Legal and Regulatory

Framework for developing

Domestic Bond Markets

towards facilitating joining

ABMF AMBIF Market

Prof. Shigehito Inukai

with Matthias Schmidt

ADB Consultants

Myanmar Bond Market Seminar

Naypyidaw, 9 th October 2013 1

V.11 as at 03 October 2013

Agenda

1. Introductory Remarks (p.3)

2. Definition of Securities (p.11)

3. What comprises the Financial Services (which includes

Securities) Market (p.21)

4. What Financial Services Market Regulator(s) should

regulate (p.27)

5. Analysis of Debt Instruments related rules (p.31)

6. What Market Participants look for (p.41)

7. Discussion Points and Clarifications (p.43)

8. Information for Reference (p.48)

9. Questions & Answers (p.50)

1. Introductory Remarks

3

Introductory Remarks

• The research for this presentation was done on the basis of laws

and regulations known to ADB Secretariat and material available

in the public domain

• This includes unofficial English translation of the Securities Exchange Certificate

Transaction Law (2013)

• This presentation and the market visit discussions are aimed at

identifying the market situation, confirming the preliminary

findings for further developing domestic bond market towards

facilitating the joining of the AMBIF* Professional Market in the

future

• Since ADB Secretariat and the ABMF members from Myanmar

intend to compile a Myanmar Bond Market Guide as part of

ABMF Phase 3 output, the market information should be

validated to the extent possible

* ABMF is now proposing the establishment of the ASEAN+3 Multi-Currency Bond Issuance Framework, or AMBIF, as 4

a measure to support local currency bond issuance and investment in the domestic markets of ASEAN+3.

5

Economy Type of Market Candidate Market Professional Market as

a result of Participation of Market

governed by SRO

Accessible to Foreign Institutional Investors

PR China

Issuing & Secondary

Inter-Bank Bond

Market (IBBM) Access/Participation Institutional

Investors PBOC NAFMII via QFII

(Issuing & Secondary)

(Qualified Foreign

Institutional Investor) (Regulation) (QFIIs, B/Ds) (CSRC) (SSE) (YES)

Hong Kong

Issuing HKEx Market Practice Professional

Investors SFC, HKEx HKEx YES

Issuing &

Secondary OTC Market Practice Professional

Investors SFC, HKMA - YES

Indonesia MTN Issuing (Private Placement) Market Practice Market

Participants - - YES

Japan Issuing Tokyo PRO-BOND Law (FIEA) Specified

Investors FSA, TSE TSE, JSDA YES

Korea

SME + SME Foreign Issuers

Issuances

QIB Market Decree to FSCMA

Qualified Institiutional

Buyers

KOFIA (FSS) KOFIA Not at the moment

Issuing

Private Placement FSCMA defines this

market

Market Practice Professional

Investors (KOFIA) (KOFIA) YES

Malaysia

Issuing &

Secondary Excluded Offers Law (CMSA) Sophisticated

Investors SC Malaysia - YES

Issuing Exempt Regime

(Listings only) Membership Institutional

Investors Bursa Malaysia - YES

Philippines Issuing & Secondary

Qualified Investor / Qualified Buyer

Market

Participation

Qualified Investors / Qualified Buyers

SEC PDEx YES

Singapore Issuing &

Secondary OTC Market Practice Institutional

Investors SGX - YES

Thailand Issuing & Secondary

Private Placement under AI Regime /

OTC

Thai SEC Regulation

Accredited Investors (AI,

includes II & HNW))

SEC ThaiBMA YES

Viet Nam Issuing &

Secondary (Private Placement) Law Professional

Investors SSC (VBMA) YES

Candidates for Proposed AMBIF Professional Market(s) or Segment(s)

Source: ADB Consultants

6

Idea of how a Professional Market can be defined

if all Components are already evident in a Market

Component

LCY Issuance

Instruments

Investor

Issuer

Documentation

6

Available in Market

LCY Issuances

Straight Bonds etc.

Licensed Investors, FII

Acceptable Issuers

Market Practice

Prerequisites in place?

Possible Approach

Regulatory Guideline

= Professional Market

✔

✔

✔

✔

✔

Points to be considered

• Uncertain and cumbersome rules should be eliminated as

much as possible

• Inconsistency between related laws and regulations should

be eliminated

• The Financial Services (which include the Securities)

Market and its infrastructures, including regulatory

framework, should reveal a high integrity in themselves

• Key Words

• Certainty

• Clarity

• Consistency

• Integrity

7

The Goal/Objective

• A construction of Financial and Capital Markets

(Financial Services Market) including professional

bond market with high quality in which a fair price

formation is continuously performed.

