482

In a voluntary contribution game, each member of a group makes a contribution to a common pool. Each player's contribution benefits everyone, but the contributor's cost exceeds his benefit.

Pat II Economic Decision Making

IN-TEXT EXERCISE 13.2 Show that Rosa will not take the gamble labeled option C on page 477. Show that she will nevertheless risk losing $1,000 against winning$S,OOO based on a coin lip.

CHOICES INVOLVING STRATEGY

In Chapter 12, we studied the field of game theory, which provides powerul tools for understanding choices involving strategy. How well do those tools perform in practice? The evidence is mixed. However, as we will see in this section, some of game theory's apparent failures may be attributable to faulty assumptions about people's preferences, rather than to undamental problems with the theory itself. Many applications of the the ory assume that people are motivated only by material self-interest. But strategic deci sions are inherently social, in the sense that they involve more than one person. When making strategic decisions, some people appear to be motivated in part by social concens such as altruism, fairness, and prestige. In some situations, it may be important to account for these social motives when analyzing strategic decisions.

PossibLe Shotcomings of Game heory

Game theory tends to predict behavior most accurately once players have gained some experience with a game, particularly if the rules are relatively simple. However, even experienced players of simple games sometimes make decisions that seem contrary to their own interests.

To illustrate these points, we'll examine the types of choices that people tend to make in voluntary contribution games. In such a game, each member of a group receives a ixed number of tokens. Players are invited to contribute some or all of their tokens to a central pool. They choose their contributions simultaneously, then the game ends. The following formula determines each player's payoff:

Player's payof ($) = Player's remaining tokens + [M X Tokens in common pool] where M is some number between 0 and I. So when a player contributes a token to the common pool, everyone else gains $M. The contributor gains $M through the growth of the common pool, but loses $1 in the form of the donated token.

Problems like the voluntary contribution game come up in the real world all the time. Think of the common pool as a joint project, in which contributions can take the form of money or efort. Each person's contribution to the project beneits everyone else.

Before reading further, imagine yourself playing this game with three other people. Suppose everyone starts with 20 tokens, and M = 0.4. What would you do?

For each token you contribute to the central pool, your payof changes by $(0.4 - I), or -$0.60. No matter what you expect others to do, your best choice is to contribute noth ing. In other words, giving nothing is a dominant strategy. Standard game theory predicts that every player should keep all his tokens.

But what if evey player were to contribute one token? In that case, everyone's payoff would change by $(4 X 0.4 - I), or +$0.60. Everyone would come out ahead. If the players could reach a binding agreement with each other, they would no doubt decide

Chapter 13 Behavioral Economics

to contribute all their tokens. That way, each would end up with $4 X 0.4 X 20, or $32, rather than $20.

In essence, the voluntary contribution game creates a conflict between individual interests and collective interests. Think of it as a mUltiple-player version of the Prisoners' Dilemma. Each player has a dominant strategy, but playing those strategies is bad for the group as a whole.

What do people do when they play this game for the irst time? Many focus on their individual economic incentives and give nothing. Many others focus on the collective interest and give all of their tokens. Relatively few give something in between. The overall contribution rate is usually around 30 percent to 50 percent-rather far rom what game theory would predict.

What happens, though, when people gain experience with this game? In one experi ment, subjects played the voluntary contribution game described above 20 times in a row. Playing a game repeatedly can sometimes change the subjects' strategic opportunities and incentives-for example, by introducing the possibility of retaliation or reciproca tion (recall Section 12.4). To avoid this possibility, the experimenters assigned players to a new group in each round, so that each round involved a group of "strangers." Subjects were not told what other members of their group had contributed in past rounds.

