti pl i er st udi es i n t he Ke ynesi an l i t erat ure report a fi s cal m ult ipli er gr eat er t han uni t y. Aft er t he Great R eces si on, R om er and Bernst ei n (2009) est im at ed a m ult ipl i er of roughl y 1.5. R am e y (2011), too, report s a m ult i pl i er m uch great er t han uni t y. R es ponding t o t hes e esti m a t es, t he l it erat ure bas ed on DS GE m odels est im at es m uch s m al l er numbers for t he mult i pl i er. For ex am pl e, C ogan et al. (2009) s ugges t a mult i pl i er of 0.7 due t o hi gher i nt erest rat es and wealt h effect s where R i cardi an consum ers t ake t ax i ncreas es i n t he fut ure int o account - and t he y undo what t he fi s cal poli c y has done wit h addi ti onal s pendi ng.

Anot her branch of recent st udi es, st ressi ng new em pi ri cs , emphas iz es that mult i pl i er effects depend on the ec onomi c envi ronm ent and t im i ng of pol i c y. W hat is al so s t ress ed is t hat acc omm odati ve m onet ar y pol i c y increas es t he m ult ipli er i n part i cul ar due t o l ow i nt eres t rat es and credi t

ex pansion. 5 Furtherm ore, the exi st ence of cons t rained consum ers al so

increases the multiplier: Gali et al. (2007) show that if the fraction of “rule of t h um b” cons um er s i ncreas es i n reces s ions t he m ul t ipli er wil l be great er 4 A mo r e e x t e n s i v e s u r v e y o f t h e mu l t i p l i e r h i s t o r y i s g i v e n i n M i t t n i k a n d S e m ml e r ( 2 0 1 2 ) . 5 S e e C h r i s t i a no e t a l . ( 2 0 1 1 ) , H a l l ( 2 0 0 9 ) , W o o d fo r d ( 2 0 1 1 ) .

84

than unit y. In t hi s cont ex t , del everagi ng cons um ers m a y i nt ens i f y downward t rends , as Krugm an and Egger tss on (2011) emphas iz e.

Moreover, hi gh s overei gn debt , as a m easure for the s oundne ss of fi s cal pol i ci es , i s li kel y t o decrease the mult ipli er . C ors et t i et al. (2012) s t at e that a thres hol d value of the debt t o GDP rati o of 100 percent decreas es t he

mult i pl i er si gni fi cantl y.6 Furt hermore, hi gh fi nanci al and banki ng s ys t em

ris k prem i a due t o fi nanci al st ress decreas e t he m ul ti pli er, t oo, as C all egari et al . (2012), M it t ni k and S em ml er (2012), C ors et ti et al . (2012) em phas iz e, as well as Bl anchard et al . (2013) and Bolt on and J eanne (2011). The l at t er thus s t ress t he fragi l it y ari si ng from soverei gn debt hol di ngs b y t he banks .

In t he cas e of an open econom y, wit h fl exi bl e ex change rat es, and hi gh l evel s of forei gn debt the mul ti pl i er decr eases t oo, as Il z etzki et al. (2013), as Erceg and Li nde (2012) s how. On t he ot her hand, the support of e xt ernal dem and m a y prove favorabl e for t he m ult ipli er. W it h respec t to the l abor m arket , the res ult s of wage s et ti ng and wage ri gi di ti es are am bi guous , as dem onst rat ed i n t he st udi es b y Bo yer (2 012), Charpe et al . (2015), on t he one hand, and M onacell i et al. (2011) on t he ot her.

In general , m ul ti pl i er st udi es em phasiz ing t he s i gni fi cance of the s t at e of the business cycle are often defined with respect to “good and bad times”, where t he effect is s hown t o be st ronger i n bad ti m es. For ex am pl e, De Long and S um m ers (2012) st ress persi st enc y effect s of mult i pl i ers as

bei ng res ponsi bl e for thi s effect.7 Mult ipli ers , s peci fi cal l y for ex pans i ons

and reces si ons , are cons i dered in Baum and Koest er (2011, 2012) i n t erm s of t he out put gap, and i n C al l egari et al . (201 2) i n t erms of out put growt h.

The l att er cons i der bot h expendit ure shocks and revenue shocks .8

Furtherm ore, as ym m et ri es of t he mult i pl i er i n booms and reces si ons , as well as t he effect s of mult i pl i ers dependi ng on t he m agnit ude of shocks , are ex pl ored in M it tni k and S em ml er (2012, 2013), S em m l er and Chen 6 I n t h e l i g h t o f t h e e x t e n s i v e c r i t i c i s m o f t h e 9 0 % t h r e s h o l d b y R e i n h a r t a n d R o g o f f , t h i s s t a t e me n t mi g h t n e e d t o b e r e v i e we d a s we l l . 7 S e e a l s o A u e r b a c h a n d G o r o d n i c h e n k o ( 2 0 1 2 a ) a n d F a z z a r i e t a l . ( 2 0 1 3 ) . 8 F o r a d e t a i l e d d i s c u s s i o n s e e b e l o w.

85

(2014), and S chl eer and S emm l er (2015), t he l at t er usi ng t he ZEW Index whi ch i ncludes banki ng vari abl es to m eas ure fi nanci al fragi l i t y and financi al condi ti ons .

2. Regi me d ep end en ce of th e fi s cal mu l tipl i er

St udi es focus i ng on the regi m e dependence of t he m ul ti pl i er account for i t in m ani fold wa ys us ing s om e vari ant s of a nonli near vect or aut oregres s i on

(VAR ).9 In t he s im pl est s et ti ng regi m es m a y be defi ned m anual l y b y t he

res earcher b y s et t ing a t hreshol d v al ue for a gi ven vari abl e (e.g. out put growt h, or a fi nanci al st res s i ndi cat or).

Fi gure 1: Low gro wth regi m e; cumul ati ve M R VAR respons es ; fis cal ex pans ion l eads to st rong effect s of the fi s cal m ult i pl i er on empl o ym ent (l eft graph). Hi gh grow th regi m e; C u m ul ati ve MR VAR respons es; fi scal expansi on l eads t o weak effect s of the m ul ti pl i er on em pl o ym ent (ri ght grap h); Source: Mi tt ni k and S em ml er (2012a)

This value can then be used to distinguish between a “good” and a “bad state”. Instead of setting up a thre shold value manually, one can also obt ain a t hres hol d val ue b y m i nim i zing/ m ax im izi ng s om e obj ect ive

86

funct i on. One s uch st rat eg y woul d be achi eved b y m i ni m izi ng the s um of

squared resi duals .1 0

Ei t her wa y, havi ng defi ned a t hreshol d val ue, a t hres hol d VAR (TV AR ), also cal l ed m ul ti -re gi m e VAR (M R VAR ), can be us ed t o es ti m at e t he

effect s of fis cal m ul ti pl i ers in di fferent set ti ngs .1 1 The MR VAR can eas il y

be es ti m at ed wit h t he hel p of an i ndi cat or vari abl e whi ch s pl i ts up the VAR int o t wo (or m ore) li near VAR s whi ch can t hen be est im at ed l ike li near VAR s , i ndependentl y.