• Protection of general investors and other

customers/users of financial services.

In particular, in developing markets, (1) the

existence of appropriate regulations for “Financial

Sector / Market Participants & Intermediaries and

their (cross-organizational) Activities” and (2) their

strict compliance, are of vital importance.

9

Objectives of the Securities Exchange

Certificate Transaction Law* (2013)

Chapter 2 Article 3. The Objectives

(a) To promote the development of a market-oriented system;

(b) Systematic appearance of capital and investment in the securities exchange

certificate market for the development of national economy;

(c) To raise state and private monetary business efficiently and to develop

economic sectors widely;

(d) To supervise the smooth running of securities exchange certificate business

so that it is carried out in an honest way;

(e) To safeguard the participants who take part in the securities exchange

certificate market according to the law;

(f) To encourage the public in order to increase the public's financial investment

and to support the state's monetary policy.

The new Law emphasizes on:

Effective supervision, safeguarding participants, national

development of a market-oriented system

* Official English title to be confirmed

10

10

Market as the place or space for trade

Stock Exchange, off-exchange (OTC)

market, and trade execution system, etc.

Ĭ Financial products

/ instruments / services

Financial services

provider Intermediary

and corresponding

system

Safety net Regulatory agency Conflict resolution agency /

mechanism (Financial ADR system)

Financial service market laws, regulations and company laws and regulations and related soft law

Į Market system infrastructure ( social capital)

Electronic platform, which integrates a series of operational process of securities investment into the “e-commerce”

Securities

clearing/

settlement

system

Disclosure

Profiling

/Registration

system

Asset

Administration

fiduciary

service

system

Various types of IT

communications

system

Various types of IT

communications

system

Cash management

system

ĭ Public institutional infrastructure such as market related laws and regulations (

social capital)

į Taxation system

İ Financial expert and educational system

Fund-raiser, issuer

company, industry

group, organization

Financial services

provider Intermediary

and corresponding

system

Components of Financial Services Market 10

Self-Regulatory

Organizations (SROs)

Investors /

Financial services

consumers

Investors /

Financial services

consumers

2. Definition of “Securities”

- Characteristics of Securities in the current laws

- Existence of Scripless Securities are important for the

creation of Professional (AMBIF) Market in the future

11

Securities as mentioned in Law

• Bonds in Myanmar Companies Act 1913,

Financial Institutions of Myanmar Law (1990) , and

Securities Exchange Certificate Transaction Law (2013)

• Commercial papers in Financial Institutions of Myanmar Law (1990)

• Credit bonds(*) in Securities Exchange Certificate Transaction Law (2013)

•

(*) “Credit bonds” seems to be “Secured bonds.” This may be a matter of unofficial English translation.

• Debentures in Myanmar Companies Act 1913,

Financial Institutions of Myanmar Law (1990) , and

Securities Exchange Certificate Transaction Law (2013)

• Securities in Myanmar Companies Act 1913,

Financial Institutions of Myanmar Law (1990), and

Securities Exchange Certificate Transaction Law (2013)

• Other securities exchange certificates and instruments in Securities

Exchange Certificate Transaction Law (2013)

No mention of “corporate bonds” as term or asset class

No definition of “securities” as such across the examined legislation

13

Securities as found in Law

• It appears as if reviewed laws assume that a definition

has been made elsewhere, but no reference was found

The existence of a clear definition of securities as

financial instruments for investments and issuances is

quite important

There is room for a comparative review of the definition

and characteristics of “Securities” in Myanmar home

country language and English as well

14

Jurisdiction Existence of a Clear Definition of Securities (Bonds) People’s

Republic of China

Securities concepts may differ by industry or by competent authority in China. The Corporation Law and Enterprise Law co-exist and, hence, either may set rules for issuance of securities, depending on the industry, issuer, and type of security. The official definition of securities is

provided in the Securities Law of PRC, which was revised in 2005. The present law shall be applied to the issuance of and transactions in stocks, corporate bonds, as well as any other securities lawfully recognized by the State Council within the territory of the PRC. However, some bonds do not fall under the Securities Law. In case where there is no such provision in the present law, the provisions of the Corporation Law and other relevant laws and administrative regulations shall be applied.