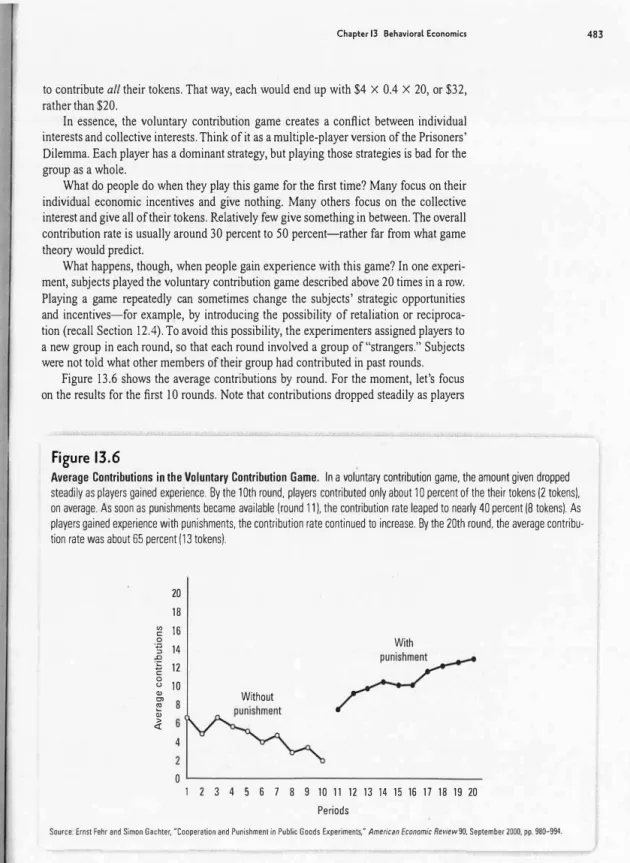

Figure 13.6 shows the average contributions by round. For the moment, let's focus on the results for the first 10 rounds. Note that contributions dropped steadily as players

Figure 13.6

Average Contributions in the Voluntary Contribution Game. In a voluntary contribution game, the amount given dropped steadily as players gained experience. By the 10th round. players contributed only about 10 percent of the their tokens (2 tokens), on average. As soon as punishments became available (round 11), the contribution rate leaped to nearly 40 percent (8 tokens). As players gained experience with punishments, the contribution rate continued to increase. By the 20th round, the average contribu tion rate was about 65 percent (13 tokens).

20 18

" 16

"

0 With

. , , 14

セ@

c

'S " 12

a u 10

" Without

o E

"

>

«

4

0

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Periods

Source: Ernst Fehr and Simon Gachter, "Cooperation and Punishment in Public Goods Experiments," American Economic Review90, September 2000, pp. 980-994.

483

484

In the dictator game, one player (the dictator) diJides a fixed prize between himself and another player (the recipient) who is a passive participant.

Pat II Economic Decision Making

gained experience. By the 10th round, players were contributing only about 10 percent of their tokens (2 tokens), on average. Other studies conirm that contributions dwindle as players become more familiar with the voluntary contribution game. Though there is· usually a small core of determined contributors, game theory predicts the behavior of experienced subjects reasonably well.

What about rounds II through 20? The experimenters changed the game by adding a second stage in which any player could punish any other player. To inflict a punishment, a player had to give up some tokens. For example, reducing another player's payof by 30 percent cost four tokens. Before reading urther, think about what you would do in this two-stage voluntary contribution game. Would you contribute more? Would you punish someone who didn't contribute to the common pool?

With a credible threat of punishment, you'd expect people to contribute more. How . ever, in this game, self-interest should guarantee that no one will punish anyone else. Inflicting a punishment is costly. And while it may change the punished player's future behavior, it doesn't beneit the punisher because the group assignments change each round. Since the threat of punishment isn't credible here, game theory tells us that the addition of punishments shouldn't change the results. (Recall our discussion of strategic credibility in Section 12.4.) Players should contribute nothing and then leave each other alone.

How do people actually play the two-stage voluntary contribution game? Look again at Figure 13.6. As soon as punishments became available (round 11), the contribution rate leaped to nearly 40 percent (8 tokens). As players gained experience with the new stage, the contribution rate continued 10 increase. By the 20th round, the average contribution rate was about 65 percent (13 tokens). So for the two-stage voluntary contribution game, our predictions based on standard game theory are quite far off, even for experienced players.

Does this result mean that game theory is wrong? That's one possibility. Another pos sibility is that our assumptions about players' preferences are incorrect. In solving the vol untary contribution game with and without punishments, we've assumed that players care only about their own monetary rewards. In fact, they may also care about other things, like fairness. To make sensible predictions, we must take all their motives into account.

he Importance of Social Motives

Since all games involve more than one person, they are necessarily social. In social situa tions, monetary gain usually isn't the only motive. Some people are altruistic; some value fairness. Others are attracted to eicient outcomes that avoid waste. Some worry about status, and try to create a favorable impression. If treated badly by others, some people react angrily.

An important objective of behavioral economics is to understand these social motives and the ways in which they inluence strategic choices. In the following sections we'll highlight some important insights, based on experimental studies of three simple two player games: the dictator game, the ultimatum game, and the trust game.

he Dictator Game In the dictator game, one player (the dictator) divides a ixed prize-say $IO-between himself and another player (the recipient) who is a passive participant. The dictator and the recipient usually don't know each other, and they have no direct contact during or ater the game. Strictly speaking, this isn't really a game at all, since only one player makes a choice. Before reading urther, think about what you would do if you played this game in the role of dictator.