R egim e dependent mult i pl i ers can al s o be i dent i fi ed t hrough other vari at ions of nonli near VARs , whi ch incl ude, am ongs t ot hers, M arkov

s wi t chi ng m odel s and s moot h t ransit i on models .1 2

An MR VAR is us ed i n Mi t tni k and S emm l er (2012) t o st ud y t he mult i pl i er where pre -defined growt h regi m es , as des cribed below, are us ed to di s ti ngui sh bet ween regi m es. Growth regi m es can be m oti vat ed i n di fferent wa ys . Bu si ness c ycl e theor y sugges ts that m ul ti pl i ers di ffer bet ween regi m es . Anot her wa y of m oti vati ng t wo or m ore growt h regi m es is gi ven b y focus i ng on i nt erest rat es . Fol l owi ng C hris ti ano et al. (2011), one can argue t hat one regi m e corresponds t o an envi ronm ent of low int erest rat es, whi l e t he s econd regi m e i s charact eriz ed b y hi gh int eres t rat es. The authors est im at e a bi g m ult i pli er effect am ounti ng t o roughl y 3 as t he i nt erest rat e i s l owered t o z ero.

In cont ras t , t he m odel in M it t ni k and S emm l er (2012) i s s i mi l ar to t he French t radit i on in m acroeconom i cs, wh ere m arkets do not neces s aril y clear and agents are constrained in the “bad” regime, while consumption

and employment remain unconstrained in the “good” regime.1 3

W hil e t he l at t er regi m e bears s om e si mi l arit y wi t h the Ri cardi an cons um er i n Gal i et 1 0 M e t h o d s o f f i n d i n g a t h r e s h o l d v a l u e wi l l b e d i s c u s s e d i n s e c t i o n 4 i n mo r e d e t a i l . 1 1 T hr e s h o l d a u t o r e g r e s s i v e mo d e l s a r e d e s c r i b e d i n T o n g ( 1 9 8 3 ) a nd b y T s a y ( 1 9 9 8 ) f o r mu l t i v a r i a t e p r o c e s s e s . 1 2 S e e H a mi l t o n ( 1 9 8 9 ) f o r M a r k o v s wi t c h i n g m o d e l s a n d S c h l e e r a n d S e m m l e r ( 2 0 1 5 ) f o r a g e n e r a l o v e r v i e w. 1 3 F o r d e t a i l s s e e G a n g a n d S e m m l e r ( 2 0 0 6 ) .

87

al. (2007 ), t he form er regi m e can be compared wit h t he “rul e of thumb” cons um er. Here t he l abor m arket does not cl ear, whi l e cons um pt i on depends on act ual empl o ym ent and i s t herefore const rai ned. As product i on decisions do depend on actual demand, the firms’ output is below capacity as well. In such a “bad” state, government expenditure is expected to have st rong effect s . As t he econom y i s oper ati ng bel ow capacit y, wi t h i ncom e, empl o ym ent and credi t cons t rai ned, addi ti onal governm ent s pendi ng becom es ver y effe cti ve b y rel axi ng thes e cons t rai nts . The effect is suppos ed t o be even st ronger i f li qui di t y is provided and i nt eres t rat es are lowered.

Mi tt nik and S emm l er (2012) use quart erl y US dat a on GDP and empl o ym ent from 1954 through 2008 to est im at e t hei r m odel. The s a m pl e m ean of out put growth is empl o yed t o di s ti ngui sh bet ween the t wo regi m es . Furtherm ore, the y u s e the Akai ke Infor m at ion C ri t eri a (A IC ) t o t est t he MR VAR agai nst a li near VAR and concl ude t hat t he M RVAR is t he preferabl e m odel . The i mpulse responses for t he t wo regi m es are s hown i n Fi gure 1.

The ri ght s ub -fi gure s hows t he res ult for em plo ym ent i n t he hi gh growt h regi m e. The em ploym ent m ult ipli er i s sm all er t han i n the low growt h regi m e on the l eft , i mpl yi n g t hat fis cal ex pans ion has a st ronger effect on empl o ym ent duri ng a peri od of subdued growt h.

The res ult cont rast s wit h ot her s tudi es on l abor m arket effec ts of fi s cal spending. For ex am pl e, Monacel li et al . (2011) argue t hat l abor m arket ti ght ness , j ob -findi ng probabi li ti es and s eparat ion rat e, ext ens i ve and int ens i ve m argi ns of work, as wel l as part i cipat ion rat es reduce the empl o ym ent m ul ti pl i er s i gni fi cantl y. H owever, t he y do not t ake i nt o account t he st at e of the econom y and us e a m odel wit h onl y one re gi m e, whi l e t he m odel of M it t ni k and S emm l er (2 012) t akes int o account t he di fferences in res pons es of em plo ym ent due t o fi s cal poli c y.

The st ronger ex pansi onar y effect duri ng a peri od of l ow growt h has im port ant im pl i cati ons for budget consoli dati ons, i .e. a negat i ve fis cal shock. Al though the general iz ed i m pulse res pons es whi ch are us ed i n Mi tt nik and S emm l er (2012) are not s ym m et ri c wit h respect t o the siz e and

88

si gn of a s hock, as wil l be ex pl ai ned i n more det ail i n s ecti on 4, one would ex pect a great er eff ect on out put and empl o ym ent i n a depress ed st at e, com pared wi t h a hi gh growt h regi m e due t o a negat i ve governm ent spending s hock. Thus, a badl y t i m ed fi scal cons ol i dat i on – duri ng a peri od of l ow growth and financi al fragi l it y wi th borrowi ng const raint s – i s ver y li kel y t o have a st rong negat i ve m u lt ipli er effect . Al t hough M it t ni k and S em ml er (2012) do not i nvest i gat e the effect s of a budget cons oli dati on condit i onal on the s t at e of t he econom y, t he i mpli cat i ons of t he MR VAR res ul ts are cl ear: fi s cal cons ol idat ions i n a peri od of economi c st res s wil l have st ronger negat i ve effect s t han im pl em ent ing t he s am e pol i ci es duri ng a peri od of st rong gr owt h rat es.

However, i n t he M R VAR m odel i n Mit t nik and S em ml er (2012) fi nanci al st res s, whi ch act s quit e di fferentl y i n expansi ons com pared wi th recess i ons , was not consi dered. Fi nanci al st res s as a regi m e defi ni ng vari abl e is empl o yed i n M it t ni k and S emm l er (2012, 2013, 2014), S em ml er and C hen (2014) and i n S chl eer and S em ml er (2015). In s om e of the papers t he regi m e dependence of m onet ar y pol i c y i s als o st udi e d .

R egim e dependence of t he m ul ti pli er effects has been di s cus s ed recent l y b y Auerbach and Gorodni chenko (2012a), Baum and Koes t er (2011, 2012), Bl anchard et al . (2013), and C all ega ri et al. (2012). Furt hermore, there has also been a change i n IMF st udi es l at el y. The st at e -dependenc y of cons oli dati ons and the poss i bi li t y of feedback effects has been acknowl edged. For ex ampl e, C al l egari et al . (2012, p.23) com e t o t he conclusion that “in all countries, a fiscal consolidation is substantially more cont ract i on ar y i f m ade duri ng a recessi on t han duri ng a n expansi on.”

In an im port ant work t he IMF change d di recti on i n it s s tud y of t he mult i pl i er effect s, roughl y i n 2012 -13. The s t ud y i ndi cat i ve of t he change in di rect ion was carri ed out b y Bl ancha rd and Lei gh (201 3). The y regr es s the forecas t error on t he forecast as s hown below. Al t hough t he form ul at i on does not us e a mult i -regi m e m odel ex pli cit l y and fi nanci al s ect or devel opm ents are not cons i dered, thei r res ult s point t o t he exi st ence of di fferent growt h regi m es .