Hong Kong, China

For bonds to be listed on the Hong Kong Stock Exchange or cleared through the Central Moneymarkets Unit (CMU), they must satisfy the criteria as set out in, among others, the Listing Rules and CMU Service Reference Manual (which is accessible to CMU members only), respectively. Also, a definition of securities is laid down in the Securities and Futures Ordinance (SFO) of the Securities and Futures Commission (SFC). Indonesia The definition of securities is not confined to a single law. Original relevant definitions found in the commercial code left by the Dutch, and

remaining in force are the following: Promissory note (PN), cheque, and bill of exchange. There is no mention of corporate bonds and debt instruments in the Company Law; however, they are often described or covered in the Articles of Association of companies. The clearest

definition of securities can be found in the Capital Market Law No. 8 (1995). Pursuant to the Capital Market Law, securities are classified as PNs, commercial paper (CP), shares, bonds, evidences of indebtedness, participation units of collective investment contracts, futures contracts related to securities, and all derivatives of securities. Today, the distinction of debt instruments can be divided into the capital market and the money market: (1) the capital market covers bonds, (2) the money market covers PN, medium-term notes (MTN), CP, Certificate of Central Bank (SBI, Sertifikat Bank Indonesia); most instruments have been introduced by foreign bank participants in recent years. MTN and CP are synonymous for all intents and purposes; legal treatises exist but there are no statutory definitions of these instruments.

Japan The Companies Act defines corporate bonds. A uniform legal framework for all types of securities exists. Distinctions between dematerialization or immobilization and physical securities are clear. Legal ownership structure of dematerialized or immobilized securities is clearly stipulated. Republic of

Korea

The revised Commercial Act (to take effect in 2012) provides a basis for corporate bonds diversity. This should resolve the discrepancy in the definition of securities between the Commercial Act and the Financial Investment Services and Capital Markets Act (FSCMA).

Malaysia Under section 2(1) of the Capital Markets and Services Act 2007, securities are defined as: (a) debentures, stocks or bonds issued or proposed to be issued by any government; (b) shares in or debentures of, a body corporate or an unincorporated body; or (c) unit trusts or prescribed

investments, and includes any right, option or interest in respect thereof, but does not include futures contracts. Debentures are also stipulated in article 125 of the Companies Act 1965.

Philippines Under section 3 of the Securities Regulation Code (SRC), securities are shares; participation or interests in a corporation or in a commercial enterprise or profit-making venture and evidenced by a certificate; contract; or instrument, whether written or electronic in character. The Philippine Dealing and Exchange (PDEx) Rules for the Fixed Income Securities Market, as amended (PDEX Rules), define securities as fixed- income securities, including government securities.

Singapore Securities are defined in the Securities and Futures Act (SFA) in sections 2(1), 196A, 214, and 239. Thailand Section 4 of the Securities and Exchange Act B.E. 2535 stipulates the definition of securities.

Viet Nam Pursuant to article 3 of the amended and supplemented Securities Law No. 62/2010/QH12 and article 6 of Securities Law No. 70/2006/QHll, securities mean evidence from an issuing organization certifying the lawful rights and interest of an owner with respect to assets or capital portion. Securities may take the form of certificates, book entries or electronic data, and shall comprise the following types: 1) shares, bonds and

investment fund certificates; 2) share purchase rights (rights issue), warrants, call options, put options, future contracts, groups of securities and securities indices; 3) investment capital contribution contracts; and 4) other types of securities stipulated by the Ministry of Finance.

Table 1.2 Existence of a Clear Definition of Securities (Bonds)