Chapter 13 Behavioral Economics

If people care only about their own monetary payoffs, every dictator should keep the entire prize for himself. That is not the way people actually behave, however. In one experiment involving $10 prizes and 24 pairs of subjects, only 21 percent of the dictators kept everything for themselves. The same fraction of subjects-21 percent-gave away half the prize ($5). Of the rest, 17 percent ceded $1 to the recipient, 13 percent ceded $2, and 29 percent ceded $3. No one gave away more than half the prize.35 The specific results have varied a bit from experiment to experiment, depending on the nature of the subject pool, the size of the prize, and other conditions. But most studies have found evidence of significant generosity, even as subjects gained experience. Indeed, a sizable raction of subjects almost always divides the prize equally.

Results of the dictator game clearly illustrate the potential importance of social motives. Possible explan�tions include altruism, fairness, and egalitarianism. Concerns about status may also play a role-subjects may want to be perceived as generous or fair . Indeed, dictators are considerably less generous when their anonymity is assured. he Ultimatum Game The ultimatum game (also known as ultimatum bargain ing) starts out just as the dictator game: one player (the proposer) ofers to give a second player (the recipient) some share of a fixed prize. The recipient then decides whether to accept or reject the proposal. If he accepts, the pie is divided as speciied. If he rejects, both players receive nothing. In other words, this game involves a take-it-or-Ieave-it offer. Before reading further, think about what you would ofer as the proposer (given a prize of, say, $10) and what you would accept as the recipient.

You might expect people to give more under a threat of rejection. But as long as the proposer ofers the recipient something, a recipient who cares only about his monetary payof will be better off accepting the ofer than rejecting it, so a threat to reject isn't cred ible. In that case, game theory tells us that the proposer will ofer only a tiny fraction of the prize, which the recipient will accept.

How do people actually play this game? When the proposer makes an ofer below 20 percent, the recipient rejects it about half of the time. Higher ofers are also rejected, but with lower frequency. The threat of rejection results in larger ofers than in the dictator game, and recipients enjoy significantly higher payoffs on average, even though some offers are rejected. In an ultimatum game experiment that was otherwise identical to the dictator game experiment discussed in the previous section (the same prize, subject pool, and sample size), 71 percent of proposers divided the $10 prize equally; none proposed keeping it all for themselves. Of the rest, 4 percent ofered $1, 4 percent ofered $2, 17 percent offered $4, and 4 percent ofered $6 36 As with the dictator game, specific results have varied a bit from experiment to experiment. Even so, virtually every study con irms that many subjects reject very low offers, and the threat of rejection produces larger offers.

Choices in the ultimatum game suggest that in social situations, emotions such as anger and indignation inluence economic decisions. People can and often do reject offers that offend their sense of fair play, even if doing so runs contrary to their monetary inter ests. As a result, many people are careul to avoid giving ofense to others.

}'Robert Forsythe, Joel L. Horowitz. N. E. Savin, and Martin Seton, "Fairness in Simple Bargaining Experiments," Games alld Eco nomic Behavior 6, May 1994, pp. 347-369. The experiment involved undergraduates and MBA students at the University of Iown. )6Ibid.

485

In the ultimatum game (also known as ultimatum bargaining), one player (the proposer) offers to give the second player (the recipientl some share of a fixed prize. The recipient then decides whether to accept or reject the proposal.

486 Pat II Economic Decision Making

Application 13.8

- � - - - - -�

- - -Admitting New States to the Union

T

he u.s. political system treats each of the 50 states as an equal partner in the federal system of governance. Today we take this equal partnership for granted. But at one time it was a hotly debated issue.to moral principles. Others offered practical arguments, as George Mason did when he reasoned as follows:

"[The new states] will have the same pride and other passions which we have, and will either not unite with or will speedily revolt from the Union, if they are not in all respects placed on an equal footing with their brethren."37

In 1787, delegates from the 13 original states met in Philadelphia to discuss the terms and conditions under which new states would be admitted to the union. A number of them worried that as the western territories were settled, new states might eventually acquire the ability to outvote the original 13. They argued for a two-tier system, with special privileges for the founding states. On the other side of the debate, many of those advocating equal partnership appealed

Mason's argument-that the western territories would reject an unfair take-it-or-Ieave-it offer-helped to sway the convention in favor of equal partnership.