89

Fi s cal consoli dati on is m easured here as a reduct ion in t he st ruct ural

defi ci t (Fi , t : t + 1 / t), Bl anchard and Lei gh (2013) dem ons t rat e t hat β i s

st ati s ti call y s i gni fi cant for Greece, Irel and and P ort ugal . Thus , a l arge mult i pl i er effect duri ng a s t res s ful period com promi s es accurat e m eas urem ent of GDP growt h.

Sim i l ar res ul ts are als o found i n Auerbach and Gorodni chenko (2012a,

2012b) and Bat i ni et al . (2012), who ana l yz e spending effect s in t he Euro area, t he US and OECD and fi nd that m ult ipli ers are s t ronger i n reces si ons than in ex pans i ons . A s im i l ar approach t o Auerbach and Gorodni chenko (2012a) was adopt ed b y C al l egari et al . (2012). The y al s o us e an i ndi cat or funct i on to st ud y t he m ult ipli er effect s condi ti onal on t he regi m e us i ng GDP growt h to def ine t he regi m es. C all egari et al . (2012) dis ti ngui s h bet ween s pendi ng a nd revenue m ul ti pl i er and com e t o t he concl usi on t hat the ex pendi ture m ul ti pl i er is , i n general , s t ronger t han t he t ax m ult ipl i er. Usi ng a nonl inear VAR , t he y fi nd s t rong as ym m et ri c eff ects of fi s cal cons oli dati ons duri ng a downt urn.

Anot her approach i s propos ed b y B aum et al. (2012). Here t he out put gap acts as a t hres hol d vari abl e for the VAR thres hol d. Thei r res ul ts show t hat u p -front fi s cal cons ol i dat i on has st rong cont racti onar y ef f e cts duri ng an econom i c downt urn. On t he ot her hand, t he negat i ve effects of a fis cal cons oli dati on on out put can be reduced, according t o Baum e t al . (2012) as long as t he cons oli dati on i s undert aken duri ng a boom (i .e. when t he out put gap i s posi ti ve).

A m et aanal ys i s by Gechert and R annenberg (2018) of t he st at e -dependenc y of fi s cal m ul ti pli ers covers 98 em pi ri cal s t udi es and 1800 observati ons . The y fi nd t hat spendi ng m ul t ipli ers i ncreas e duri ng downt urns b y 0.7 -0.9 unit s . Tax mul ti pl i ers are not s ens it i ve t o t he econom i c regi m e, and are general l y l o wer than s pendi ng mult i pl i ers. The mult i pl i er vari es l ess across i nst rum ents i n boom s than i n downturns .

90

Furtherm ore, for all s pendi ng cat egori es other than governm ent cons umpti on, t he m ult ipli er s i gni fi cantl y ex ceeds one duri ng downt urns .

In rel at i on t o t he current pandemi c, a recent st ud y i nvest i gat ed it s m acroeconomi c i m pl i cat i ons (Guerri eri et al. 2020). The st ud y fi nds that shutt i ng down som e s ect ors m akes a Ke ynesi an s uppl y s hock more l i kel y t o be encount ered and furt her m ut es down t he Ke ynes i an m ul ti pli er. The aut hors argue t hat fi s cal s ti muli are l es s effect ive t han us ual in count eri ng econom i c shocks (shutdowns, l a yoffs , and fi rm ex it s ). In order t o accel erat e recover y and break t he vi ci ous ci rcl e of po s t poning i nvest m ent , Sti gl i tz and R as hi d (2020) s ugges t t hat governm ent s need to rem ove t he risks of today’s purchases. One model to achieve this end lies in the so -call ed Arrow -Debre u s ecurit i es, whi ch woul d gi ve hous eholds and fi rms cert aint y re gardi ng t hei r purchas es b y offering t hem com pens at i on i f t he econom y fai l ed t o recover b y a cert ai n point i n t im e.

Sti l l, m os t of t he cont ri buti ons descri bed above di s regard t he i nt eract ion bet ween t he fi nanci al m arkets and the rea l econom y. Al t hough som e st udi es – for example Mittnik and Semmler (2012, 2013, 2014), Semmler and Chen (2014) and S chl eer and S emm l er (2015) – t r y t o i ncorporat e fi nanci al and banki ng s t ress , t he i nt eract i on bet ween fiscal and monet ar y pol i ci es i s not dealt wit h i n m ost cas es. Thi s ki nd o f i nt eract ion bet ween the real and financi al s i de of an econom y wi l l be ex pli cit l y m odel ed i n a finance -m acro regi m e change m ode l i n t he nex t secti on.

3. Th e f in an cial ma rk et and fi s cal mu l tipl i er

The rel evance of fi nanci al m arket st at es i s al so di s cus s ed i n t he em pi ri cal li t erat ure on t he effect s on fi s cal mult i pl i ers. Earl y st udi es whi ch addressed t he cruci al rol e of fi nanci al i ndi cat ors i n t he m acroeconom y were carri ed out by Bal ke (2000) and At anas ova (2003). Bal ke (2000) invest i gat ed t he rol e of credi t s as a n onl inear propagat or of s hocks . He conduct ed a TVAR regi m e s wi t chi ng s t ud y on t he US econom y and found that s hocks are more pot ent i n t he t i ght -credi t regim e and t hat cont ract ionar y m onet ar y shocks have a great er effect on out put t han do

91

ex pansionar y s hocks . At anas ova (2003) st udi ed credi t fri ct i on i m pact s on business c ycl es in t he UK, broadl y confi rmi ng t he fi ndings of Bal ke (2000).

NK-DS GE st udi es t hat anal yz ed t he rol e of fi nanci al st abil it y i n rel at i on to fi scal poli ci es al so arri ved at s im il a r f indings re gardi ng the i mpact of ti ght credi t regi m es (Fernández -Vil l averde 2010 , C arri ll o and P oi ll y 2013 , Kara and S i n 2012). The result s of t hese st udi es bear out t he obs ervati on that fi s cal mult i pl i ers are hi gh under fi nanci al i ns t abi l it y a nd cons t raine d credit m arket s.

Bes i des est im ati ons of fi s cal mult i pl i ers under di fferent econom i c regi m es , em pi ri cal st udi es have als o i nves ti gat ed t he changes i n fi s cal mult i pl i ers i n t he c ont ext of di fferent financi al m arket regi m es . A recent li t erat ure revi ew on fi s cal m ult ipli er s (C ast el nuovo and Li m 2019) emphas iz ed thei r s t at e dependence. La rge m ul ti pli ers can be found i n reces si ons but more cruci al l y t he form s of s t at e dependence m at t er s uch as financi al fri cti ons , hi gh publi c or pri vat e debt , forei gn bond hol di n gs and the m onet ar y poli c y z ero l ower bound. A ke y s t ud y b y F errares i et al . (2015) buil ds up on the speci fi cati on em pl o yed b y Bal ke (2000) to anal yz e int errel at i ons bet ween fi s cal pol i ci es and the st at e of t he corporat e bond m arket . The y es ti m at e a thresh ol d vect or aut oregres s i on (TVAR ) model on US quart erl y dat a f or t he peri od 1984 –2010. The y fi nd tha t the res pons es of out put to fi s cal pol i ci es si gni fi cant l y change accordi ng to t he s t at e of the credi t m arkets : under “t i ght ” credit regi m es t he y report gene ral i m pul s e res pons e funct ions (G IR F) wi t h a s t rong and pers is t ent react ion of output to fi s cal pol i c y s hocks whi l e under “norm al ” credi t condi ti ons t he respons e of GDP t o fis cal poli ci es i s m uch m il der. Ti ght credi t periods are i dent i fi ed through t he s pre ad bet ween BAA -rat ed corporat e bond yi el ds and 10 - year t reasur y cons t ant m aturi t y rat es . For r obust nes s t es ts the y us e furt her alt ernati ve thres hol d vari abl es (M IX and t he GZ, ED and EBP s preads ) t o single out ‘tight’ credit conditions. Their additional te sts confirm the main res ul ts that fis cal s hocks are ex t rem el y succes s ful in s ti m ul ati ng out put when t he corporat e bond m arket s are under pres s ure, whil e t he effects are weakened in the ‘normal’ credit regime. A later study by Afonso et al. (2018) invest i ga t es li nkages bet ween changes i n t he debt rati o, economi c