Source: ASEAN+3 Bond Market Guide, ADB, April, 2012

15

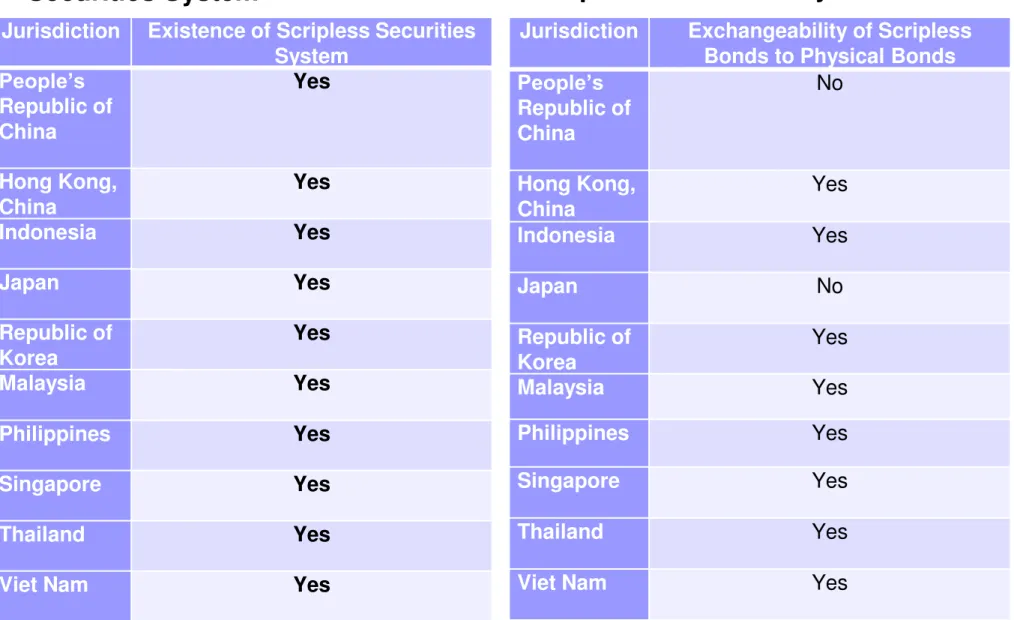

Jurisdiction Existence of Scripless Securities

System

People’s

Republic of

China

Yes

Hong Kong,

China

Yes

Indonesia Yes

Japan Yes

Republic of

Korea

Yes

Malaysia Yes

Philippines Yes

Singapore Yes

Thailand Yes

Viet Nam Yes

Table 1.3 Existence of Scripless

Securities System

Jurisdiction Exchangeability of Scripless

Bonds to Physical Bonds

People’s

Republic of

China

No

Hong Kong,

China

Yes

Indonesia Yes

Japan No

Republic of

Korea

Yes

Malaysia Yes

Philippines Yes

Singapore Yes

Thailand Yes

Viet Nam Yes

Table 1.5 Exchangeability of

Scripless Bonds to Physical Bonds

Source: ASEAN+3 Bond Market Guide, ADB, April, 2012

16

Jurisdictio n

Form of the Bonds (Settlement Method)

Status (Bearer / Registered) People’s

Republic of China

Book-entry Registered.

(Bonds are generally getting scripless in a central register and registered in an account holder’s or bondholder’s name; some older bearer bonds may still exist. As for China Central Depository and Clearing (CCDC)-settled bonds in the China Inter-bank Bond Market, CDCC centralized the management of the bearer bond library in 1998, and 2001 saw the end of bearer bonds in this market.) Hong Kong,

China

Book-entry form (dematerialized) for Exchange Fund paper, and

Global note form for corporate bonds

Bearer / Registered

Indonesia Book entry (from 2000)

Physical certificate still exist (issued prior to 2000)

Bearer / Registered

Japan Book-entry (Completely dematerialized, except for a few non- central securities depository [CSD] settled private placed notes)

Registered

Republic of Korea

Book-entry

Dematerialized securities: Securities which are not issued in paper form and where ownership is held and is transferable by book entry in a ledger maintained by a CSD or account management

institution. Immobilized securities: Physical securities and non- certificated securities held and transferred by book entry in a ledger maintained by a CSD or account management institution.

Bearer / Registered

Malaysia Listed bonds: Book entry at Bursa Malaysia Depository

Unlisted debt securities: Book entry at Bank Negara Malaysia (BNM)

Basically, registered. Cagamas papers are unsecured bearer bonds issued by Cagamas, the national mortgage corporation established in 1986 to promote the secondary mortgage market in Malaysia.

Philippines Government Securities: Book entry in the Registry of Scripless Securities (RoSS) or in the Philippine Depository and Trust Corporation (PDTC)

Scripless Corporate Bonds: Book entry in PDTC

Physical Corporate Bonds: Endorsement and actual delivery of physical certificates with duly notarized Deed of Assignment

Bearer / Registered. Dematerialization/immobilization versus physical securities: both equities and debt securities are legally recognized in physical and dematerialized forms. In the organized market for debt securities, however, debt securities must be in dematerialized form and cannot be listed if the same are still in physical form, even if immobilized.

Singapore Book entry for government bonds

The Central Depository Pte. (CDP) holds universal certificates for physical bonds

Bearer / Registered. A foreign issuer is normally required to appoint a paying agent in Singapore while debt securities are quoted on the Exchange and upon the issue of debt securities in definitive form. The Exchange may accept other arrangements to enable definitive certificate holders of the bearer debt securities in Singapore to be paid promptly.

Table 1.4 Forms and Status of Bonds across Economies

Source: ASEAN+3 Bond Market Guide, ADB, April, 2012

Legislation for reference-I

I. The Government Securities Act 1920

(Old Paper-based rule with no book-entry

structure)

• Securities or Issuance of Securities ?

• Mention of promissory notes (including treasury bills), bearer bonds

• Reference to Negotiable Instruments Act

• Mentions ‘renewal’ of securities (promissory notes)

• Significant mention of replacement and dispute procedures

17

Article 2. Definitions (extracted part)

(a) "Government security" means promissory notes (including treasury bills), stock-certificates,

bearer bonds and all other securities issued … by the Governor in respect of any loan, but does not

include a currency-note;

Article 8.