In the trust game, one player (the trustor) decides how much money to invest. A second pa rty (the trustee) divides up the principal and earnings.

he Trust Game In the trust game, one player (the trustor) starts out with a ixed amount of money, $X, which he can keep or invest. The investment yields $R for every dollar invested (where R > 1), but the principal and earnings are controlled by a second player (the trustee). The game ends just as the dictator game: the trustee divides the prin cipal and earnings between herself and the trustor. Before reading urther, think about what you would invest as the trustor (assuming that X = 10 and R = 3) and what you would return as the trustee.

You might think that players are more likely to return the money if someone entrusts them with it. But if the trustee cares only about her monetary payof, she'll keep all the principal and earnings for hersel. Anticipating this response, a selfish trustor invests nothing. Since R > I, this result is ineicient. In other words, if players have no motives other than monetary gain, game theory tells us that trustees will be untrustworthy and trustors will forgo potentially profitable investments.

How do people actually play this game? In one experiment involving $10 prizes and 32 pairs of subjects, only two trustors invested nothing; ive of them invested every thing. Overall, trustors invested about half their initial unds. Trustees varied widely in their choices. Twenty percent retuned nothing and another 27 percent returned only $1. But others paid back large amounts. Among the 30 trustees who invested something, II received more than their investments, 16 received less, and 3 received the same amount. Overall, trustors received about $0.95 in return for every dollar invested.38 These results are fairly typical of experimental trust games. Trustors show trust by investing sizable

37Michael Farrand (cd.). Records of the Federal Convention, Vois. I-III, New Haven, Conn.: Yale University Press, 1966, pp. 578-579. lIJoyce Berg. John Dickhaut, and Kevin McCabe, "Trust, Reciprocity. and Social History," Games and Economic Behavior 10, July 1995, pp. 122-142.

Chapter 13 Behavioral Economics

amounts. Some trustees prove trustworthy, while others don't. On average, trustors usu ally come close to breaking even on their investments.

Why is the trust game important? In the real world, people can sometimes enter into binding contracts, which eliminate the need for trust. Here, a contract might specify that the trustor is to provide investment unds of $ lO, and the trustee is to return $15, keeping

$15 for hersel. Both parties would come out ahead. But binding contracts don't work well in all situations. A great deal of business is conducted on the basis of handshakes and verbal agreements. The trust game helps us to understand one reason why this approach works. Many (but not all) people do feel obliged to justiy the trust shown in them by oth ers. As a result, many are willing to extend trust to others.

• NEUROECONOMICS: A NEW FRONTIER

Like the previous sections of this chapter, the ield of behavioral economics is highly compartmentalized. It catalogs noteworthy observations concerning decision making and offers specialized theories to explain many of them. Unlike standard economic theory, it does not proceed from overarching principles, nor does it provide a single unified the ory of decision making. Some behavioral economists believe that it may be possible to develop a new unified theory of economic decision making by studying the human neural system, including brain processes. Such speculation has led to a new field of microeco nomic research called neuroeconomics. Progress to date has been limited, but the ield is still in its infancy, and the pace of discovery is accelerating.

How can the study of human neural processes help with economic modeling? Take the issue of self-control, discussed in Section 13.3. Neuroeconomic research has identi ied a plausible neurological source of dynamic inconsistency. In one experimental study, subjects made choices involving immediate and delayed rewards while undergoing brain scans.39 The results suggest that when someone chooses between, say, $10 in two weeks and $12 in six weeks, the brain evaluates both alternatives using the same neural circuitry. However, when someone chooses between $10 immediately and $12 in four weeks (that is, the same alternatives two weeks later), the brain appears to use diferent circuitry. All alternatives-whether delayed or immediate-activate a portion of the brain that is well suited to evaluating and comparing abstract rewards (the lateral prefrontal cortex and related structures). But immediate rewards produce more pronounced responses in a part of the brain that is thought to play an important role in many of our emotional responses (the limbic system).

Figure 13.7(a) provides a composite image of multiple brain scans. It highlights areas in which activity is elevated during decision making. Figure 13.7(b) shows how the level of activity in four areas of the brain changes over time once the subject has been asked to choose between two alternatives. Three of these areas are considered limbic structures. The red lines show the level of activity when one of the altenatives provides an immedi ate reward ("d = today," where d indicates when the earliest reward is available), while the green and blue lines show the level of activity when both alternatives provide delayed

39Samuel M. McClure, David I. Laibson, George Loewenstein, and Jonalhan D. Cohen, "Separate Neural Systems Value Immediate and Delayed Monetary Rewards," Science 306, OClober 15,2004, pp. 504-507.