92

acti vit y and fi nanci al s t ress . The y us e a com posi t e i ndex of financi al s t ress in a TVAR s tud y t o defi ne l ow and hi gh fi nanci al s t ress regi m es . Thei r res ul ts s how that i ncreas es in t he debt -rat i o have a s t ronger im pact on out put growt h in t he hi gh s t ress regi m e. However, t he report ed val ues for fis cal m ul ti pli ers rar el y ex ceed uni t y eve n in t he hi gh st res s regi m e and i n part i cul ar for the US A, and are l ower t han t he val ues report ed i n t he st udi es b y Au erbach and Gorodni chenko (2012b) or Ferrares i et al . (2015). Sti l l, pos it ive effect s of defi ci t -fi nanced fi s cal poli c y on out put growt h i n peri ods of financi al s t ress or s l owdowns are borne out b y the em pi ri cal li t erat ure.

III. A Financial Fragility and M ultiplier Model

We are i nt eres t ed i n st ud yi ng whi ch m acro m echani sm s account for fi s cal pol i c y effect s , t aki ng m onet ar y pol i c y i nt o account as well . Thus , we cons t ruct a nonl inear m acro m odel whi ch i ncludes t hos e i nt eract ion feat ures . W e s how how monet ar y pol i c y part l y or ful l y mi ti gat es the cont ract ionar y pres s ures from fi s cal consoli dati ons. Furt hermore, we al s o s et out to ex ami ne t o what ext ent debt st abil iz ati on i s pos si bl e. To ans wer thes e ques ti ons , i t i s i mport ant t o m odel ampli fi cati on effects i n ec onomi c and fi nanci al regi m es.

The model vari ant s i nt roduced here are ex t ens i ons of t he m odel s b y Mi tt nik and S em ml er (2013), S annikov a nd Brunnerm ei er (2014), and S t ein (2011). Thos e m odel s, however, focus m ore on the banki ng s ys t em and t he int eracti on wi t h t he m acroeconom y. W e wil l m odel t he fi nanci al st res s -out put growt h li nk m ore generi call y here.

In our m odel t here are t wo st at e equat i ons , as in Bl anchard and Fi s cher (1989, C h.2), but we add m acroeconomi c -fi nanci al feedback loops. Thes e m acroeconomi c fe edback effect s coul d m agni f y expans ionar y peri ods and booms, but are al so l ikel y, when fi nanci al fragi l it y and s t res s s et in, t o generat e s evere m acroeconom i c am pl i fi cat i ons. These effects have been

93

det ai l ed i n t he rec ent li t erat ure, i ncl udi ng Brunnerm ei er and Oehm ke (2013), C harpe et al . (2015), and S anni kov and Brunnerm ei er (2014).

The m odel pres ent ed here is desi gned wit h t he ai m t o underst and t he debt is sue i nvol ved i n a m ult i -peri od m odel . There are s everal reasons wh y

the choi ce of a mult i -period mode l m a y b e us eful :1 4 (1) the need i s to t rack

the path of d ynam i c vari abl es over a l onger horiz on. The evoluti on of debt and t he s ust ai nabi li t y of debt can onl y be t racked over a l onger horiz on, though we do not as sum e an i nfi nit e horizon here, (2) l everagi ng and the evol ut i on of debt is frequent l y s een to be i nt erconnect ed wit h as s et pri ces or net wort h, as des cri bed i n S t ei n (2011). In ass et pri ci ng theor y i t i s im port ant t o have a mult i -peri od pa yoff funct ion, for bot h cons um ers and fi rm s . (3) The is s ue of i mbal ances and debt s us t ai nabil it y i s cruci al , and it is not feasi bl e t o deal wit h thi s i n a one -peri od m odel , and (4) t he out com es of such an i nt ert em poral decis ion -m aki ng m odel can t hen be com pared t o st andard m acro models whe n modeli ng and est i m at ing po li c y effect s.

As m enti oned above, we al so want t o t ake am pli fi cati on and m acroeconomi c feed back m echani sm s i nto account; the y hav e been known of in m acroeconom i cs for a l ong t im e but have been s eri ous l y negl ect ed i n DS GE m odel s. In C harpe et al . (2015) the re are t he fol lowi ng am pl i fi cat ion effect s, poss i bl y ar is ing from cont ract ionar y fi s cal pol i ci es or fi s cal cons oli dati ons , wit h the pot ent i al t o becom e even great er i n t he pres ence of financi al s t res s :

• The Harrod -Dom ar uns t abl e accel erat or, generat ed b y a k ni fe edge

probl em i n t he vi ci ni t y of t he st ead y st at e .

• The Fi sher debt defl at i on effect , and a ri s e in hous ehol d

del everagi ng .1 5 1 4 S e e a l s o S c h l e e r a n d S e m m l e r ( 2 0 1 5 ) . 1 5 K r u g ma n a n d E g g e r t s s o n ( 2 0 1 1 ) e x t e n s i v e l y t r e a t t h e F i s h e r d e b t d e f l a t i o n e f f e c t i n t h e i r p a p e r , b u t t h e y a l s o s t r e s s t h e h o u s e h o l d s ’ d e l e v e r a g i n g e f f e c t o n d e ma n d .

94

• A regi m e dependent credi t avai l abil i t y as i n Ki ndl eberger ( 1989) and

Mi nsk y (1992), or t he correspondi ng ef fect , i .e. t he l oan rat e m ovi ng count er -c ycl i cal l y.1 6

• The real l oan rat e and pri ce ex pect ati on effects as developed in

Tobin’s (1975) work.

• Wage channel effect s t hat can t ri gger a mpli f yi ng forces (t h is depends ,

of cours e, on whet her t he econom y i s wa ge l ed or profit l ed) .

• A regi m e-dependent P hi ll i ps curve, wi t h t he i nfl ati on rat e reacti ng

di fferent l y t o unem pl o ym ent i n st ages of reces s ion, as compared t o boom , as des cri bed i n Ernst and S emm l er (2015) .

Wit h res pect t o t he Euro -Area, the fina nci al m arket (credi t avai l abi li t y and l oan rat e cha nnel ), t he wage channel and forces, s uch as t he defl at ionar y pres s ures , affecti ng effect i ve dem and, are current l y l i kel y t o be t he mos t im port ant . W e ex pl ore i n parti cul ar the finance - m acro li nk, and the rel at ed dem and channel s , usi ng model v ari ants of low and hi gh financi al fragi l it y an d fi nanci al s t res s.