Distinction of securities from negotiable instruments (in that they are not to be repaid by holder of

bearer securities)

Legislation for reference-II

II. The Myanmar Companies Act 1913 (revised

by Act XXIII 1955)

• Companies

•

Foreign companies are able to do business in Myanmar

•

Need ‘Permit to Trade’ = business licence, renewable every 2 years

•

Minimum capital applies (approx. USD 50,000)

•

Constituent documents in both Myanmar language and English

•

Comprehensive bankruptcy / insolvency provisions (Part V: Winding Up)

• Securities or Issuance of Securities

•

Reference to prospectus, share(s) under Definitions

•

Provisions, reference to debentures, underwriters in Prospectus section (Art 92 ff)

•

Prospectus section (Art 92-100) stipulates only issuing and filing of prospectus (Art 92)

•

Additional disclosure requirements mentioned in Prospectus section (Art 93 (1A))

•

Provisions for subscription of company issues appears to refer to both shares and bonds

•

Art 96 Proviso (b) implies securities can be privately placed without a prospectus (non public

offering)

•

Every document indicating offer for sale to public deemed prospectus (Art 98A)

•

Reference to the need to issue certificates (Art 108), including for debentures

•

Specific provisions for the issue of debentures (Art 126ff)

Legislation for reference-III

III. Financial Institutions of Myanmar Law (1990)

• Issuance of debentures and other debt securities (Art 25 (c))

• “purchasing and selling of bonds or other forms of securities on

behalf of customers;” (Art 25 (g))

• “receiving securities or valuables for safe custody;” (Art 25 (h))

• “collecting and transmitting money and securities;” (Art 25 (i))

• “undertaking other financial services activities;” (Art 25 (o))

• Foreign bank branches mentioned

• Includes establishment of State-Owned Financial Institutions

19

Legislation for reference-IV

IV. Securities Exchange Certificate Transaction

Law (2013)

Article 2.(a) Definitions of Securities Exchange Certificate

Securities Exchange Certificate contains the following meanings:

• (1) Treasury certificates, treasury bonds, credit bonds(*) and debentures issued, or about

to be issued, by the government or any government organization;

• (2) Treasury certificates, treasury bonds, credit bonds (*) and debentures issued by

international organizations or foreign governments and its organizations;

• (3) Shares, stocks, credit bonds (*) and debentures issued, or about to be issued, by

public companies, related privileges, option rights and share warrants;

• (4) Other securities exchange certificates and instruments (**) prescribed as securities

exchange certificate by notifications issued by the supervisory commission for the

securities exchange certificate business.

(*) “Credit bonds” seems to be “Secured bonds.” This may be a matter of unofficial English translation.

(**) Scripless securities may be included here

(At a glance, it seems like paper-based rule with no book-entry structure)

21

3. What comprises the Financial

Services (which includes

Securities) Market?

Financial Services Market

22

Banking

business Insurance

business

Financial Services Market should

be regulated with Integrity

Securities Market

and

Securities business

Source: ADB Consultants, for purpose of Myanmar Knowledge Support

23

Securities Business in Banking / Financial

Institution Legislation

I. Myanmar Companies Act 1913

• Provisions for “Banking Companies” (Part XA, Art 277F-)

• Identified as those in business of e.g. issuing debentures, bonds…

• Identified as those conducting promotion, underwriting of

securities (including bonds) for both public and private

• Banking company can form or hold share of subsidiary for the purpose of

undertaking and executing trusts, trustee, etc. set forth in Art 277F (Art 277M)

II. Financial Institutions of Myanmar Law (1990)

• Appears as very modern and practical legislation

• Describes roles for banks relative to securities that are very much in line

with typical roles of banks across ASEAN+3

• Issue debt securities

• Buy and sell bonds etc. for clients and self

• Promote, sell and underwrite issuances

• Conduct settlement and custody functions

• No apparent need for the creation/use of subsidiaries to engage in

securities business

(On the other hand, Companies Act stipulates that bank can form a

subsidiary to do so) (Art 277M)

• Non-bank FI include finance companies, credit societies

Roles or functions akin to universal banking concept

N.B.: Securities Exchange Certificate Transaction Law

can extend roles of financial institution in transitional

period (Art 67)

How to differentiate Business of

Banks and Securities Companies?

• In many economies, commercial banks can

underwrite and distribute debt and equity

securities

• Securities companies can also underwrite and

distribute debt and equity securities

Is Myanmar applying Universal Banking System?