487

Neuroeconomics studies the human neural system, including brain processes, with the object of discovering new principles of economic decision making.

488 Part II Economic Decision Making

Figure 13.7

Brain Activity during Choices Involving Time. Figure (a), a composite image of multiple brain scans,. shows four areas of the brain that are disproportionately activated by immediate rewards. Figure (b) tracks the level of activatIOn In each of these struc tures in response to various choices. Here, "d" refers to the time delay before the earliest of two rewards. Immediate rewards (d = Today) produce higher activation in all four areas.

(a)

x =4mm y=8mm z= -4mm

(b) VStr MOFC MPFC PCC

0.4

�

"> 0.2

"

"

: u ii " 0.0

>

i -0.2

-4 -4 4 -4 4 -4

ime (s)

-d = Today -d = 2 weeks - d= 1 month

Source: Samuel M. McClure. David I. Laibson. George Loewenstein. and Jonathan O. Cohen. "Separate Neural Systems Value Immediate and Delayed Monetary Rewards: Science 306. October 15, 1004, 504-507.

rewards ("d = 2 weeks" and "d = I month"). Activity in each of these brain structures is considerably higher when one of the alternatives provides an immediate reward than when rewards are delayed (compare the red lines to the green and blue lines). However, as long as the earliest reward is not immediate, the amount of delay doesn't seem to matter (compare the green lines to the blue lines).

Earlier in this chapter, we emphasized that it is oten diicult to determine whether a particular behavioral pattern relects preferences or mistakes. As Application 13.9 illus trates, another potential beneit of neuroeconomics is that it may help us resolve this issue in particular instances.

Application 13.9

AddictionT

he consumption of addictive substances is an important social issue that affects members of all socioeconomic strata in virtually every nation. According to estimates for the United States, nearly half a million deaths each year are attributable to cigarettes, more than 100,000 to alcohol. and roughly 20,000 to various narcotics. Alcohol abuse contributes to 25 to 30.percent of violent crimes.One school of thought, known as the theory of rational addiction, holds that the consumption of addictive substances is simply an expression of consumer preferences.40 According to this view, addictive substances are distinguished only by the particular pattern of benefits and costs they deliver over time; otherwise, they're just like other goods. While it's true that addictive substances are potentially dangerous, so are hang-gliding, rock climbing, and eating too much fast food. And while it's true that the use of addictive substances sometimes harms other people, the same can be said of automobiles, electricity, and matches. What is the justification for treating addictive substances differently?

I. Objectives and methods of behavioral economics a. There are two main motivations for research in behavioral economics. First, people sometimes make choices that are inconsistent or at least very diicult to reconcile with standard economic theory. Second, in some situations, standard economic theory leads to seemingly unreasonable conclusions about consumer welfare.

b. The main objective of behavioral economists is to modiy, supplement, and enrich standard economic

Chapter 13 Behavioral Economics 489

There is a growing consensus among neuroscientists that addictive substances interfere with the normal operation of a neural system that generates forecasts of near-term pleasure. Normally, this system learns through feedback that is, it forecasts pleasure based on past experience. Addictive substances "short circuit" this system, causing it to malfunction. With repeated use of a substance, the cues associated with past consumption cause the system to forecast grossly exaggerated pleasure responses, creating a poweful (and disproportionate) impulse to use.4t

This new consensus within neuroscience has potentially important implications for the economic analysis of addictive substances. Normally, economists infer consumers' preferences from their choices, and evaluate policies based on these inferred preferences. But in the case of addictive substances, some choices may be attributable to malfunctions of the brain's forecasting circuitry. As a result, they may not reveal consumers' preferences reliably. Indeed, many addicts say they want to quit, and many of them try to quit, but report that they are unable to control their use.

theory by adding insights from psychology. Usually they modiy the theory either by making diferent assumptions about preferences or by assuming that certain actions are mistakes.

c. For the most part, behavioral economists employ the same tools as other economists, though they tend to rely more on experinents. Experiments ofer several potential advantages and disadvantages over other nethods.

wSee Gary Becker and Kevin Murphy. "A Theory of Rational Addiction," Jounal of olitical Economy 96, August 1988, pp. 675-700.

lIFor a review of the evidence, as well as an elaboration of the policy implications, see B. Douglas Benheim and Antonio Rangel, "Addiction and Cue-Triggered Decision Pro cesses," American Economic Review 94, December 24, pp. 1558-1590.