We devel op t wo m odel s and sol ve t hem b y us i ng a recedi ng fi nit e horiz on m odel wit h t he hel p of nonli near model predi cti ve cont rol (NMPC ), as des cri bed in Gruene et al. (2015). The procedure al l ows for a m ul ti -peri od m odel i ncl udi ng t he m acroeconom i c feedback effects des cri bed above.

1. Exp an si on s and l ow fin an ci al s tress

We st art wit h a model where t he int erest rat e on debt i s gi ven exogenous l y and rem ai ns s t abl e a t a l ow l evel . Such a s cena rio m a y be rep res ent ed b y a

1 6 I n o t h e r t e x t s t h i s i s d e s c r i b e d a s t h e f i n a n c i a l a c c e l e r a t o r , w h i c h d i f f e r s f r o m t h e

95

cent ral bank purs i ng a l ow i nt eres t rat e, whi ch m i ght be cl os e t o z ero, i n the endeavor t o keep t he econom y i n a l ow fi nanci al st res s regi m e.

Fi gure 2: D ynam i c paths of soverei gn debt for cons t ant i nt erest rat e, for two i ni ti al condi ti ons , k(0) = 0 . 9, b (0) = 0 . 9, convergenc e t o st eady st at e, wi th r = 0 . 04 (upper graph), r = 0. 0 2 (l ower graph).

In equ ati on (1) we model the i ndi vi dual deci s ion probl em bas ed on l og ut il it y and a finit e deci si on horiz on T. The agent has to d eci de on

cons umpti on, ct, and t he growt h rat e of capi t al, gt.

Equ at ion (2) s hows the l aw of m ot i on for t he capit al s t ock. The capi t al

st ock grows wi t h rat e gt and depreci at es at a gi ven rat e δ. La st l y, equ ati on

96

ext ernal borrowi ng of the pri vat e and t he publi c s ect or.1 7 As can be s een

from equati on (3), debt i ncreas es wit h int erest pa ym ent s on debt , gi ven b y

rbt, but, at the s am e ti m e, debt also increas es b y (yt − ct − it − ϕ(gtkt)),

whi ch repres ent s t he di fference bet ween incom e and s pendi ng, where

ϕ(gtkt) i s a quadrati c adj ust m ent cost for invest m ent .

The m odel gi ven by equat i ons (1) thr ough (3) coul d be ext ended b y di s aggre gat i ng i ncom e int o three parts: y = norm al ret urn on capit al + capit al gai ns + wage i ncom e. Thus, we can i nt roduce a Mi ns k y t yp e capi t al gai ns effect , where an ex ces s return on capi t al i ncom e over t he i nt eres t rat e is generat ed t hrough capi t al gai ns. It has been point ed out i n t he li t erature that t his ex ces s i n cap it al gai ns can be us ed t o s ervi ce debt – s ee S t ein (2011, 2012) – , whi ch agai n woul d fuel borrowi ng. Thi s m a y hol d as l ong as there is no ri sk premi um i ncl uded i n t he i nt eres t bei ng pai d. Low int erest rat es and capi t al gai ns are frequent l y negat i vel y corr e l at ed. Thi s i s the Mi ns k y effect , where i t i s t ranqui l periods t hat s t art bui ldi ng up financi al fragi l it y. Thi s channel was obs erved in the US duri ng t he real est at e boom when low i nt erest rat es, l ow risk prem i a and l ow di s count rat es were obs erved. Low di s count rat es i n t urn generat e hi gh a ss et pri ces and capit al gai ns . C ons e quentl y, fi nanci al fragi li t y bui l ds up, as S emm l er and Chen (2014) s how.

Thi s is a ki nd of Mi ns k y s cenari o where financi al fragi li t y m a y ari s e i n a peri od of t ranquil i t y, but, at t he s am e ti m e, l ow or z ero ri s k prem i a can be observed, as s een, for ex am pl e, i n t he US from t he 1990s to 2007. S t ein (2011) shows t hat t he as s et si de wi ll then t end t o becom e ver y l ar ge, because of the l ack of an y correct i on t hrough a ri s k prem ium, whi l e hi gh capit al gai ns help in s ervi ci ng the debt .

We now s ol ve our m odel usi ng NMP C. We s et δ = 0 .0 7 and di s cus s t wo s cenari os for t he i nt eres t rat e. In t he fi rst cas e we us e r = 0 .0 4. W e t hen st ud y t he s am e m odel wit h r = 0 . 02 . The res ul ts are depi ct ed i n Fi gure 2. The vert i cal ax is s hows t he debt t o capi t al st ock rati o, t he horiz ont al axi s indi cat es the capi t al st ock. The paths show t he res ul ts for the t wo dis ti nct

97

int erest rat es. The s t ead y s t at e of t he m odel is uni que and can be s een as the upper end i n t he fi gure where both t raj ect ori es end up. The l ower t raj ect or y corres ponds to a s cenari o w here the cent ral bank i s capabl e of reduci ng t he dis count rat e t hrough m onet ar y poli c y t o r = 0 .2 . In s uch a s cenari o, t he m ul ti pli er woul d becom e qui t e l arge, as i t i s support ed b y ex pansionar y m onet ar y poli c y.

The s cenari os as s ugges t ed b y Fi gure 2 a re s t abl e wi t h s t rong mult i pl i er effect s as l ong as ris k premi a are i nex is t ent , or rem ai n l ow. Thi s al lows for us e of capi t al gai ns t o repa y debt so t hat the debt l evel s t abi li zes at a fi nit e rati o.

So far we have as s um ed t hat t he cent ral bank has s uffi ci ent c ont rol over the i nt erest rat e at a l ow l evel , t hereb y reduci ng credit s preads and cont ai ni ng defaul t ris k. However, t hes e periods of st abil it y wi t h l arge capit al gai ns due t o ass et pri ce boom s coul d l ead to an uns t abl e s cenari o as agent s t ake on ris k and s t art overl everagi ng. A burs ti ng as s et pri ce bubbl e mi ght then reduce net wort h drast i cal l y. As a cons equence, debt t o i ncom e rati os wi ll st art ri s ing and int erest rat es and credi t s preads wil l go up. The econom y wi l l ent er a peri od of fi nanci al s t res s wi t h t he pot ent i al of di re cons equences for the real econom y as well . This t ype of s cenari o wil l be di s cuss ed i n t he next s ect i on.

2. Reces s ions an d h igh f in an ci al s tress

In t hi s s ect ion we wi ll m odel an econom y where bond yi el ds are endogenous . Furt hermore, w e al so al l ow for feedback m echani sm s bet ween the fi nanci al and real s phere of t he econom y wi t h t he pot ent i al of inducing financi al st res s . Thus, we bui ld on a m odel where t he cent ral bank i s no longer capabl e of el i mi nat i ng fi nanci al s t res s.

98

In t hi s m odel vari ant we al low for i ncreas ing fi nanci al s t ress due to defaul t ris k, fi nanci al s t ress becomi ng a nonli near functi on of t he credit spread r (bt/ kt):

Thi s i s roughl y t he funct ion that was us ed i n C hi arel l a et al . (2009) and can be s een i n De Grauwe (2012). Here, the int erest pa ym ent on borrowi ng (bank credi t or bonds ) ri s es s l owl y wi t h the debt t o capi t al s tock rati o at the outs et , t hen more rapi dl y, but i s finall y bounded. In this s cenari o capit al gai ns coul d becom e negat i ve as as s et pri ces are l ik el y t o fal l. Cons equentl y, capit al gai ns can no l onger be us ed to s ervi ce debt . Moreover, debt s ervi ce wil l ris e, and sus t ai nabi l it y o f t he current

indebt ednes s i s no longer gi ven.1 8 Furt hermore, we not onl y i ncl ude an

endogenous credit spread in the m odel, but al s o add endogenous ris k prem i a, i nt eres t rat es and capit al ut il iz at i on. Em pi ri cal l y, t hes e are im port ant m acroeconom i c feedback loops t hat can oft en be obs erved duri ng peri ods of financi al st res s.