OR

Is there a distinction who can participate in the

(bond) markets

25

Scope of Application/Relations

among Laws on Securities Business

Scope of application/relations in Securities

business is not clear between Banks and

Securities Companies among;

Myanmar Companies Act 1913

(ref: Art 277F,M)

Financial Institutions of Myanmar Law (1990)

(ref: Art 25 (o))

Securities Exchange Certificate Transaction

Law* (2013)

27

4. What Financial Services Market

Regulator(s) should regulate?

What Financial Services Market

Regulator(s) should regulate?

i. Financial & Capital Market Transactions

ii. Financial Sector Market Operators,

Traders & Intermediaries, and their (cross-

organizational) Activities

And

iii. Market itself and All other Market

Participants

29

What should be governed/regulated?

29

Trading rule or

Rule for Transactions

(Rules relate to

requirements/conditions and the

effect) (For instance, rules for

retail investors and professional

investors no need to be the same)

Operators rule, Traders rule

or Rule for Intermediaries

Rule for certain financial

Business Industries

(Code of Conduct / Fit and proper

rule) (This rule should be cross-

organizational)

Financial Services (Securities) Market rule

(Primary market + Secondary market)

(Exchange Market / OTC Market)

[Disclosure rules / Unfair trading prohibition / Insider rules]

(This rule should be adopted to everybody. Regulator should

oversee a fair price formation in the market)

i. Financial Transactions

ii. Financial Sector /

Market Participants

iii. Market and All other Participants

Source: ADB Consultants, for purpose of

Myanmar Knowledge Support

Areas to be governed/regulated

Generally, Law and Decrees should govern/regulate:

Financial Services and Financial instruments for investments, including

securities

Transactions and trading of Government and Non-government Securities

and other investment contracts

Financial Services businesses and those business providers (operators,

traders and intermediaries, including brokers, underwriters, etc.) with

their codes of conduct and fit and proper rule perspective

Market place and market system(s) providers including the securities

exchange(*), clearing and settlement system/facilities, securities

depositories

(*) Securities exchange may having two dimensions / functions (market

place provider + listing authority (SRO) -- should avoid “conflict of interest”)

Market (Exchange Market / OTC Market) itself including Disclosure

Rules, Unfair Trading Prohibition and formation of fair market prices

Generally, Issuing of Securities of Business Corporations and Enterprises may be

governed by Law on Enterprises / Company Act and securities regulations.

31

5. Analysis of Debt Instruments

related Rules

Debt Instruments related Rules - Government

1. Government Debt Instruments

• The Government Securities Act 1920

• Establishes government securities as a concept

• No specific provisions on issuance of government bonds, or participants

• Securities Exchange Certificate Transaction Law (2013)

mentions

• Art 2.(a) treasury certificates, treasury bonds, credit bonds and debentures issued, or

about to be issued, by the government or any government organization

It appears that no detailed regulations exist for

government bonds

Debt Instruments related Rules - Banks

2. Bank Bills

Financial Institutions of Myanmar Law (1990), Chapter V. Art

25, states

• (c) drawing, making, accepting, discounting, buying, selling, collecting

and dealing in bills of exchange, promissory notes, drafts, bills of

lading, railway receipts, debentures, and other documents of title and

debt securities, whether negotiable or not;

It appears that these provisions include the

Central Bank of Myanmar

33

3. Corporate Bonds

The Myanmar Companies Act 1913 provides for the issuance

of debentures by companies.

The Financial Institutions of Myanmar Law (1990) provides for

the issuance of debt (bank debentures and other) securities by

financial institutions.

Government passed the Securities Exchange Certificate

Transaction Law in July 2013.

The Law contains mentions of different types of bonds, but not

the term of asset class of corporate bonds, and no treatment

specific to bonds in further detail.

It appears that no detailed regulations exist for

Corporate Bonds

34

Debt Instruments related Rules - Corporate

35

35

Issuance of Securities and Public Offering /

Private Placement in Securities Law

Securities Exchange Certificate Transaction Law

(2013)

Mention of issuance of securities limited to Chapter 6

Distribution of Securities Exchange Certificates

• Art 35. (b) “when selling to the public, announce the prospectus

consisting of the company's memorandum of association, articles

of association, and the company's important salient facts.”

Meanings derived from law text (Art 35):

Public offering is possible

Wording implies that offerings other than public (private

placement) may also be possible

No distinction who can distribute, only reference to license holders

Developing the Legal and Regulatory

Framework for Corporate Bonds - I

• No public limited company, has so far issued and sold corporate bonds at least

through public offering [to be confirmed].