Last l y, we can als o m ake the act ual consum pti on and i nves tm ent dem and depend on credi t s preads t ri ggered b y ris i ng yi el ds on ri s k y cr edit and

bonds.1 9 W e woul d t hen have for consum pti on and i nves t m ent dem and:

1 8 F o r a s c e n a r i o l i k e t h i s , s e e S t e i n ( 2 0 1 1 ) , w h e r e i t i s e x e m p l i f i e d wi t h

ma c r o e c o n o mi c d a t a f o r S p a i n a n d I r e l a n d .

1 9 A d r i a n e t a l . ( 2 0 1 0 ) s h o w h o w a r i s e o f a n o v e r a l l ma c r o e c o n o mi c r i s k p r e mi a c a n

99

wit h the deri vati ves df / d(b/ k)<0 an d dg/ d(b/ k)<0. Th ough opt im al consumpti on and i nvest m ent pl ans are chos en, actual cons umpt ion and invest m ent decli ne due t o ri s ing ri s k premi a, credit s pread and fi nanci al st res s. Overall , we m a y have:

where agai n du/ d(b/ k) <0 . W e t ake

We can now refer to t he ris i ng credi t s pread and fi nanci al st res s as t ri gge ri ng a s el f -e nforci ng m echani s m reduci ng out put and capaci t y ut il iz ati on. The l at t er i s due t o l ower consum pt i on and i nves t m ent dem and. If capaci t y ut il iz ati on fal ls , incom e, and t ax revenue wil l decreas e too. Moreover, capi t al ga ins , whi ch are us ed t o s er vi ce debt , are fall ing as well . Thi s m i ght m ake debt – and bond i s s ui ng, i f bonds are s old on t he m arket – u ns ust ai nabl e due to furt her j umps i n credi t spreads or even credit rati oni ng.2 0

More general l y, s t ronger adverse m acroe conomi c feedback loops , s uch as di s cuss ed at t he beginning of S ect ion 3, m a y ari s e. M oreover, t he fract ion of credit - and i ncom e -const rai ned hous ehol ds and fi rms m a y i ncreas e t o t he ext ent t hat financi al st res s i s t ri ggere d. As t he s it uat i on evol ves , t he cent ral bank m a y ha ve no ins t rum ent s avail abl e – or be unwi l li ng – t o force the int erest rat e down furt her and/or t o reduce ris k prem i a and credi t spreads, for ex am pl e b y purchas ing soverei gn bonds t o dri ve down

2 0 A mo d e l wi t h c r e d i t c o n s t r a i n t s i s t r e a t e d i n E r n s t a n d S e m m l e r ( 2 0 1 2 ) . H o we v e r ,

t h e r e wo u l d a l s o b e t h e p o s s i b i l i t y o f b a n k i n s o l v e n c i e s i n t h e p e r i o d o f h i g h

100

soverei gn ri s k and ris k y bond yi el ds.2 1 In part i cul ar – m agni f yi ng t hi s

process – t here coul d occur an even wor se feedback effect , as obs erved i n the Euro -Area: a we ak financi al sect or, hol di ng ri s k y s overei gn debt , m a y com e under s evere s t res s because soverei gn bonds m a y go i nto defaul t and

banks reduce l endi ng t o t he real econom y , or wors e, even defaul t .2 2

We now go on t o devel op si mul ati ons of this m odel vari ant wit h m acro feedback loops. W e fi rst as s um e t hat t he m acro feedback loops are ver y weak. W e get t he result as dem ons t rat ed b y t he ri ght graph i n F i gure 3. As the sol uti on p at h for the capi t al s tock and l everagi ng – ri ght t raj ect or y i n Fi gure 3 – shows , at fi rs t t he lower i nt er est pa ym ent s on governm ent bonds all ow for a hi gher c api t al s t ock and hi gher l evera gi ng. Yet as t he i nt eres t rat es – in our cas e the ri s k y bond yi el ds – reach a cert ai n thres hol d, we observe t hat wit h i ncreasi ng l everagi ng and s overei gn ri sk prem i a t he capit al st ock ceas es to ri s e but t he l everage rat io keeps ri si ng. Thi s occurs when the credit s pread i s moving be yon d a cert ai n t hres hol d. In t hi s cas e d ebt final l y becom e s unsus t ai nabl e s ince the i nt eres t pa ym ent s becom e hi gher t han t he surpl us to s ervi ce t he debt, as equ ati on (6) i ndi cat es .

In the next st ep we i ncreas e t he st rengt h of the m acroeconom i c feedback loops. S t art i ng wit h a debt t o capi t al st ock rat io more or l es s above norm al , we ex pect the above feedback m echani sm s t o l ead t o hi gher financi al m arket st res s and hi gher ri s k yi el ds , hi gher credi t spreads and l ower out put , res ul ti ng in a cont racti on in t he uti liz ati on of the capi t al s tock, and in capit al s tock it s el f, and an i ncreasi ng debt t o capit al st ock rat i o.

The debt d ynam i cs wit h endogenous credi t s pread and endogenous output and surplus of s ys t e m (4) -(6) and (7) -(9) are s hown i n Fi gur e 3 i n t he l eft t raj ect or y, a gai n usi ng t he NMPC sol ut i on m ethod. A s it uati on i s s ket ched 2 1 T he E C B wa s , f o r e x a mp l e , c o n s t r a i n e d b y t h e M a a s t r i c h t T r e a t y n o t t o p u r c h a s e s o v e r e i g n b o nd s . L a t e r t h i s wa s r e l a x e d , a l l o wi n g i t t o p u r c h a s e s o v e r e i g n b o nd s o n t h e s e c o n d a r y ma r k e t , t h o u g h t h e r e a n u mb e r o f p r o g r a ms t h a t b y - p a s s e d t h e M a a s t r i c h t T r e a t y. F i n a l l y, i n M a r c h 2 0 1 5 Q u a n t i t a t i v e E a s i n g w a s i n t r o d u c e d . 2 2 S e e B r u n n e r me i e r a n d O e h mk e ( 2 0 1 3 ) a n d B o l t o n a n d J e a n n e ( 2 0 1 1 ) . T h e l a t t e r p r e s e n t d a t a o n t h e s o v e r e i g n d e b t ho l d i n g s o f b a n k s .

101

where t he cent ral bank cannot – or is not aut horiz ed t o – bring down t he ris k prem i a and credit s preads t hrough as s et m arket int ervent i ons .

Fi gure 3: Debt d yn ami cs wi th endogenous i nt erest rat es and weak m acro feedback l oo ps (ri ght t raj ector y), and debt d ynam i cs wit h endogenous i nt eres t rat es and st rong m acro feedback loops (l eft t raj ect or y), bot h s t arti ng from t he init i al condit i on k(0) = 0. 9 , b(0) = 0 .9 .

The l eft t raj ect or y of Fi gure 3 shows , s t arti ng wit h a debt t o capi t al st ock rat io of roughl y unit y, the feedback m echani sm s of hi gher ris k prem i a and hi gher yi elds , hi gher credit spreads and l ower out put l eadi ng to a cont ract i on of capit al s t ock and t o a rapi dl y i ncreas ing d ebt t o capi t al st ock rat i o i n t he l eft graph. Ag ai n, t he ri ght t raj ector y repre s ent s t he cas e

wit h weak m acro feedback l oops onl y, as di s cus s ed above.2 3

Not e that t he us ual bui ld -i n st abi liz er – t he ris ing publi c defi ci t – and the m ul ti pli er effe cts of defi ci t s are not li kel y t o work s m oot hl y. Mult i pl i er s of defi cit spending becom e weak when t here i s s im ult aneous

2 3 S e e a l s o t h e e mp i r i c s o f d r o p i n i n v e s t me n t a n d c o n s u mp t i o n d e ma n d i n H a l l ( 2 0 1 1 )

102

occurrence of ri s ing financi al s t ress, ri sk premi a and credi t s pread, and vul nerabi li t y of t he banki ng s ys t em . On t he other hand, given fi nanci al st res s it is l i kel y t o be t he s uddenl y a ri sing ri s k premi a and credit s preads that produce a s t rong downward m ul ti pli er for aus t eri t y m eas ures. Negat ive effect s of budget cons ol i dat i ons woul d, of cours e, be much weaker i n ex pansions and booms , as the above st ud y and the em pi ri cal res ult s i n Mi tt nik and S emm l er (2012) show.

Not e t hat us ual l y t he m acroeconomi c mult i pl i er woul d al so work in ex pansions , i f i nt erest rat es were kept down b y t he cent ral bank and financi al m arket s t ress and risk premi a di d not aris e. Furt herm ore, in a reces si onar y peri od, when t h e i nt erest rat e i s kept down b y m onet ar y pol i c y, or the i nt erest rat e s t a ys at t he z ero bound, t he ex pansi onary m ult i pl i er i s us uall y effe ct ive. However, i n t he s cenario s hown i n Fi gur e 3, when the financi al s t ress , ri sk premi a and credit spreads are ris i n g, t here i s l i kel y t o be a sharp reducti on of the mult i pl i er eff ect , even when ex pans i onar y fi s cal pol i ci es are att em pt ed.

Fi s cal consol idat ion m a y creat e a l arge mult i pl i er effect downward i f financi al s t ress , ri sk premi a and credi t spreads are hi gh, and the m acroeconomi c m echani s ms t ri gger s t rong downward m acroeconomi c feedback effects . If we agai n refer to our defi nit ion of i ncom e y i ncl usi ve of capi t al gai ns , t o be s pli t up i nt o y = norm al ret urn on capi t al + capit al gai ns + wage i ncom e, the negat i ve ca pit al gai ns mi ght decrea s e t he sources for debt s ervi ces even m ore, m aki ng t he debt l es s s us t ai nabl e, as des cribed in St ei n (2011). Gi ven t he s ket ched m acro feedback l oops i t is eas il y ex pl ai ned wh y t here coul d be a regi m e swit ch, from a l ow t o a hi gh st re s s regi m e wit h vul nerabi li t i es i ncreasi ng and fas t er det eri orati on of t he econom y s ett i ng i n.

Debt st abil iz ati on coul d work under t he condit i on s pel l ed out i n S ecti on 3.1. and i t al s o m i ght t em porall y work under t he condit i on shown i n the ri ght t raj ect or y of Fi gure 3. Yet, wi t h a l arger j um p i n the ris k premi a (and di s count rat e), respondi ng to hi gher l everagi ng, wit h l ower net worth, due to capi t al gai ns fal l ing, a vulnerabl e banki ng s ys t em , and cent ral banks fail i ng t o undert ake an unconvent i onal int erven t ion i n t he asset m arket s,

103

the st rong m acro feedback l oops are l ikel y t o be at work and debt st abil iz ati on i s not l ikel y t o be achi eved when fi s cal cons ol i dat i on pol i ci es are im pl em ent ed, as shown i n t he l eft t raj ect or y of Fi gure 3.

IV. Empirical Evidence on the Euro-Area

The l ast s ecti on has s hown t hat m ul ti pli er effect s not onl y depend on t he st at e of the econom y but are als o i nfluenced b y t he conduct of m onet ar y pol i c y, fi nanci al st re ss si t uat i ons and financi al fragi l it y.

Buil ding on t he i nsi ght s of the previ ous sect i on and t he em pi ri cal s t udi es of, for ex am pl e, Auerbach and Gorodni chenko (2012a), Baum et al . (2012), and Mi tt nik and S em ml er (2012), we deplo y a five -dim ens ional MR VAR in this s ect ion, where we t ake i nt o acc ount financi al st res s and cos t of borrowi ng.

The s am e m odel is t hen es ti m at ed for Germ an y, France, It al y, and S pain. Our fi ve vari abl es cons is t of t he ZEW Fi nanci al C ondi ti on Indi ces ( f ci ), t aken from S chl eer and S emm l er (2015), t he change i n t he i ndex of indust ri al product ion ( i pp ), and t he change i n the harm oniz ed cons um er pri ce i ndex ( hi cp ), bot h provi ded b y Eu rost at. Furt hermore, the change i n cost of borrowi ng ( bor r ow ) for non -fi nanci al corporati ons was obt ained

from t he EC B2 4, whi l e the change i n unempl o ym ent ( unemp ) was provided

b y t he OEC D. The dat a run from 2003 t o 2013 on a m ont hl y basi s .

1. Meth od ol ogy

As di s cuss ed above, m ul ti -regi m e m odels hel p t o dis ti ngui s h bet ween economies operating in a “good state” versus economies caught in a “bad

104

state”. The MRVAR model distinguishes be tween two (or more) states bas ed on a t hreshol d vari abl e. The m odel can be wri tt en as fol l ows (s ee Mi tt nik and S emm l er (2012)):

where yt = (y1 t,...,yn t) i s an n -dim ensi onal vector cont aini ng t he endogenous

vari abl es of t he m odel . As des cri bed before, i n our cas e n = 5 and t he

vector i s ordered as foll ows : yt = (f ci , i pp, hi cp, borr ow , unemp ). The

regi m e -dependent i nt ercept i s gi ven b y ci where i repres ent s t he regi m e. In

our case i s wi t ches bet ween a “good st at e” and a “bad st at e”, t o be

ex pl ai ned below. Ai j repres ent s t he coeffi ci ent m at rix , where j is the

current l ag and p t he number of l ags i ncluded. W e s et p = 1 , whi ch m eans that we are es ti m ati ng a MR VAR wit h one l ag, as s uggest ed b y t he