• The Myanmar Companies Act 1913 broadly stipulates that only a public limited

company may issue and sell corporate securities such as shares, debentures

and bonds to the public with a prospectus. This means that public limited

companies including full or quasi-SOEs may be able to issue corporate bonds.

• However, the Companies Act and Securities Exchange Certificate Transaction

Law as well as other laws do not contain procedures nor criteria for a public

limited company to issue corporate bonds. [to be confirmed; "Securities and

Exchange Rule" and other regulations draft under Securities law].

• At the same time, the Financial Institutions of Myanmar Law (1990) allows

banks to issue bank debentures and other debt securities.

At the early stage of bond market development when both issuers and

investors are not familiar with corporate securities, it is recommended

that the relevant regulator approves who can issue corporate bonds

and how much.

Developing the Legal and Regulatory

Framework for Corporate Bonds - II

• Even with no corporate bond market currently in place in Myanmar,

public limited companies are likely to be interested in issuing

corporate bonds for investment projects and working capital needs.

• The government therefore needs to further develop the legal and

regulatory framework for corporate bonds with considering and

maintaining consistency with other laws and regulations.

More concretely, it needs to:

i) elaborate regulations on application and issuance

procedures as well as approval criteria;

ii) anchor information disclosure / continuous disclosure in

the law(s).

[to be confirmed; "Securities and Exchange Rule" and other regulations

draft under law].

37

Developing the Securities (Bond) Business with

regards to over-the-counter (OTC) market

• As bonds are mostly traded on over-the-counter (OTC) market or

quote-driven markets generally, rather than at an exchange or auction

markets, the development of well-trained dealers becomes essential

especially to develop the bond market.

• At this stage in the market development in Myanmar, allowing and

encouraging bank dealers to trade bonds among themselves would be

practical and reasonable.

This would require the suitable identification in law and corresponding

licensing of market participants.

In this context, the intended role of the Over-The-Counter

Market, as outlined in the Securities Exchange Certificate

Transaction Law, should be further clarified.

38

Financial Sector / Market Participants related Laws and Decrees

39

Jurisdiction Name of Legal Document Enacting

Authority

Date Enacted

and

Latest

Amendment

Remarks

Central Bank of

Myanmar

Financial Institutions of Myanmar Law (1990) Chairman Council 4 July 1990

Commercial Banks Myanmar Companies Act 1913

Financial Institutions of Myanmar Law (1990)

President

Chairman Council

1 April 1914

4 July 1990

Insurance Business The Insurance Business Law (1996) Chairman Council 24 June 1996

NBFI (Non-Bank

Financial Institutions)

Financial Institutions of Myanmar Law (1990) Chairman Council 4 July 1990

SEC, MSX, Public

Offering & Listing

Securities Companies

Operation of Securities

Activities

Disclosure/Continuous

Disclosure

Etc.

Security Exchange Certificates Transaction

Law* (2013)

Myanmar Companies Act 1913

(Draft regulation of MSX**)

(Draft Securities & Exchange Rule*/**)

President

President

30 July 2013

1 April 1914

Oct 2013*

*Currently

no official

English

translation

available.

**Currently

unavailabl

e

NBFI = Non-Bank Financial Institution; here: finance companies, credit societies;

SEC = Securities and Exchange Commission

Sources: public domain, incl. http://www.dica.gov.mm (Directorate of Investment and Company Administration);

http://mm.myanmars.net/laws *Titles and timeframe to be confirmed

To be updated/confirmed for MM if info available

Financial Transactions related Rules

Financial Transactions

Name of Legal Document Enacting

Authority

Enacted Date and Latest Amendment

Remarks

Banking Financial Institutions of Myanmar Law (1990) Chairman Council 4 July 1990

Cheque Negotiable Instruments Law (To be confirmed) (To be confirmed)

Secured Transactions

Insurance Insurance Business Law (1996) – (to be confirmed) Foreign Currency

Exchange

SEC

Myanmar Exchange

To be investigated

To be updated for MM if info available

41

6. What Market Participants look for

(in Legal/Regulatory Framework)

Typical (General) Due Diligence

Considerations include

• Can FII (Foreign Institutional Investors) participate

in the domestic market?

• Permitted by law?

• Access requirements (e.g. investor registration)

• Are foreign intermediaries (banks, brokers) able to

participate in bond market (affiliate, JV, or

branch)?

• Account holding structure

• Finality of transaction(s)

• Bankruptcy / Insolvency provisions

7. Discussion Points and

Clarifications

43

With regards to Clarifications

• Knowing that the Myanmar policy bodies are now in the

process of creating supplementary legislation and

regulations starting from “Securities & Exchange Rule*,”

it is well understood that these future regulations could

very well already address or resolve the discussion

points mentioned in the following slides.