S chwartz crit eri a. La st l y,

ε

i t repres ent s t he regi m e -s peci fi c res iduals .Fi nal l y, t he s econd part of equ. (12) defines t he regi m es t o be es ti m at ed. As previ ous l y s peci fi ed, i represent s t he regi m e, whi l e r s t ands for t he threshol d vari abl e, and d i s t he t hres hol d del a y wi t h d = 1 i n our cas e. This im pl i es t hat the val ue of r from peri od t −1 defi nes the s t at e of t he MR VAR in period t. The t hres hol d vari abl e m ay b e i ncl uded i n y, becom ing an endogenous t hres hold vari abl e, or re m ai n outs ide the MR VAR model (ex ogenous t hreshol d vari abl e) . W e opt for an endogen ous thres hol d vari abl e, nam el y t h e change i n t he indus t ri al i ndex of producti on. The form ul a s t at ed above s hows the regi m e swi t chi ng rul e for t he general cas e where the number o f regi m es m a y be gr eat er than t wo. It d efines t hat t he model is i n st at e i i f t he current t hreshold vari abl e is great er t han t he threshol d val ue of the precedi ng re gim e and sm all er or equal t o t he threshol d value of the s ucces si ve regi m e. For t he cas e of a m odel wi th onl y t wo regi m es , t he t hres hol d value i s uni que and τ defi nes whether the m odel is i n t he fi rs t regi m e (i n t he cas e of rt − d ≤ τ) or the second regime (if rt − d >

105

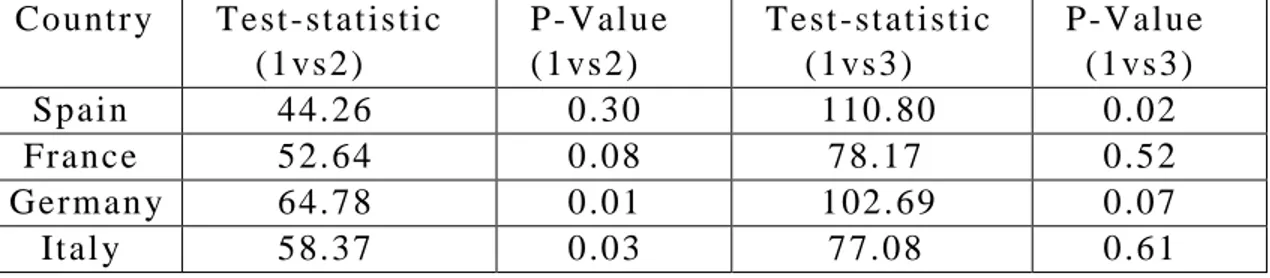

We obt ai n our t hres hol d vari abl e wi t h a gri d s earch al gori thm: i n t he fi rs t st ep we have t o define m anuall y a l ower bound for t he num be r of observati ons i ncluded i n each regi m e – t he t ri mm ing val ue, as i t is cal l ed. We use a t ri mm i ng val ue of 0.2, m eani ng t hat at l east 20% of the t ot al num ber of obs ervati ons have to be i ncl uded i n each regi m e. In t he s econd st ep al l perm i ss i bl e thres hol d values (gi ven b y al l t he value s ipp t akes on whi ch do not vi ol at e t he t rim mi ng value requi rem ent ) ar e t est ed. The opt im al t hres hol d value i s t hen chos en by m i ni miz i ng t he s um of s quared resi duals . For our models t he t rim mi ng values are −0. 4 (S pai n), −0.7 (France) 0 (Germ an y), and −0 . 5 ( It al y). Thus t he “bad regi m e” is gi ven b y negat i ve growt h rat es for all four count ri es . The i mpl i ed num ber of observations in the “bad regime” are then 45% (Spain), 34% (France) 44% (Germ an y), and 38% ( It al y).

The M R VAR approach i s frequent l y us ed for st udi es of regi m e dependent m ult ipli er effect s as i t exhi bi t s i nt eres t ing propert i es : i t i s non -li near as i t defi nes t wo (or m ore) regi m es wi th dis ti nct param et er coeffi ci ents , whi ch all ows for st at e -depe ndenc y of t he m ul ti pli er. However, whi l e bei ng non -li near, t he m odel is li near wit hi n each regi m e, si mpli f yi ng the est im ati on process , whi ch i s perform ed wi t h l eas t s quares condi ti onal on t he regi m e. Thi s s im pl i cit y of t he model als o m akes it appli cabl e for pol i c y anal ys i s (s ee Mi tt nik and S em ml er (2012) and S emm l er and Haider (2016)): whil e i n M arkov s wi t chi ng m odel s , s t at es of the econom y c annot be observed, t he thres hol d val ues i n t he MR VAR m odel are obs erved and are eas y t o i nt erpret , as demonst rat ed above.

Fi nal l y, as i n the cas e of a l inear VAR , t he effects of shocks, and therefore i mpuls e respons e functi ons, are of s peci fi c i nt eres t for s t udi es of the regi m e -dependent m ul ti pli er. However, whi l e i m pul s e res pons e funct i ons for li near VARs can be derived from t he m ovi ng-avera ge (MA(∞)) repres ent at i on of t he VAR, t he non -li neari t y of t he MR VAR does not all ow for s uch a deri vati on as regi m e swi t ches have t o be account ed for. Ins t ead, one m ust re l y on general iz ed im pul s e res pons e funct ions (G IR Fs ), as des cri bed i n Koop et al . (1996).

106

G IR Fs are of int eres t for esti m at i ng st at e -dependent m ul ti pli ers as t he y are capabl e of account ing for as ym m et ri es i n t he res pons es and his t or y dependence. G IR F b ui l d on a si mul ati on t echni que whi ch wi ll be des cribed here bri efl y. The rea der m a y refer t o Koop et al . (1996), or t he appendix of Fazz ari et al . (2013) t o gai n det ail ed i ns i ght i nt o t he t echni que. To summ ariz e, G IR Fs are defi ned as foll ows :

where Ωt − 1 repres ent s t he st at e of t he ec onom y at a gi ven point i n ti m e,

Vt i s a s hock to a vari abl e i n our s ys t em, and n st ands for t he forecas t

horiz on. G IR Fs s pli t t he dat a i nt o subset s accordi ng t o t he regi m es as des cri bed above. W e st art wit h the fi rs t regi m e and us e a random st arti ng

val ue from i t (whi ch depends on the hi st or y Ωt − 1) t o si m ul at e t he model

wit h boots t rapped resi dual s , whi ch are r egi m e -dependent and als o t ake t he cross -s ecti onal correl at i on of t he errors i nt o account . W e repeat t he si mul ati on wi th t he s am e s t arti ng val ue and res i dual s, but add an addit i onal shock t o one vari abl e. Thi s vari abl e wi ll be call ed t he s hocked vari abl e ; here we aim t o anal yz e the effect of t he s hocked vari abl e on t he ot her vari abl es of the s ys t em. In our case the shoc ked vari abl e wi l l be the FC Is ,

where we s im ul at e a negat ive shock of t he s iz e of one st andard devi ati on.2 5

The i mpuls e res pons e for thi s fi rst repl i cati on i s t hen gi ven b y t he

di fference bet ween the res pons e wi th t he addit i onal s hock ( Vt) and t he

res pons e wi thout it . This procedure i s repeat ed 100 t i m es for a gi ven st arti ng val ue, whi l e resi duals are dra wn randoml y. In t h e next st ep t he average of t he s im ul at ed di fferences i s c om put ed.

Fi nal l y, t he procedure i s repeat ed 3 00 t im es for each regi m e wi t h di ffere nt s t art i ng val ues. The st arti ng val ues are t hus drawn randoml y wi th repl acem ent for each regi m e. Com put ing t he m ean (and quanti l es for anal yz i ng s im ul at i on i nt erval s) over t he di fferent im pul s e res pons es i n

2 5 N o t e t h a t a n e g a t i v e s h o c k t o t h e F C I i n d e x i m p l i e s a n i mp r o v e me n t o f f i n a n c i a l c o n d i t i o n s i n t h e e c o n o m y .