• At the same time, much of the research was/will be

conducted on English translations of the respective laws;

hence, understanding and the use of terminology

could/may differ from the original intentions of the

stakeholders.

*Official English title to be confirmed

45

Discussion Points and Clarifications

• Understanding Myanmar Approach (Showing Items only)

A) Confirm “Planned Legal Framework”

B) Meaning of the Over-The-Counter Market

C) Current bond market vs. Over-The-Counter Market

D) Over-The-Counter Market vs. Exchange

E) Licenses and Market Participants

F) Disclosure / Continuous Disclosure

G) Policy Direction

H) Terminology & Convention

• Some Clarifications may be desirable

I) Relative to ABMF Topics (See next page)

• Typical Market Challenges (Showing Items only)

J) Foreign Institutional Investors (FII)

K) Taxation

L) Financial Reporting

I) Relative to ABMF Topics (Shown as examples)

Professional Investor

•

Intended to be included in future/supplementary legislation?

Professional Market

•

The future Exchange market is professional by participants but will likely be accessible by individual

investors through securities firms

•

Would proposed OTC market be earmarked as professional market/platform?

Private Placement / Exempt (exempted) Market segment

•

Private Placement is not directly mentioned in Securities Exchange Certificate Transaction Law

(2013)

•

However , Art 35. (b) ‘when selling to public’ could be interpreted that non-public offers (Private

Placement) may also be possible (in future)

Listing / Listing Place

•

Planned Exchange intended for listing of bonds?

•

Listing Place requires SRO-type status

•

Securities Exchange Certificate Transaction Law (2013) does not seem to indicate SRO status

•

Art 38. “shall be under the management, monitoring and control of the Commission”

Roles of Listing Place

•

For shares, listing equals trading

•

In case of bonds, listing is typically for profiling (only)

•

But, it performs an important function, as Place of Disclosure

•

Key role as Listing Authority may present conflicts of interest

•

Hence, important to balance well business activities vs. supervision role

46

47

Importance of clear Terminology

• Example: Securities Exchange Certificate

Term suggests paper and physical handling, and exchange traded nature

• ‘Securities exchange’ may imply stock exchange for listing and trading

• ‘Certificate’ or ‘Exchange certificate’ may imply only paper securities (but

limited to paper?)

• Implications

• Meaning that legal title (or ownership) has to be transferred separately (e.g.

transfer deed or deed of assignment)

• Risk angle: observers drawn to think of chance of fraud, theft

• Operational aspects include need for vault, counting, larger staff

• Could mean that book-entry concept would require a change of law?

Myanmar language term or definition will always remain absolute

But, should consider most representative English term

Preferably, this should be determined at the outset

8. Information for Reference

• ASEAN+3 Professional Investor Matrix

AMBIF Investor Types as currently evident in ASEAN+3 Economies

and their Legislation; Information on Myanmar not yet conclusive.

49

Economy Investor Term

As stated

by

Investor Term in each Economy represents the following Types of Investors (expressed as Categories mentioned in Laws, Regulations or Market Practice)

Banks Broker/Dealers Insurance Companies Mutual Funds Provident Funds Government Funds Central Banks Closed-ended Funds Corporates Deposit Protection Agency Derivatives Businesses Development Funds Exchanges Foreign Institutional Investors Finance Companies Fund Managers High Net Worth Individuals Individuals as Fund Managers Supra Fin. Institutions Institutional Investors Other (to be specified) Private Funds Statutory Companies/Boards Subsidiaries of Inv. Types Trust Companies Trustee

Cambodia Institutional Investors Anukret u u u

PR China

'IBBM Investors' PBOC u u u u u u u u u u u

Qualified Foreign

Institutional Investor CSRC u u u u u

Hong Kong

Professional Investor Law u u u u u u u u u u u u

'Offer to Prof.

Investors' HKEx u u u u u u u u u u u u u

Indonesia {Professional Investor} IFSA u

Japan Specified Investors Law u u u u u u u u u u u u u u u u

Korea

Professional Investors Law u u u u u u u u u u u u u u u u u u

Qualified Institiutional

Buyers Law u u u u u u u u u u u u u

Lao PDR (Institutional Investors) (Law) u u u u

Malaysia Sophisticated Investors Law u u u u u u u u u u u u u

Philippines Qualified Investor, Qualified Buyer

Law,

SEC u u u u u u u u u u u u u u u

Singapore Institutional Investors Law u u u u u u u u u u u u u u u u

Thailand Accredited Investors SEC u u u u u u u u u u u u u u u u u u u u u u

Viet Nam Professional Investors Law u u u u u u